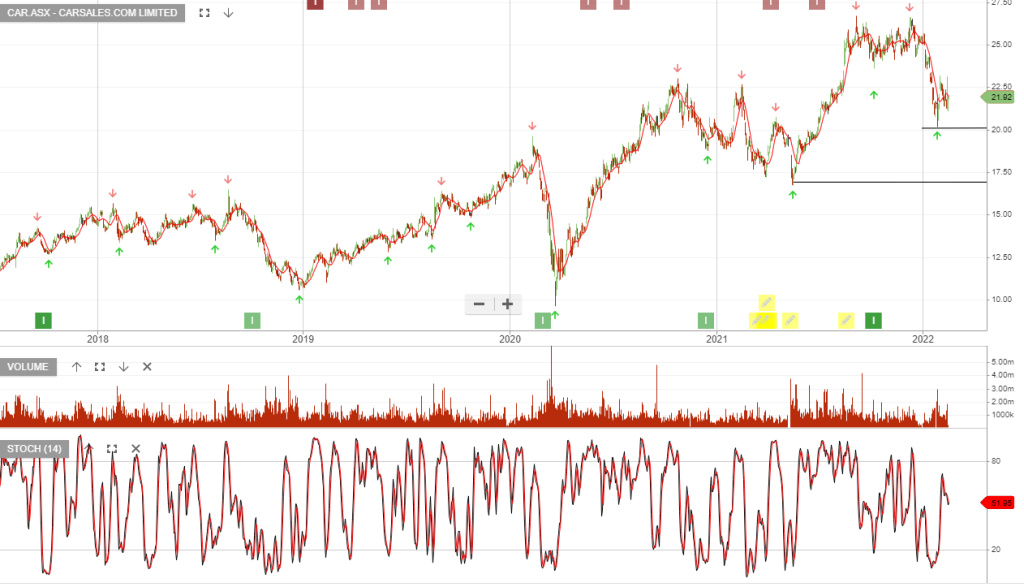

Car Group

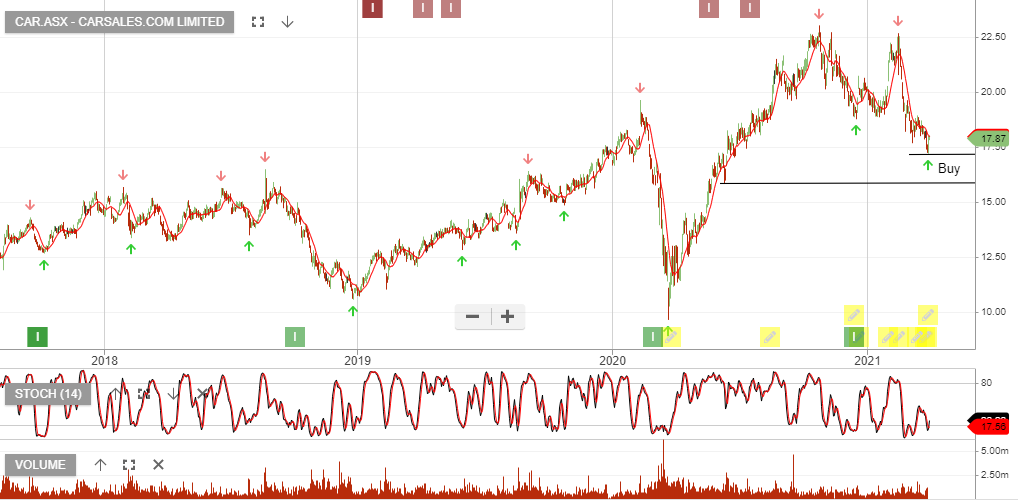

CAR Group is rated a buy with a stop loss at 36.66

CAR Group is rated a buy with a stop loss at 36.66

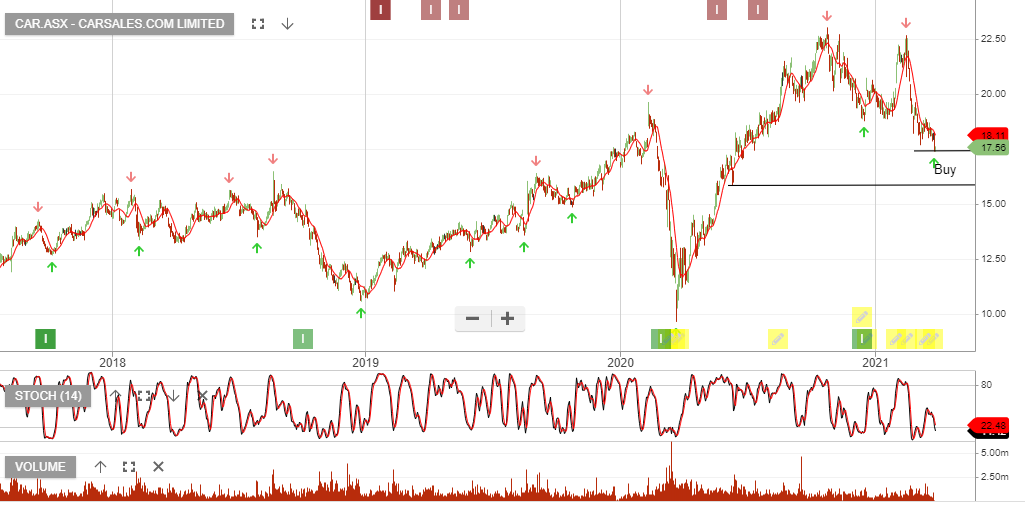

Carsales.Com delivered a solid 1H22 result particularly on the revenue line. The outlook has seen slight downgrades and the focus for investors will be the performance of the international businesses in FY23.

EBIT is expected to grow by 10% and the forward yield now represents 2.5% and the stock trades on 27x FY23 earnings.

Carsales.Com is on our watchlist and we intend to add the stock to our model portfolio on the next Algo Engine buy signal.

FY21 revenue rose 8% to $394 million and EBITDA increased 20% to $427 million. Profit growth was driven largely by strong international growth.

Carsales.Com is under Algo Engine sell conditions and is not currently in our portfolio.

We highlight the recent announcement where Carsales will acquire a 49% stake in a US marketplace business for A$797m. The acquisition is mainly funded with a A$600m equity raising.

We expect 5 – 10% revenue growth and EBIT increasing from $230m to $270m in FY22. This supports a forward dividend yield of 2.6%.

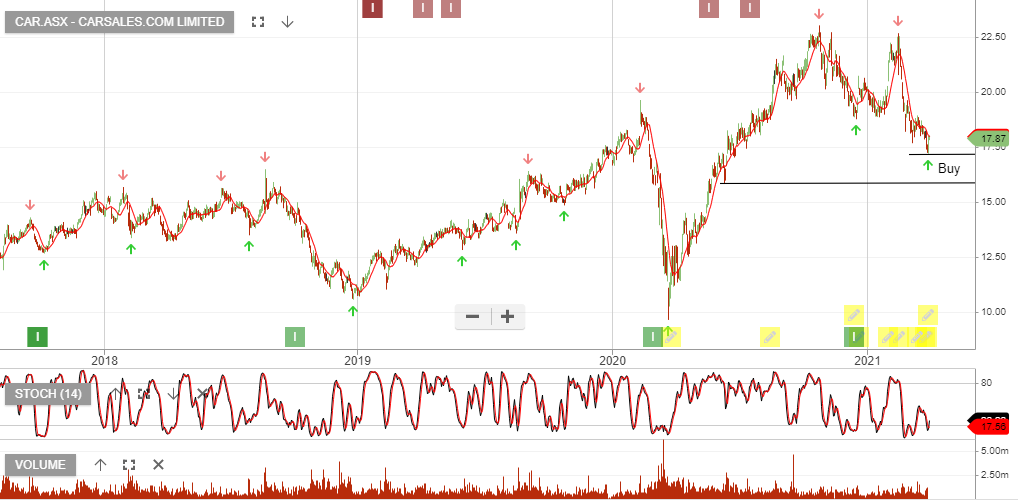

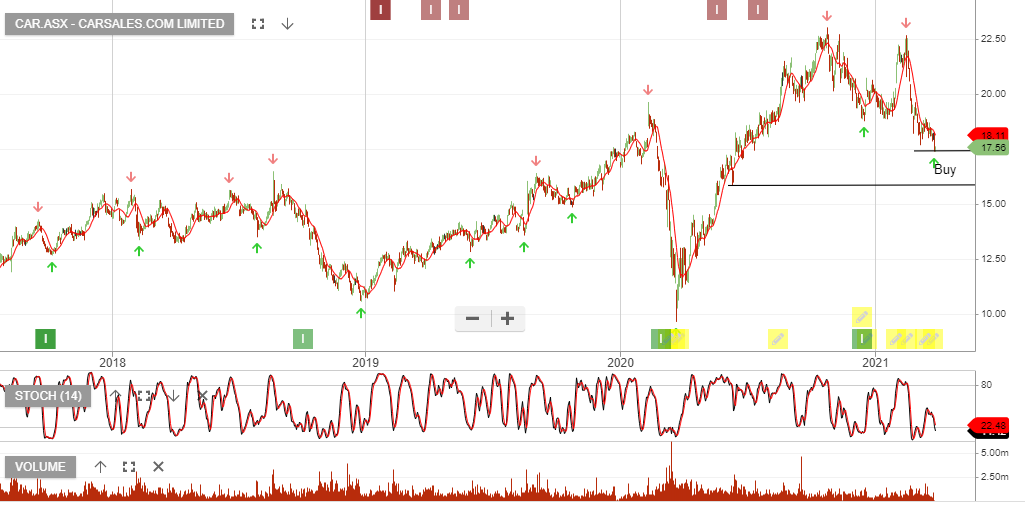

Carsales.Com is under Algo Engine buy conditions and is a current holding in our model portfolio.

Accumulate.

8/4/21

Carsales.com is now up 10%+ from the entry point and momentum based investors may choose to stick with the trade as long as it remains above the 10 day average.

Carsales.Com is under Algo Engine buy conditions and is a current holding in our model portfolio.

Accumulate.

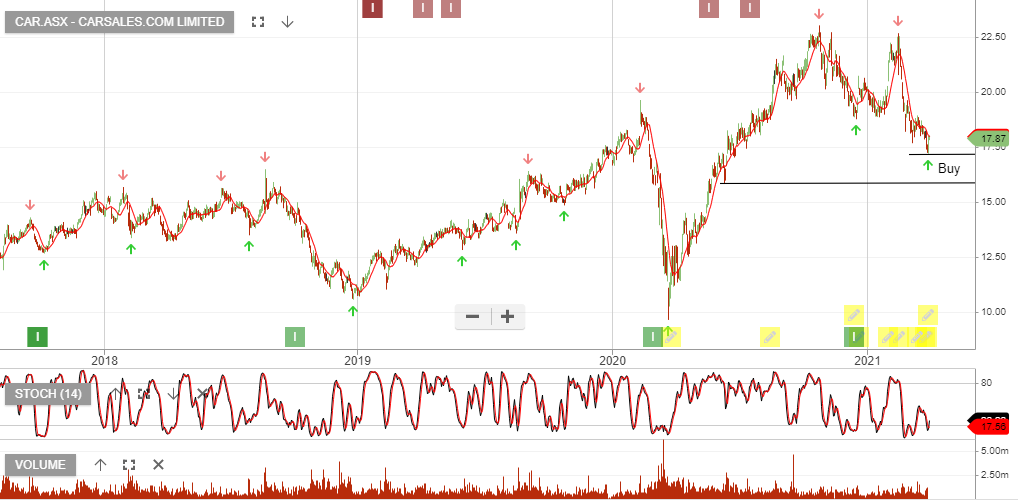

Carsales.Com is under Algo Engine buy conditions and is a current holding in our model portfolio.

Accumulate.

Carsales.Com is under Algo Engine buy conditions and is a current holding in our model portfolio.

Accumulate between $16 – $17.50

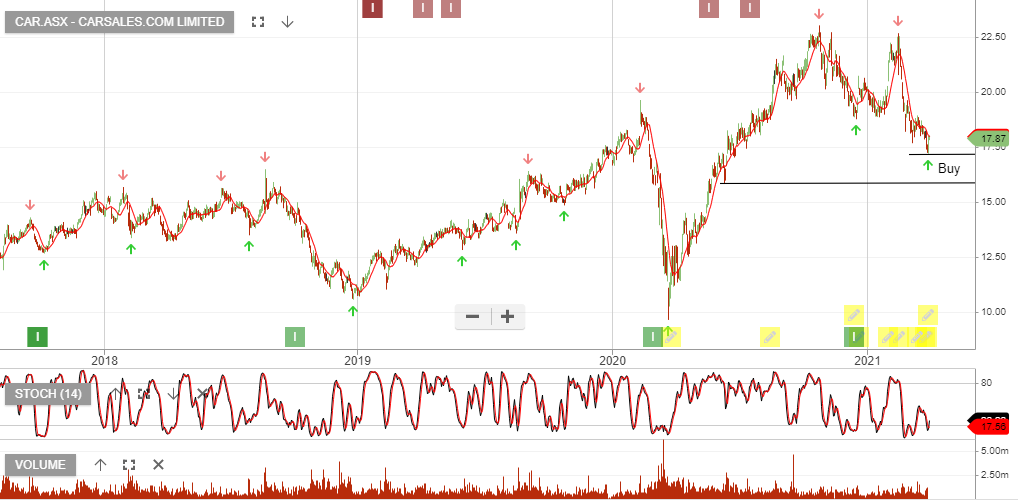

Carsales.Com is under Algo Engine buy conditions and is a current holding in our model portfolio.

Accumulate between $16 – $17.50

Carsales.Com is under Algo Engine buy conditions and is a current holding in our model portfolio.

Accumulate between $16 – $17.50

Or start a free thirty day trial for our full service, which includes our ASX Research.