James Hardie

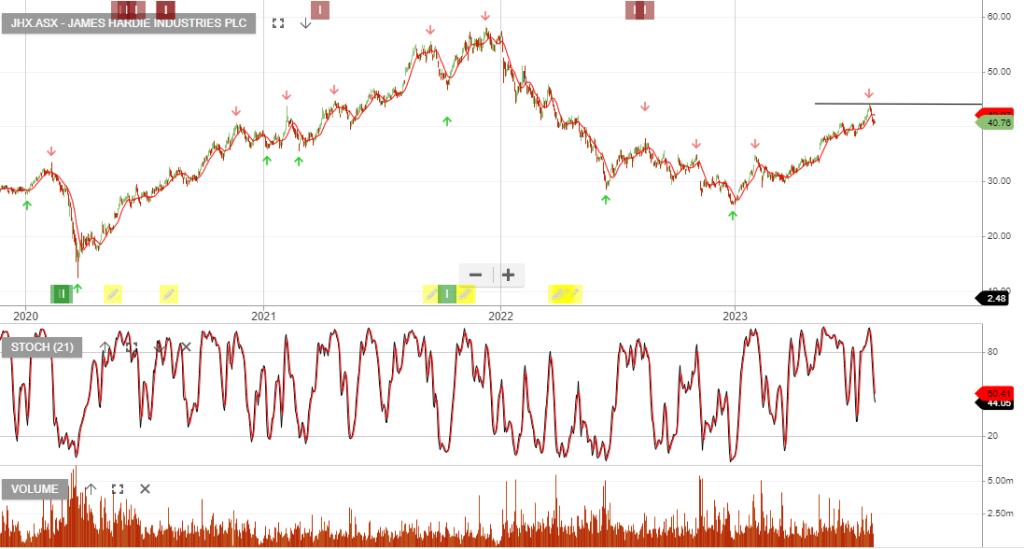

4/6 update: Stop loss $35.70

Add to watchlist and wait for a close above the 10-day average.

4/6 update: Stop loss $35.70

Add to watchlist and wait for a close above the 10-day average.

James Hardie Industries is under Algo Engine buy conditions.

James Hardie Industries is a new holding in the ASX200 Trade Table.

James Hardie Industries 1QFY24 NPAT increased 14% and guidnace for the 2Q was upgraded to US$170-190m. The key positive is USA growth and margin expansion.

We’re looking to JHX on the next Algo Engine buy signal.

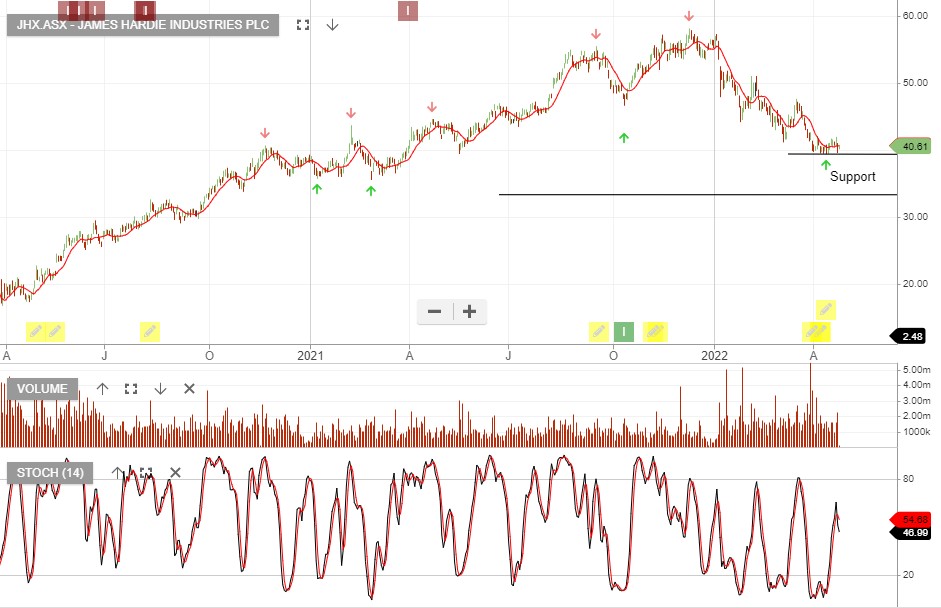

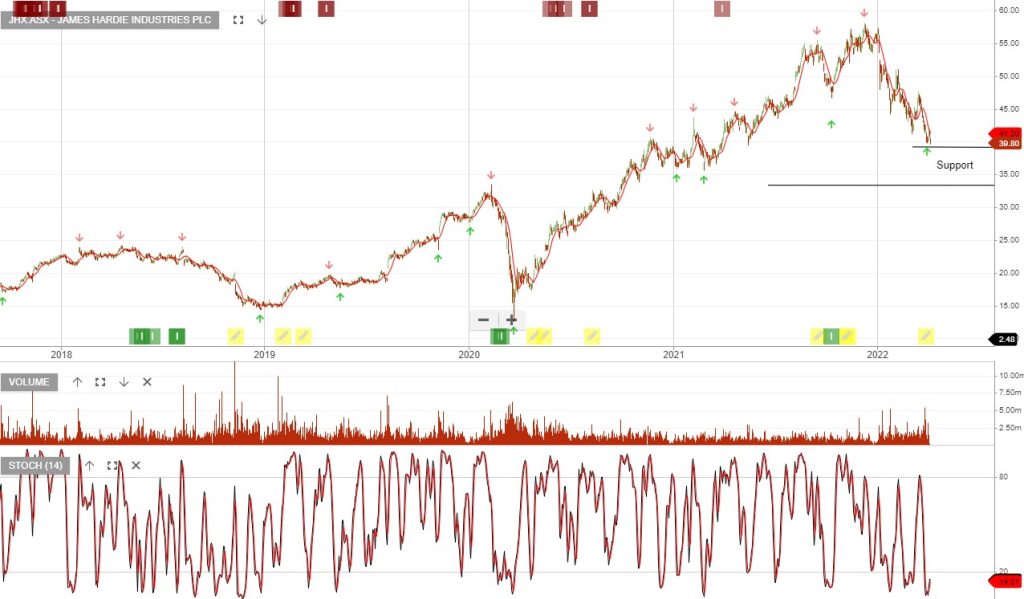

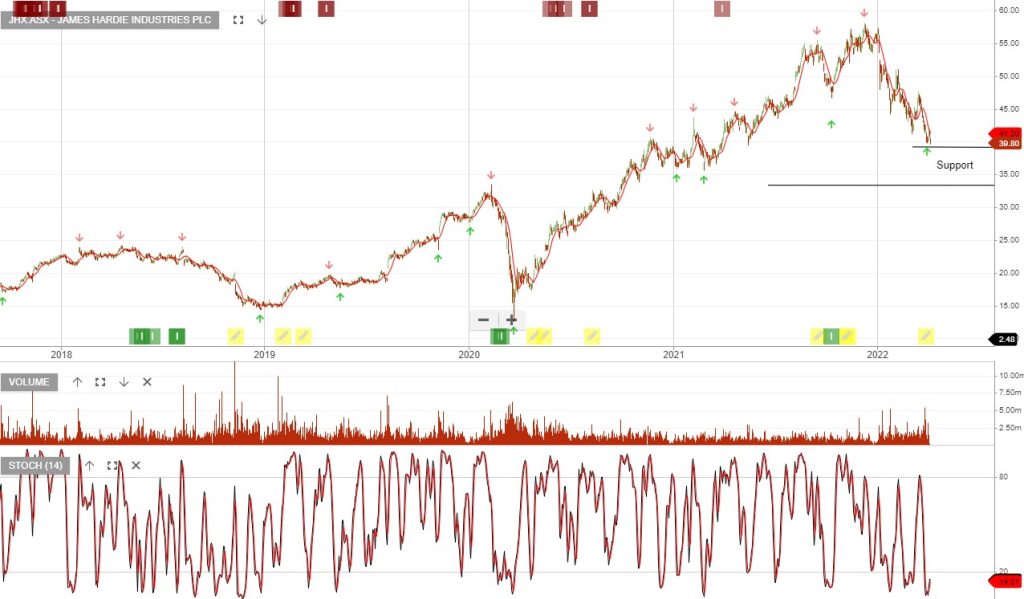

James Hardie Industries is approaching an oversold range where investors should begin monitoring the short-term momentum indicators for a pick-up in buying activity.

James Hardie Industries is approaching an oversold range where investors should begin monitoring the short-term momentum indicators for a pick-up in buying activity.

The price range for a reversal in price action remains wide at $33 to $39.

James Hardie Industries is approaching an oversold range where investors should begin monitoring the short-term momentum indicators for a pick-up in buying activity.

The price range for a reversal in price action remains wide at $33 to $39.

Or start a free thirty day trial for our full service, which includes our ASX Research.