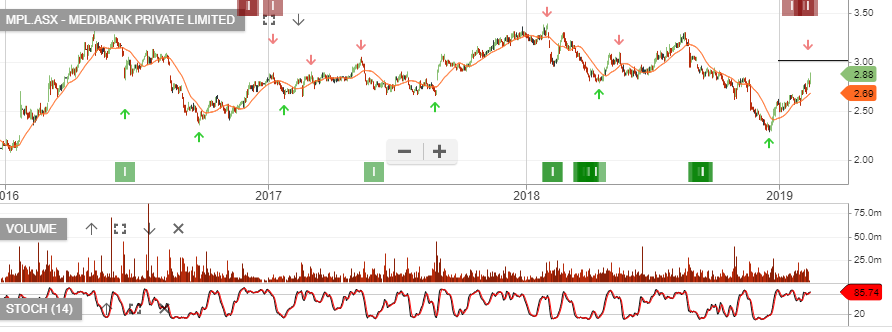

Medibank – Finding Support

Medibank Private is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

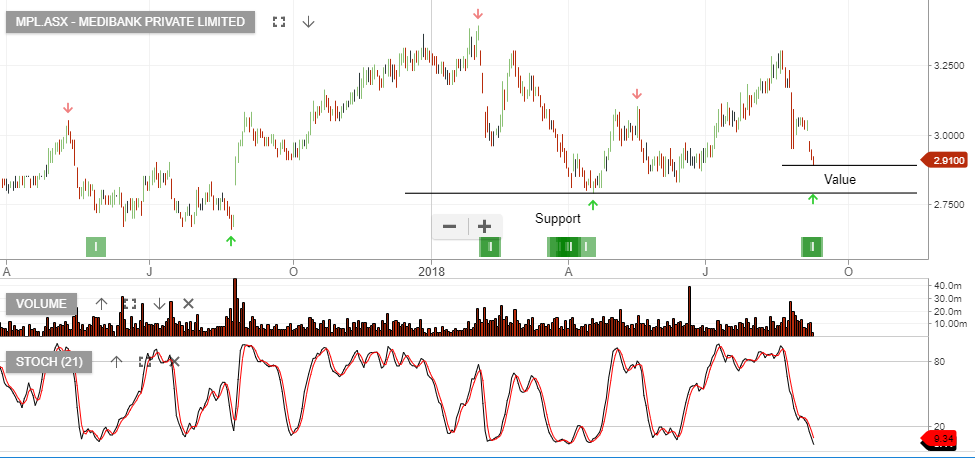

We highlight the price support on the MPL chart, as the price action nears the $2.94 gap created back in May last year.

MPL goes ex-div $0.057 on the 5th of March.