ANZ

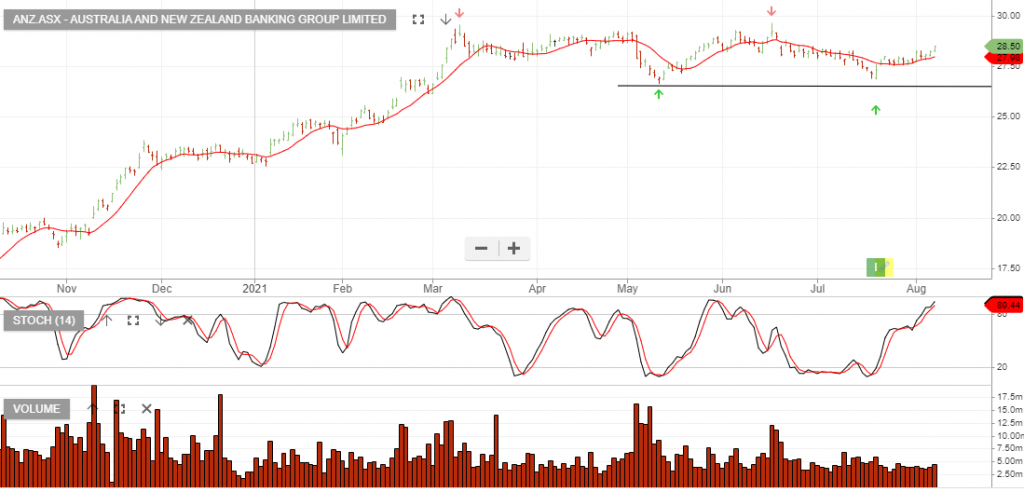

ANZ Group Holdings is rated a short-term buy with a stop loss at $28.39

ANZ Group Holdings is rated a short-term buy with a stop loss at $28.39

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

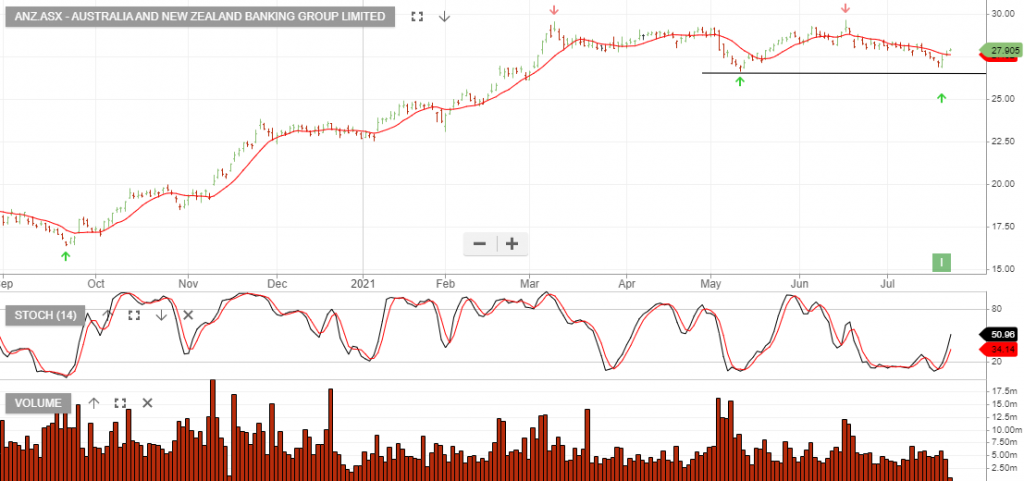

Australia and New Zealand Banking Group is under Algo Engine buy conditions and is a current holding in our ASX model portfolio.

Australia and New Zealand Banking Group is under Algo Engine buy conditions.

ANZ has announced an on-market share buyback program of up to $1.5bn commencing in August. This should provide investors with increased confidence in the strength of major bank balance sheets.

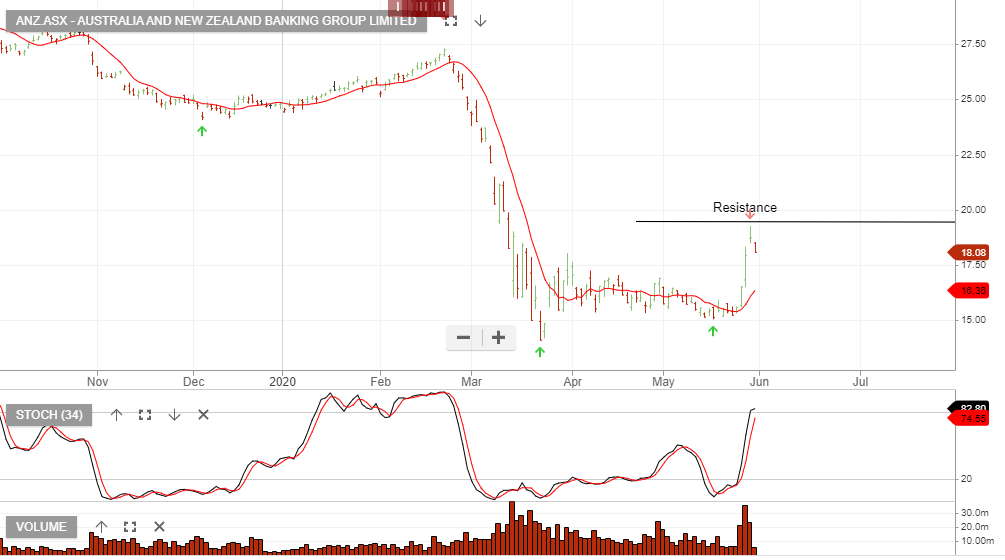

Australia and New Zealand Banking Group is under Algo Engine sell conditions and we see selling pressure increasing at $19.00.

Australia and New Zealand Banking Group is a current holding in our ASX 100 model portfolio.

Pressure from lower interest rates more than offset mortgage repricing benefits for the banks and we’ve seen 10%+ correction across the sector.

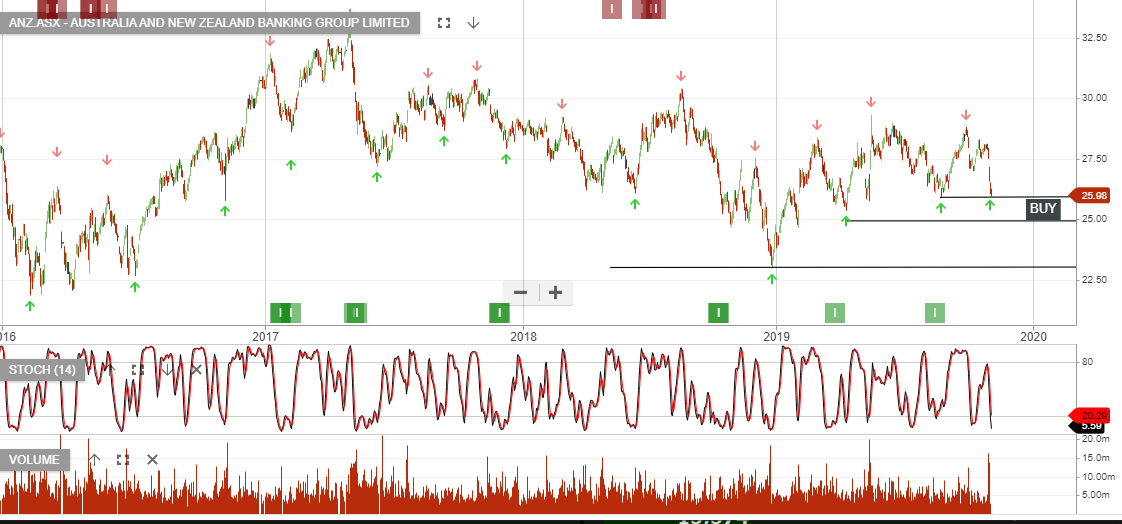

ANZ, WBC & NAB remain our preferred exposures and we highlight the buying opportunity which is approaching for ANZ.

Buy ANZ within the $25 – $26 price range.

Or start a free thirty day trial for our full service, which includes our ASX Research.