Origin

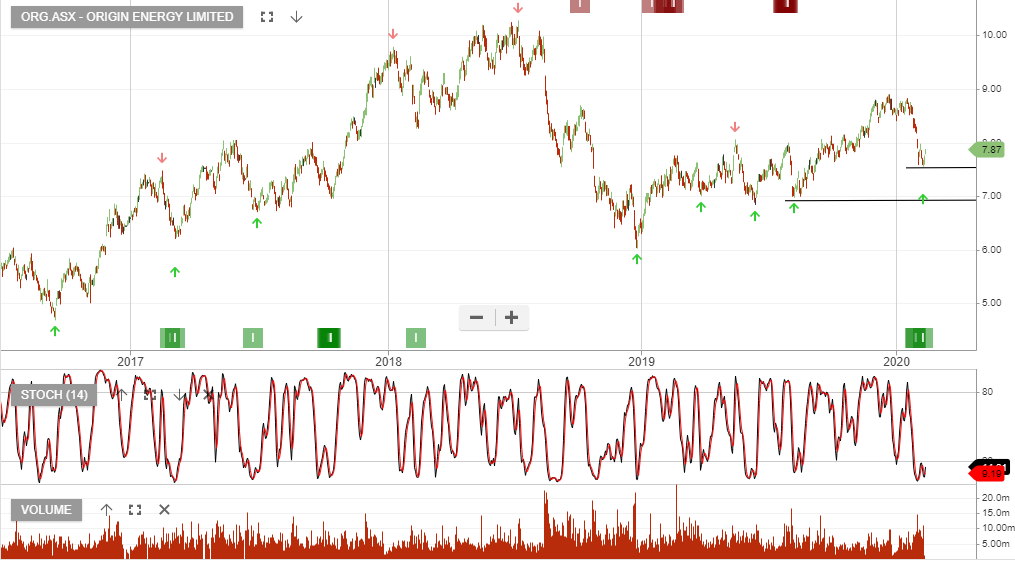

Origin Energy is under Algo Engine buy conditions. The recent result shows a 23% increase in core net profit for the first half, buoyed by earnings from its gas business.

Origin Energy is under Algo Engine buy conditions. The recent result shows a 23% increase in core net profit for the first half, buoyed by earnings from its gas business.

Origin Energy is under Algo Engine buy conditions.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Origin Energy has broken out of a prolonged downtrend as the negative earnings cycle appears to be nearing the bottom.

The market has low expectations for FY22 earnings with EBITDA down almost 40% on FY21 and DPS falling from $0.14 to $0.10 placing the stock on an expected yield of 2.2%.

We see upside for Origin and suggest a stop loss below the recent $3.87 low.

Nat Gas prices continue to rebound from the historic lows reached mid this year.

Origin share price remains under selling pressure but is likely to soon find buying support.

Origin’s September quarter revenue of A$374m was down 39% from the prior quarter. Lower prices were in part offset by higher production volumes.

Origin Energy is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

Buy ORG at $7.80.

Or start a free thirty day trial for our full service, which includes our ASX Research.