Coles

Coles Group is under Algo Engine buy considerations. We have a buy rating with the stop loss at $17.70

Coles Group is under Algo Engine buy considerations. We have a buy rating with the stop loss at $17.70

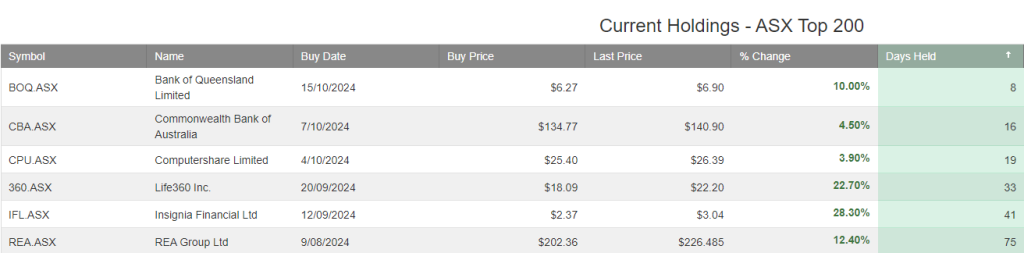

Current holdings include…

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Monday, October 21 – Nucor and Logitech.

Tuesday, October 22 – General Electric, Philip Morris, Verizon, Texas Instruments, Lockheed Martin, General Motors, and 3M.

Wednesday, October 23 – Tesla, Coca-Cola, T-Mobile, IBM, AT&T, and Boeing.

Thursday, October 24 – Valero, UPS, Honeywell, American Airlines, Northrop Grumman, Southwest Airlines, and Dow.

Friday, October 25 – Centene, HCA, and Colgate-Palmolive.

Collins Foodsis rated a buy with the stop loss at $8.43

AMP remains an overweight multi-year recovery play.

BetaShares Global Agriculture ETF – Currency is rated a buy.

Bank of Queensland is under Algo Engine buy conditions.

VanEck China New Economy is rated a buy at $6.25

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Or start a free thirty day trial for our full service, which includes our ASX Research.