Treasury Wine

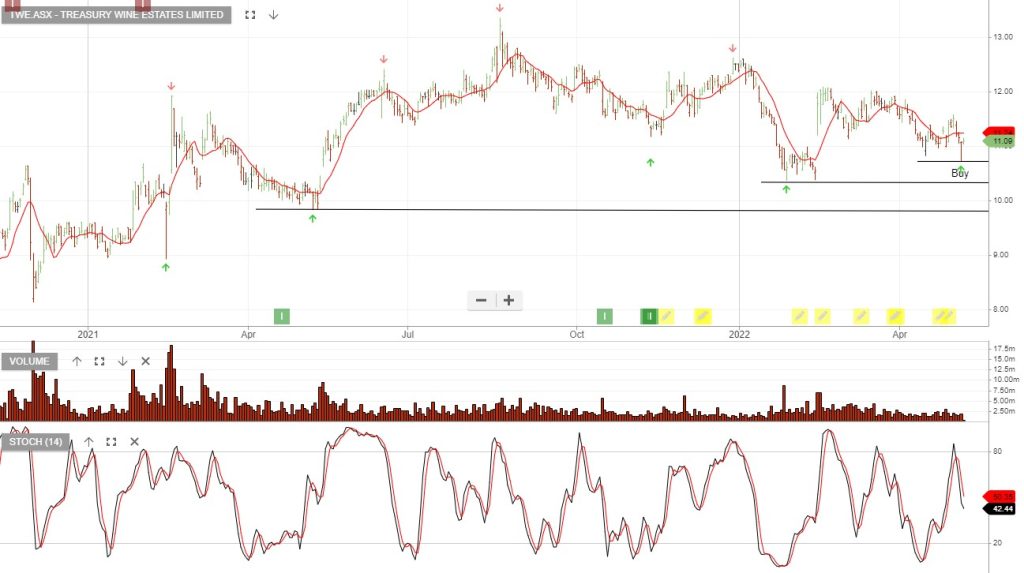

Treasury Wine Estates is under Algo Engine buy conditions. Group EBITS guidance of mid- to high single-digit growth over FY24 was reaffirmed.

Treasury Wine Estates is under Algo Engine buy conditions. Group EBITS guidance of mid- to high single-digit growth over FY24 was reaffirmed.

Treasury Wine Estates is under Algo Engine buy conditions.

Treasury Wine Estates closed at 11.77

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Treasury Wine Estates remains under Algo Engin buy conditions.

Treasury has significant earnings growth opportunities driven by the re-opening of higher-margin channels which were disrupted due to Covid.

Treasury Wine Estates remains under Algo Engin buy conditions.

Treasury has significant earnings growth opportunities driven by the re-opening of higher-margin channels which were disrupted due to Covid.

Treasury Wine Estates remains under Algo Engin buy conditions.

Treasury has significant earnings growth opportunities driven by the re-opening of higher-margin channels which were disrupted due to Covid.

Or start a free thirty day trial for our full service, which includes our ASX Research.