Ai Coins: Special Review

1. NEAR Protocol (NEAR)

- Purpose: NEAR is a decentralized application (dApp) platform designed to make blockchain-based apps user-friendly.

- AI Relevance: NEAR supports AI integration for scalable and efficient dApps, enabling machine learning and data-driven applications in decentralized environments.

2. Artificial Superintelligence Alliance (FET)

- Purpose: The Fetch.ai (FET) platform focuses on creating decentralized AI solutions using blockchain for automation and optimization.

- AI Relevance: Fetch.ai enables autonomous agents powered by AI to perform tasks like supply chain optimization, smart city infrastructure, and decentralized marketplaces.

3. BitTensor (TAO)

- Purpose: BitTensor is a decentralized machine learning network where users can share and trade AI models.

- AI Relevance: It incentivizes AI developers to contribute and improve the network’s collective intelligence through a blockchain-based token economy.

4. Render (RNDR)

- Purpose: Render is a decentralized GPU rendering network that provides computational power for graphics and AI workloads.

- AI Relevance: It supports rendering AI-driven visualizations and simulations by enabling access to GPU resources on the blockchain.

5. The Graph (GRT)

- Purpose: The Graph is an indexing protocol that enables efficient querying of blockchain data.

- AI Relevance: Its indexing services are used by AI and machine learning projects to quickly retrieve structured blockchain data for training and analytics.

6. Virtuals Protocol (VIRTUAL)

- Purpose: Virtuals Protocol is focused on decentralized metaverse and AI technologies.

- AI Relevance: It provides AI-powered tools to enhance virtual environments, including digital identities and autonomous avatars.

7. AIOZ Network (AIOZ)

- Purpose: AIOZ is a decentralized content delivery network (CDN) that leverages blockchain for efficient media delivery.

- AI Relevance: AI is used within the network to optimize content distribution and enhance streaming quality for end-users.

8. Akash Network (AKT)

- Purpose: Akash Network is a decentralized cloud computing platform that offers flexible and cost-effective computation.

- AI Relevance: It provides infrastructure for running AI workloads, machine learning models, and other resource-intensive processes.

9. Grass (GRASS)

- Purpose: Grass focuses on decentralized AI services, offering solutions for digital resource management and automation.

- AI Relevance: It supports the deployment and monetization of AI algorithms and tools for various applications like agriculture and automation.

10. Arkham (ARKM)

- Purpose: Arkham is a blockchain intelligence platform that specializes in on-chain data analytics.

- AI Relevance: It uses AI to track and analyze blockchain transactions, providing insights into market movements and financial patterns.

These projects represent a convergence of AI and blockchain technologies, addressing a variety of use cases, from decentralized computing to AI-powered analytics and automation. Let me know if you’d like a deeper dive into any specific coin!

Best Overall Technology

If we consider AI-specific technology, BitTensor (TAO) stands out for its unique approach to incentivized AI model collaboration, which is foundational for decentralized AI ecosystems.

For general-purpose AI and blockchain integration, Fetch.ai (FET) leads with its versatility and real-world use cases.

For infrastructure and scalability, Akash Network (AKT) and NEAR Protocol (NEAR) are highly robust, depending on whether you prioritize computing or dApp development.

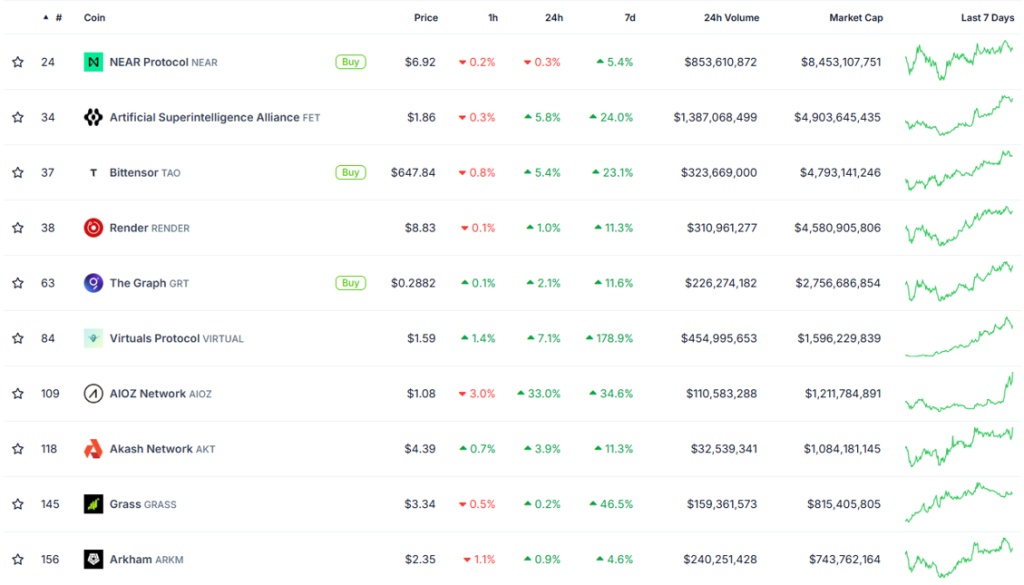

Key Insights from the Table

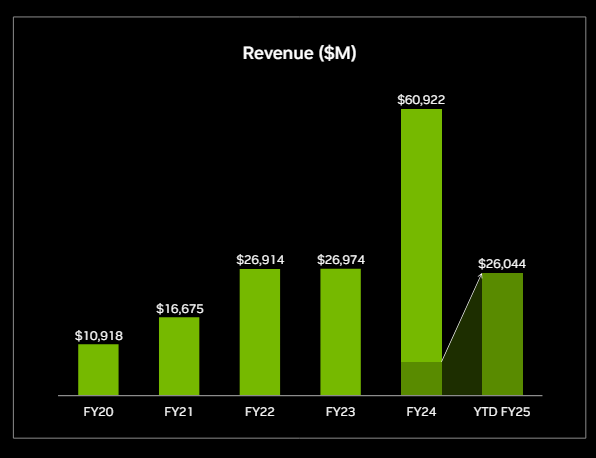

BitTensor (TAO): $4.79 billion.

24-Hour Trading Volume: A high trading volume indicates strong investor activity.

Fetch.ai (FET): $1.387 billion (highest trading volume among the coins in the list).

NEAR Protocol (NEAR): $853 million (second-highest).

Virtuals Protocol (VIRTUAL): $454 million.

7-Day Price Change: Significant price gains over 7 days indicate growing investor demand.

Virtuals Protocol (VIRTUAL): 178.9% (largest 7-day gain).

AIOZ Network (AIOZ): 34.6%.

Grass (GRASS): 46.5%.

Market Cap: Higher market caps suggest established projects with significant investor backing.

NEAR Protocol (NEAR): $8.4 billion (largest market cap in the list).

Fetch.ai (FET): $4.9 billion.