Over the last three weeks, the $33 billion takeover offer of WFD by French commercial property company Unibail-Rodamco has moved a few steps closer to completion.

Following the approval from French regulators, the Australian Foreign Investment Review Board also gave the transaction the green light to proceed; shareholders will vote at the AGM on May 24th.

As illustrated in the charts below, since part of the $10.00 per share offer includes Unibail script, the price of WFD has been following price of Unibail shares higher.

WFD was added to our ASX Top 20 Model Portfolio on February 7th at $8.90 and our ALGO engine triggered a buy signal on the same day.

Technically, the December high of $9.77 is the next key level of resistance. We suggest shareholders look to add to long positions into the AGM and take profits or use a covered call strategy in the $9.70 price range.

This has been a very popular trade on our SAXO Go CFD platform. For more information on WFD or CFD trading opportunities, call our office at 1-300-614-002.

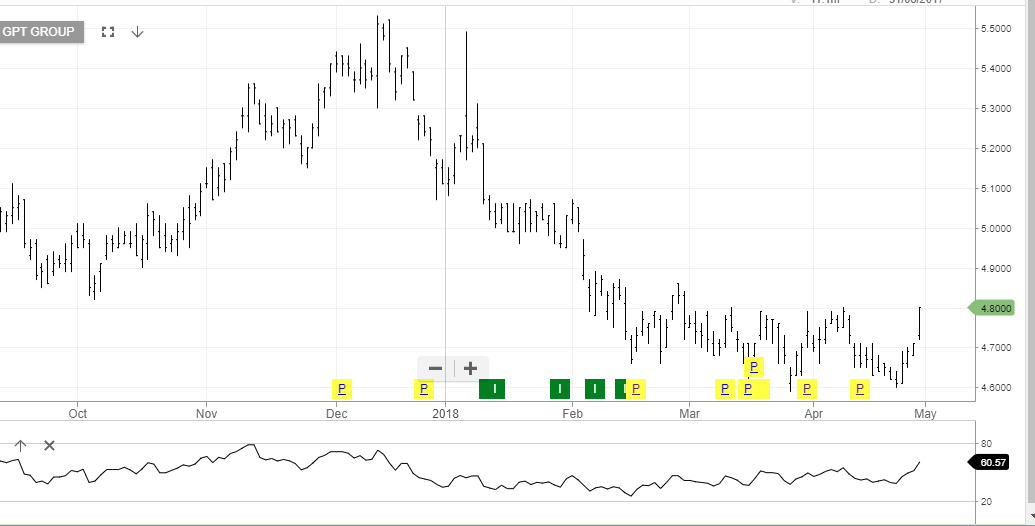

Unibail-Rodamco

Westfield Corp LTD

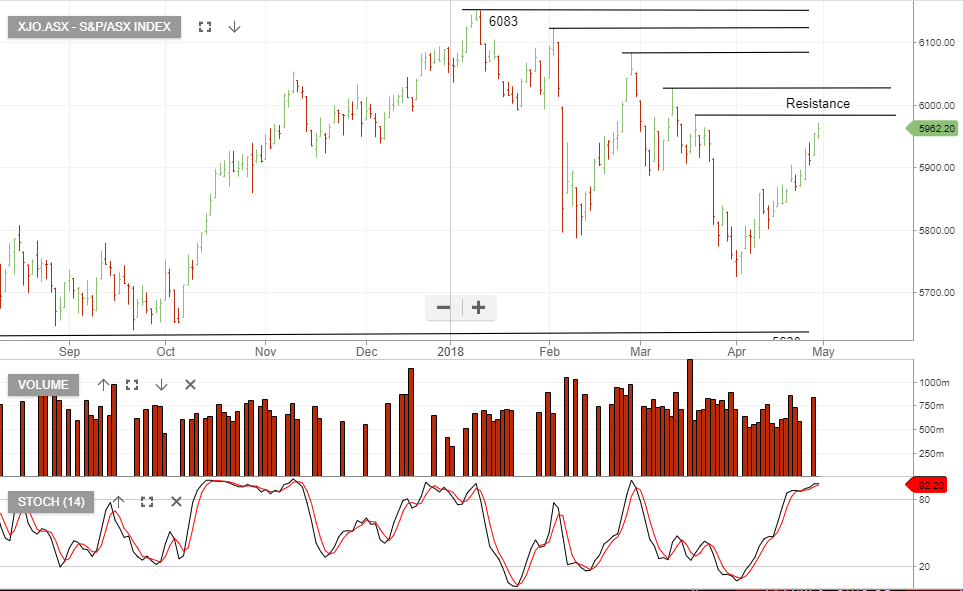

Woodside Petroleum

Woodside Petroleum