Bank of Queensland

Bank of Queensland is under Algo Engine buy conditions.

Bank of Queensland

Bank of Queensland has switched to Algo Engine buy conditions.

After stripping out the cost and bad debt movements, the 1H24 result was soft. In a difficult retail banking outlook, the path to restoring profitability is unclear.

Stop loss @ $5.76

Bank of Queensland

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

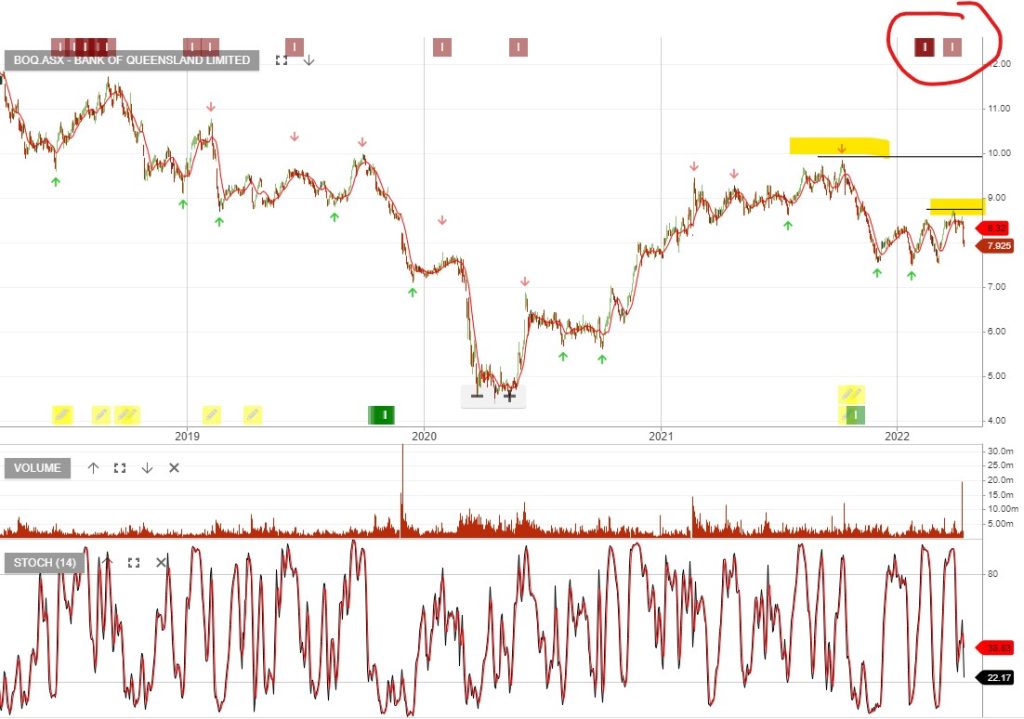

Bank of Queensland 1H22 Earnings

Bank of Queensland is under Algo Engine sell conditions.

BOQ has reported 1H22 cash earnings of $268m, supported by credit loss provision releases and one-off revenue gains. The underlying business reflected -5% profit growth and forward revenues in the next 12 months are forecast to remain flat.

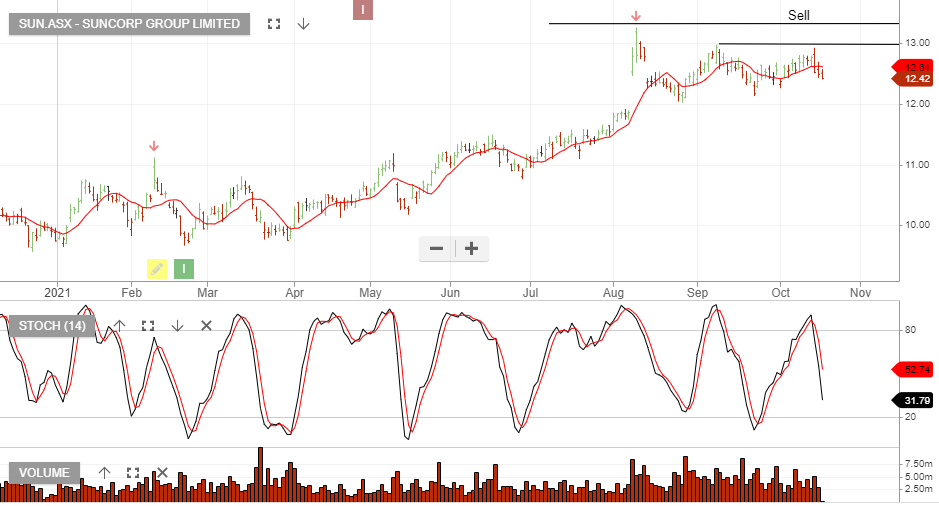

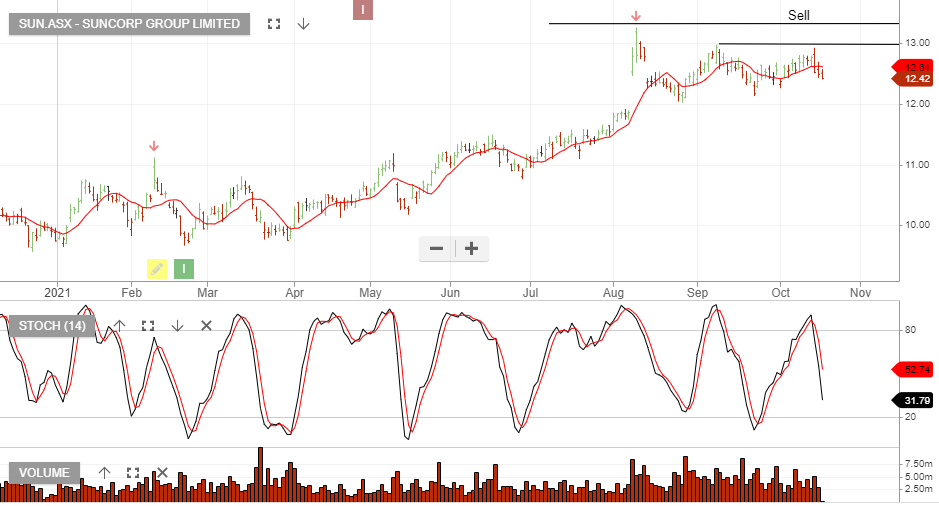

Suncorp – Sell

Suncorp Group is under Algo Engine sell conditions and we expect selling pressure to build below the $13.00 resistance level.

Short SUN with stops above $13.00

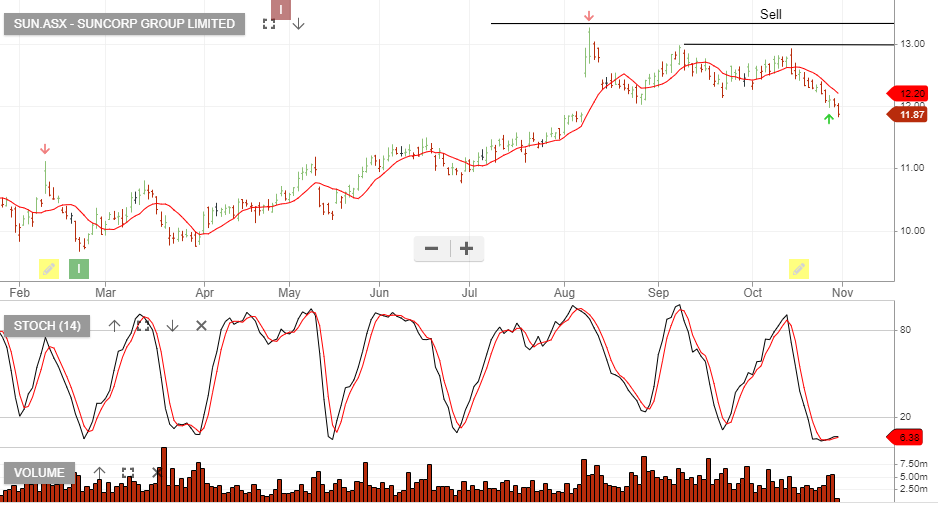

29/10 update:

Suncorp – Sell

Suncorp Group is under Algo Engine sell conditions and we expect selling pressure to build below the $13.00 resistance level.

Short SUN with stops above $13.00

Bank of Queensland – Sell

Bank of Queensland is under Algo Engine sell conditions and we expect selling pressure to build below the $10.00 resistance level.

Short BOQ with stops above $10.00

BOQ – Algo Sell Signal

Bank of Queensland announced 1H19 cash earnings of $167m which is below the downgraded guidance the company provided in February and 8% below the same time last year.

The result continues to highlight the struggles the regional banks have in the current environment.

An interim dividend of $0.34 was declared, which is a reduction from 2018 levels.

The chart below shows the Algo Engine sell signals in BOQ, starting in early 2018 at $13.00. BOQ now trades sub $9.00 and is likely to continue lower.

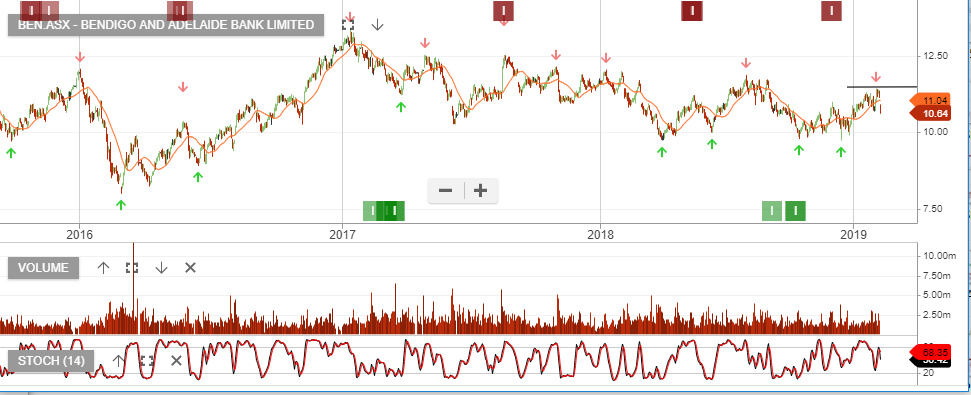

Bendigo Bank – 1H19

Bendigo reported earnings slightly below market consensus.

1H19 cash profit came in at $220m, however, we continue to see challenging conditions for the regional banks.

BEN and BOQ both display lower high formations and are under Algo Engine sell signals.

Send our ASX Research to your Inbox

Or start a free thirty day trial for our full service, which includes our ASX Research.