Resmed

Resmed

Resmed

Resmed

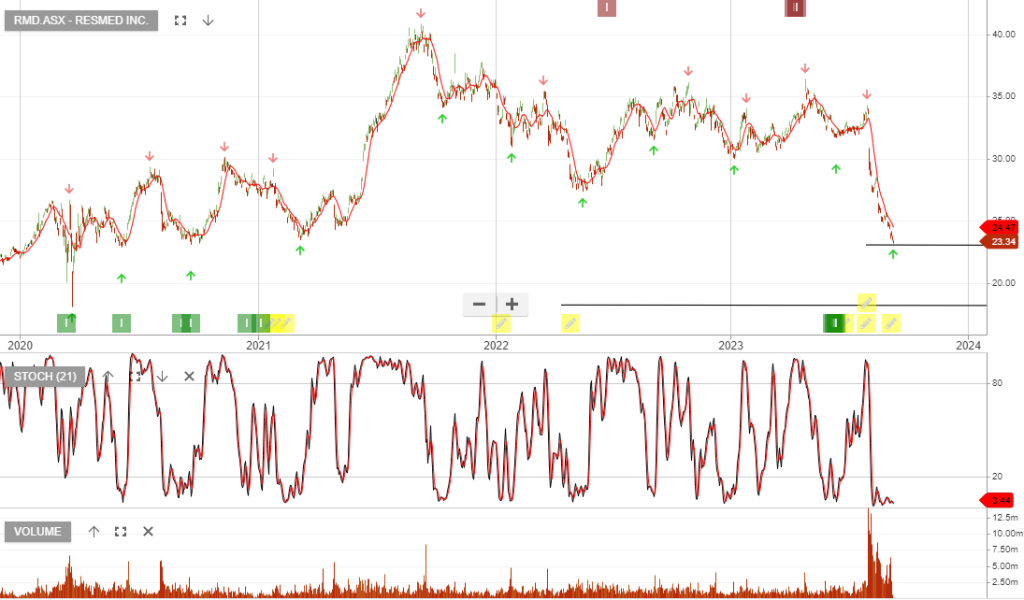

ResMed is due to report 4Q23E EPS Friday.

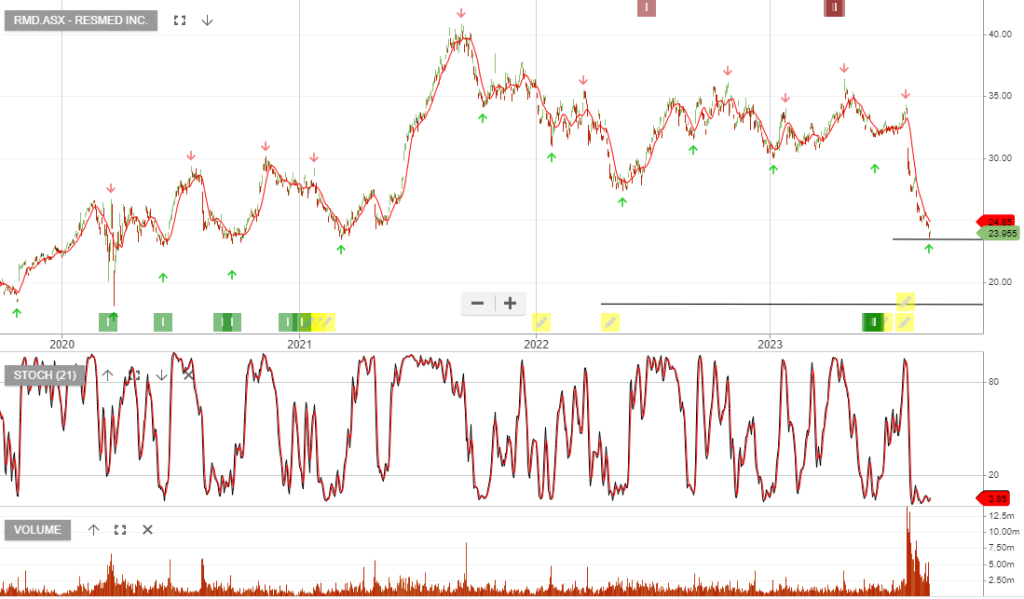

Resmed

ResMed is due to report 4Q23E EPS Friday.

Resmed

Resmed

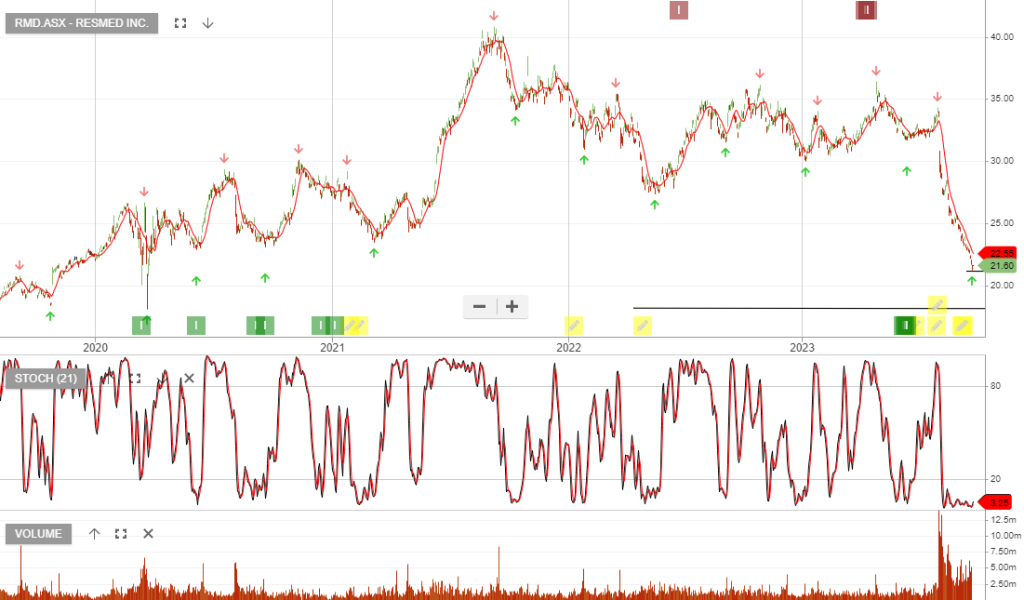

ResMed is under Algo Engine buy conditions.

Resmed – Add Watchlist

ResMed is approaching a price range where we’re likely to see a new Algo Engine buy condition.

Resmed – Support Zone

ResMed is under Algo Engine buy conditions and we see buying support building within the $30 – $33 price range.

Send our ASX Research to your Inbox

Or start a free thirty day trial for our full service, which includes our ASX Research.