Seek

Seek

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Seek

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Seek

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Seek

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

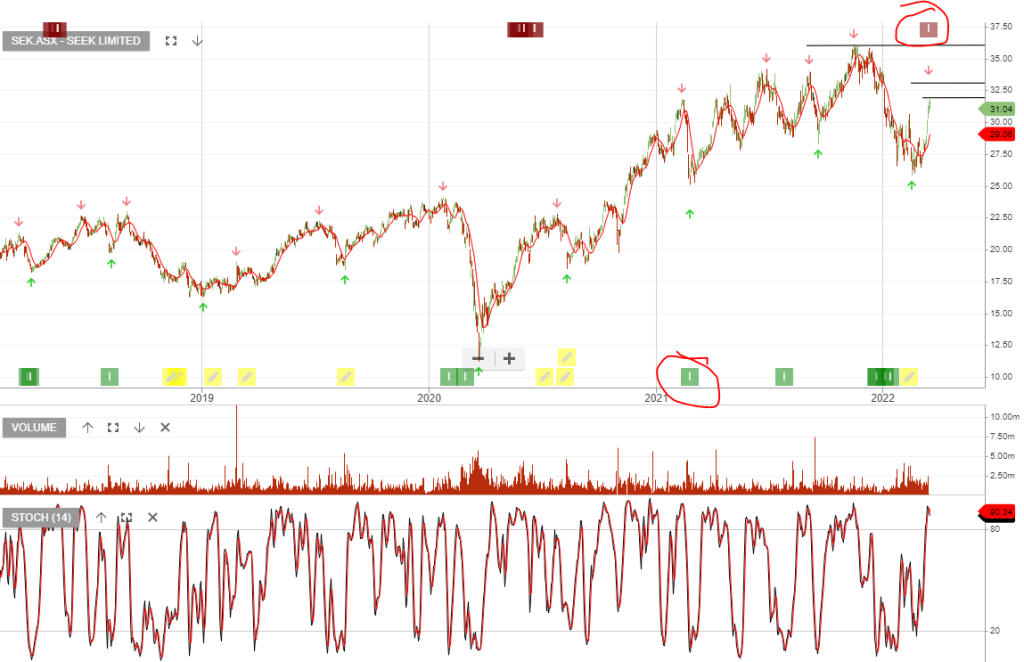

Seek – 23% Gain

Seek is now under Algo Engine sell conditions and was removed from our ASX model portfolio on Friday.

Seek delivered a 23.20% Gain.

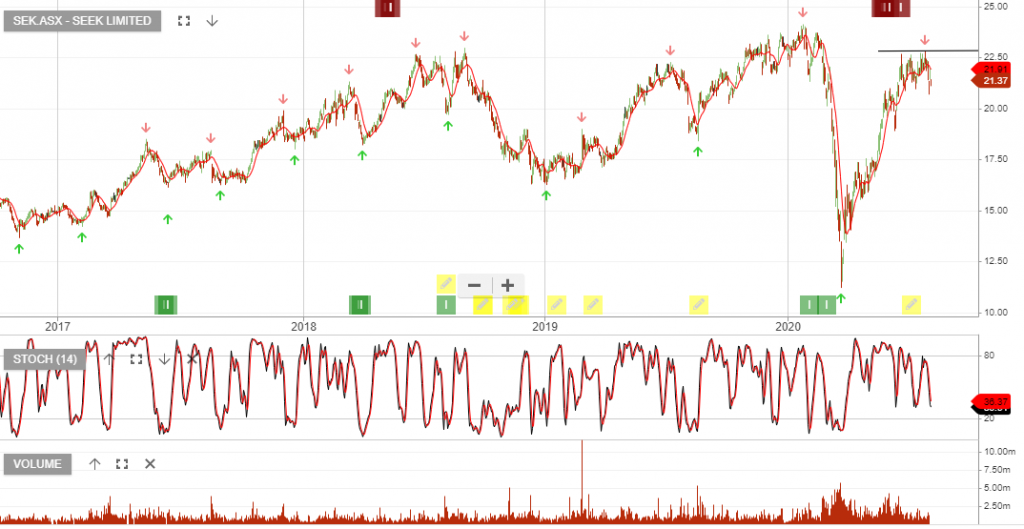

Seek: 1H22 Earnings

Seek is under Algo Engine buy conditions.

The 1H22 performance looks strong, with revenue from continuing operations increasing 59% to $517m, reported profit up 152% to $126m. Total reported profit rose 32% to $88.1 million.

The company expects full-year revenue to be in the range of $1bn to $1.1bn and EBITDA to be in the range of $490m – $515m, NPAT to be in the range of $230m – $250m.

Seek – Sell Signal

Seek is under Algo Engine sell conditions and we remain on the short-side of the trade.

Two negatives we focus on:-

1}Surprise need to raise money in the bond market; and

2} Announcing they were dumping the final dividend in a bid to preserve capital, blaming the “uncertain environment” for the decision.

The above post was from Monday. Following today’s earnings release, Seek is down 13%. Seek has been a high conviction “short” trade expressed on our blog and in our Monday night webinar.

We suggest covering the short and taking profit.

Seek – Sell Signal

Seek is under Algo Engine sell conditions and we remain on the short-side of the trade.

Two negatives we focus on;

1}Surprise need to raise money in the bond market; and

2} Announcing they were dumping the final dividend in a bid to preserve capital, blaming the “uncertain environment” for the decision.

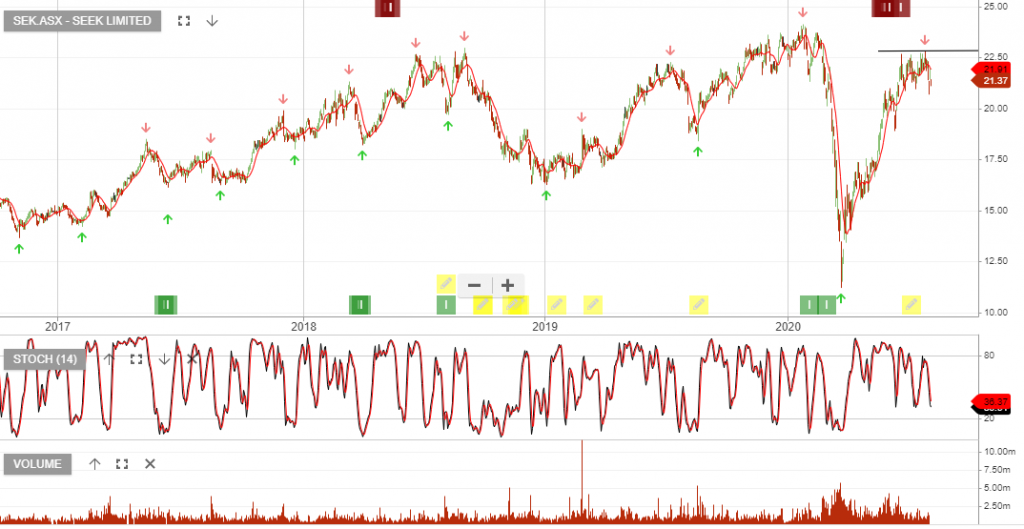

SEEK

Seek is under Algo Engine sell conditions and we see selling pressure increasing near the $22.50 level.

Send our ASX Research to your Inbox

Or start a free thirty day trial for our full service, which includes our ASX Research.