Qantas

Qantas Airways is under Algo Engine buy conditions.

Qantas Airways is under Algo Engine buy conditions.

Qantas Airways is under Algo Engine buy conditions.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

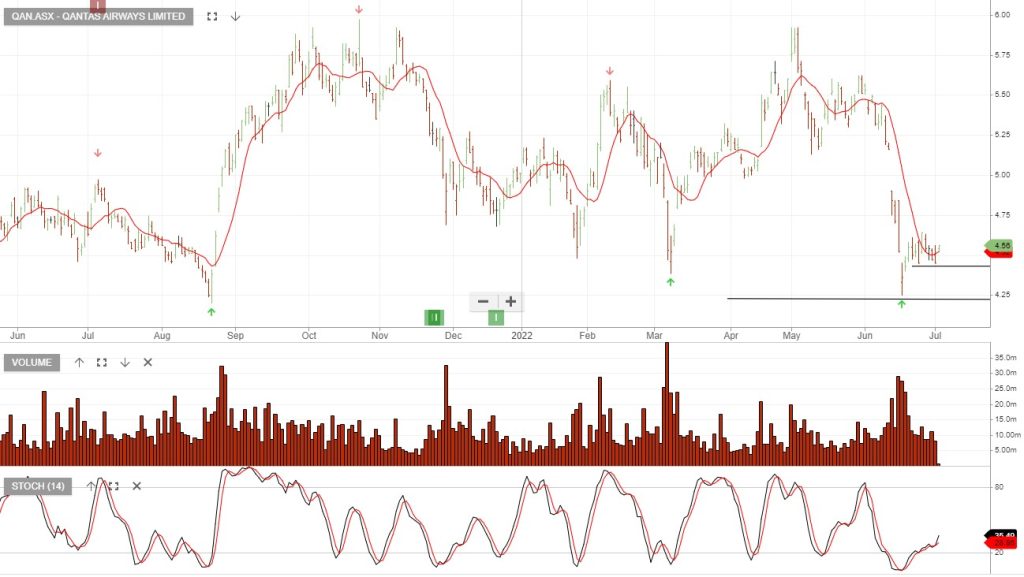

Qantas Airways is under Algo Engine buy conditions. We expect the recent $4.25 low to hold and highlight the entry opportunity with a stop loss below $4.40 or the pivot low at $4.25.

Qantas Airways is under Algo Engine buy conditions and is now a current holding in our ASX 100 model.

The switch from sell to buy conditions means the stock has automatically been added, however, traders may wish to watch the shorter-term indicators for confirmation of the change in trend.

The below graph highlights the key trend signals to watch and we forecast buying support to build near the $6.50 level.

Qantas Airways has been under Algo Engine sell conditions since forming a lower high in February at $6.25. The stock is now trading at $5.25 and we see little reason to change our short-side bias on this one.

The post below is from the 6th of December. Qantas has since sold off and is now trading $5.35

Qantas is under an Algo Engine sell signal, following the lower high formation at $6.16

Chart from 6th of Dec

Our ALGO engine triggered a sell signal on QAN on November 14th at $6.05.

Since then the stock has traded lower and reached $5.45 in early trade today.

From a longer-term perspective, we believe QAN will benefit from from the 30% drop in crude oil since October. Even if energy prices stabilize near current levels, QAN is well-placed for solid profit growth in 2019.

We expect to see investor interest accumulate in the $5.10 area and will look for an ALGO buy signal in that range.

QANTAS

Our ALGO engine triggered a sell signal for QANTAS into yesterday’s ASX close at $5.90.

This “lower high”pattern is reference to the intraday high of $6.30 from September 12th.

On October 25th, we posted a report to buy QAN in the $5.40 area on the basis of lower oil costs and steady earnings growth.

At this point, it looks like oil prices are overdue for a rebound higher, which could pressure QAN back into our $5.40 to $5.35 buy zone.

As such, we suggest taking profits in QAN. At current levels the return will be just over 8%.

We will look for another ALGO buy signal in the $5.30 area.

QANTAS

Or start a free thirty day trial for our full service, which includes our ASX Research.