NAB

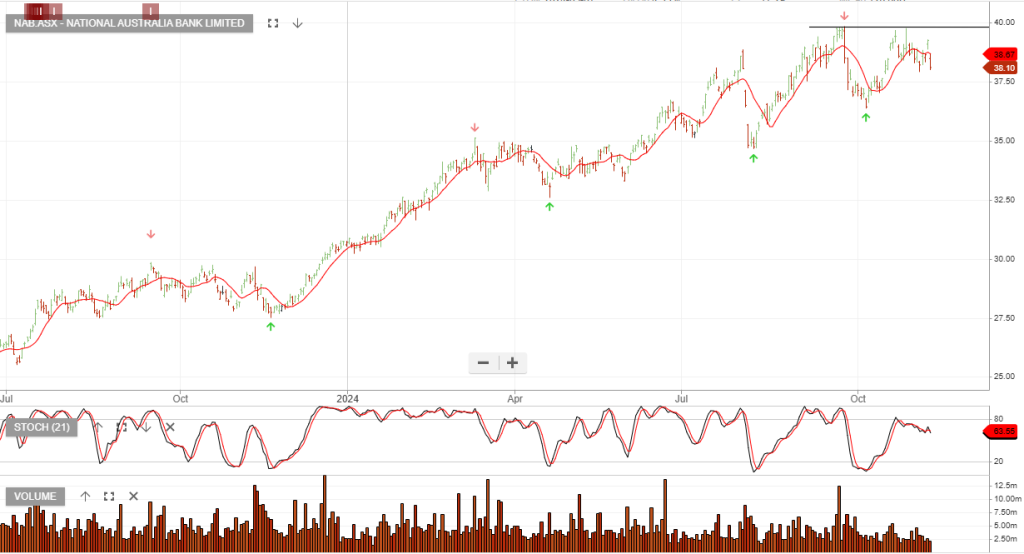

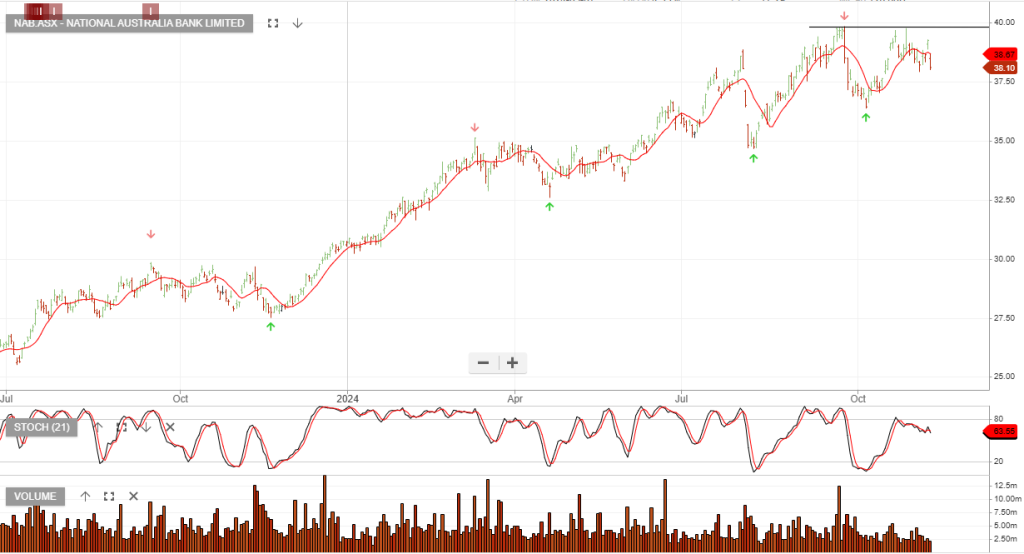

National Australia Bank is under Algo Engine sell conditions. Australia’s second-largest lender reported an 8% drop in cash profit to $7.1 billion in FY24.

National Australia Bank is under Algo Engine sell conditions. Australia’s second-largest lender reported an 8% drop in cash profit to $7.1 billion in FY24.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

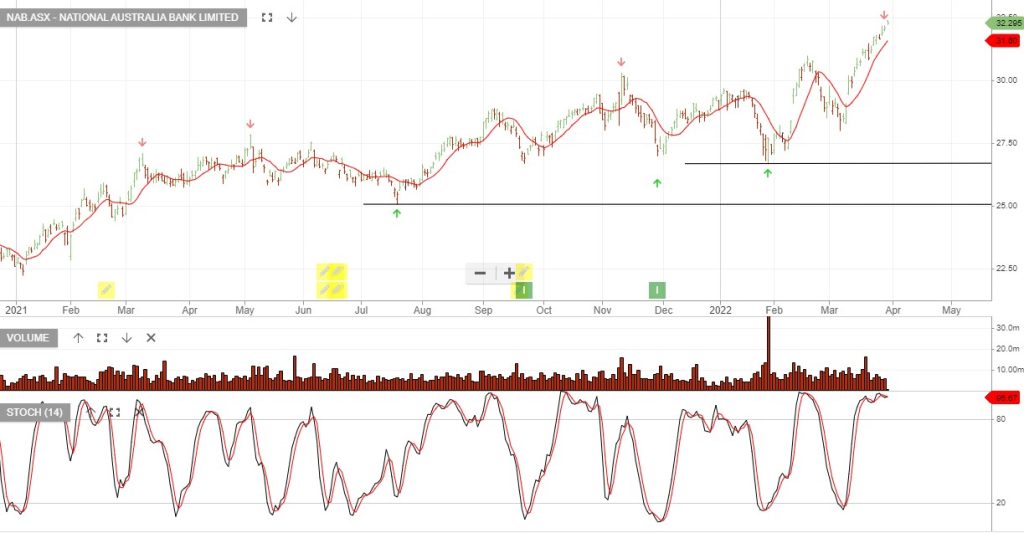

National Australia Bank is under Algo Engine buy conditions and remains in our ASX model portfolio. The share price is up 22.7% since being added on 22 Sep 2021.

Having completed its A$2.5 bn on-market share buy-back only yesterday, NAB has today announced that it intends to buy back up to an additional A$2.5 bn of shares on-market.

National Australia Bank is under Algo Engine sell conditions and we expect selling pressure to build with overhead resistance at $29.00

National Australia Bank is under Algo Engine sell conditions and we expect selling pressure to build with overhead resistance at $29.00

Westpac Banking is under Algo Engine sell conditions and we expect selling pressure to build with overhead resistance at $26.90

National Australia Bank is under Algo Engine sell conditions and we expect selling pressure to build with overhead resistance at $27.50

Westpac Banking is under Algo Engine sell conditions and we expect selling pressure to build with overhead resistance at $26.90

Or start a free thirty day trial for our full service, which includes our ASX Research.