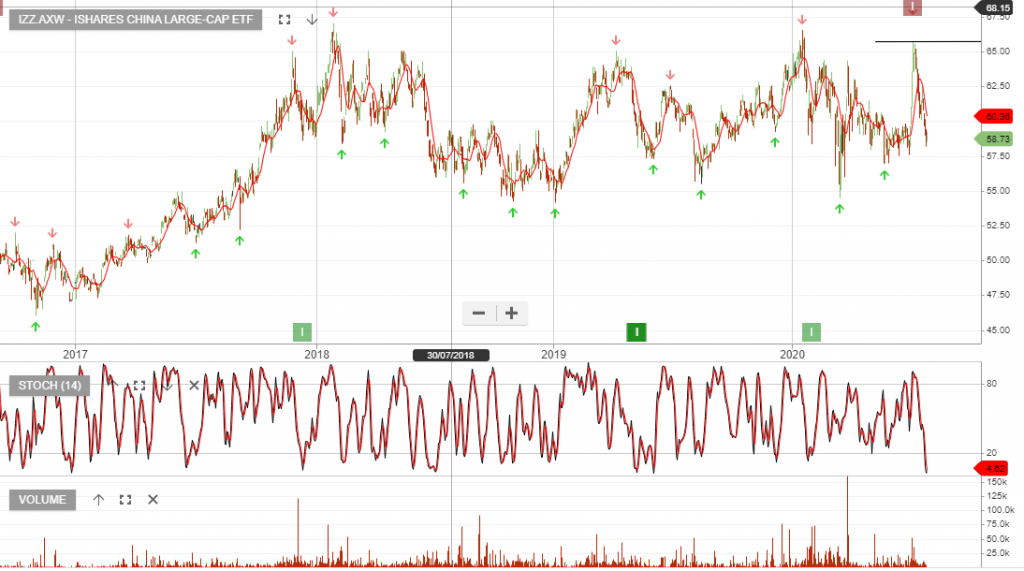

China ETF – IZZ

ASX:IZZ is under Algo Engine sell conditions following the lower high formation at $65 back on 7 July. Since then, the ETF has corrected lower and is now trading at $58.

For the past 2.5 years the ETF has tracked sideways within the $54 to $65 consolidation band.

We expect to see the IZZ retest the lower level and we’ll revisit the trade closer to $54, in the weeks ahead.