Woodside

Woodside Energy

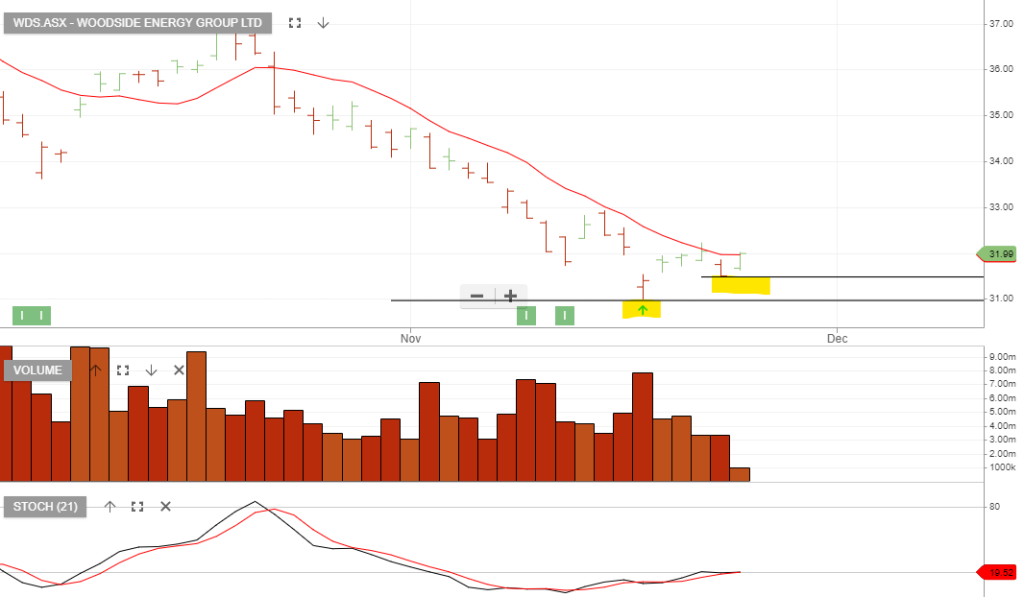

ASX:WPL needs to hold the $30.21 higher low formation.

Woodside

Woodside

ASX:WPL has formed the FTFF support at $31.50.

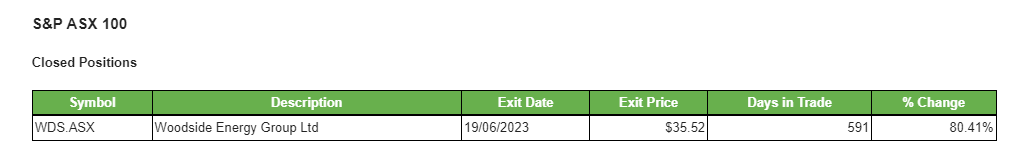

Woodside Energy Delivers 80.41% Gain

ASX:WPL was sold after a 591-day holding period, generating an 80.41% gain including dividends.

Woodside

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Woodside Rallies 25%

Woodside Petroleum is under Algo Engine buy conditions and is a current holding in our ASX 100 model.

17/2 Update: WPL has now rallied 25%+

WPL – Rallies 10%

WPL:ASX is under Algo Engine buy conditions and is a current holding in our ASX model portfolio.

10/1 update: WPL remains our preferred energy exposure along with the FUEL ETF. WPL has now rallied 10% and the momentum remains positive.

WPL – Buy

WPL:ASX is under Algo Engine buy conditions and is a current holding in our ASX model portfolio.

Send our ASX Research to your Inbox

Or start a free thirty day trial for our full service, which includes our ASX Research.