Bluescope Steel

BlueScope Steel Buy with a stop-loss at $22.10.

BlueScope Steel Buy with a stop-loss at $22.10.

BlueScope Steel is under Algo Engine buy conditions.

Bluescope looks to be a winner from Trump’s decision to double tariffs on imported steel because it generates about half of its profits from its US operations.

BlueScope Steel is under Algo Engine buy conditions.

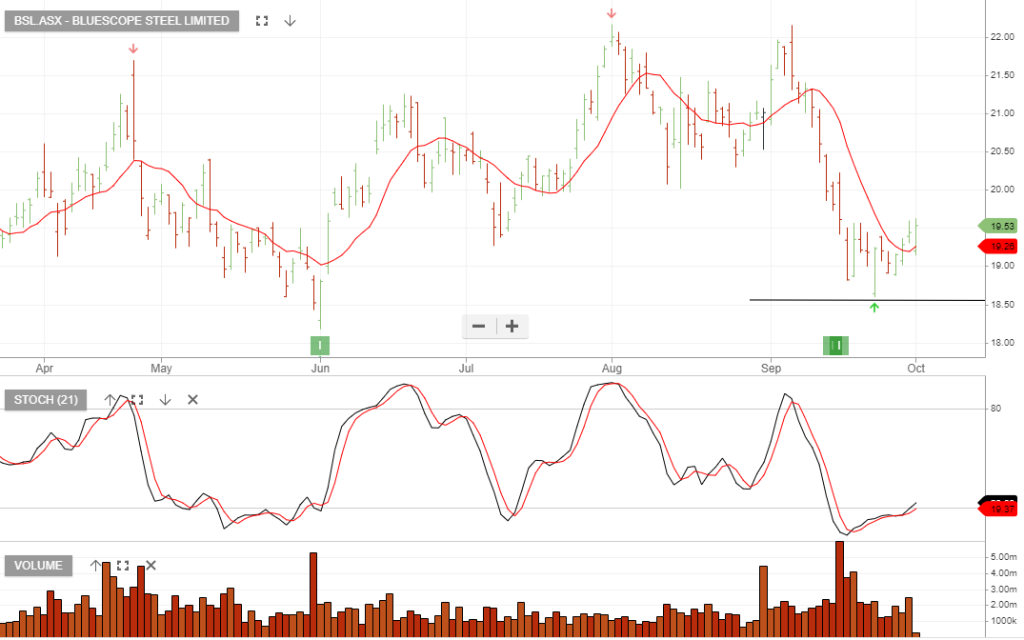

BlueScope Steel is an open trade with a stop loss at $18.85

BlueScope Steel is rated a buy with the stop loss at $18.87

BlueScope Steel is rated a buy with the stop loss at $19.73

BlueScope Steel announced underlying EBIT of $718m in 1H FY24, (beat consensus), and at the top end of guidance of $660m.

BlueScope Steel has cut 1H24 EBIT guidance to A$620-670m. We’re buyers within the $15 – $17 price range and expect earnings to recover in 2025.

BlueScope Steel is under Algo Engine buy conditions and it’s also a recent addition to the ASX Trade Table.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Or start a free thirty day trial for our full service, which includes our ASX Research.