Altium

Altium closed

Altium

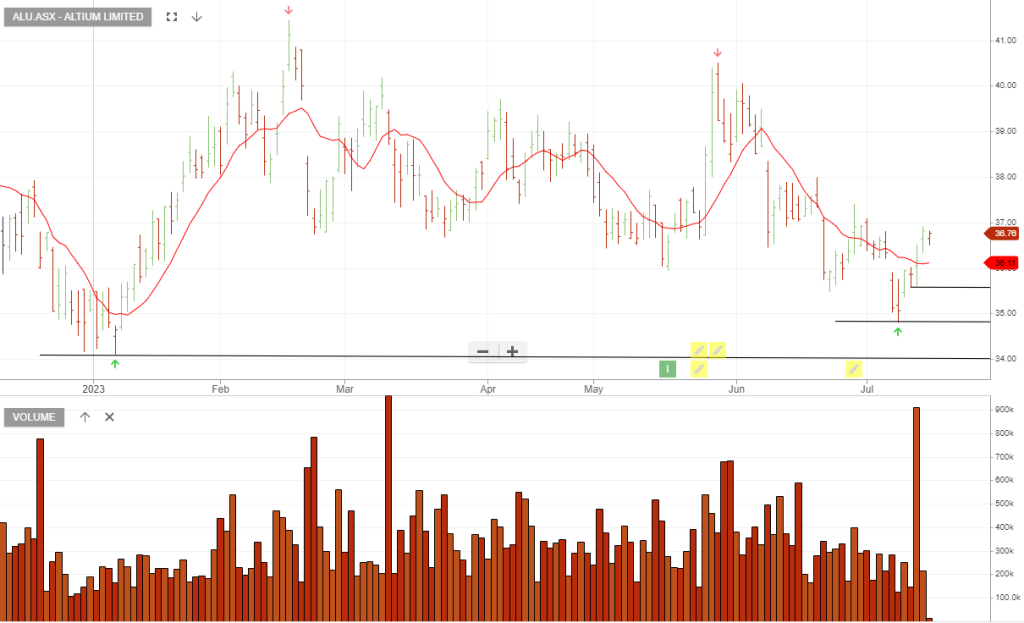

Altium FY24 guidance reaffirmed 20%+ revenue growth.

Altium

Altium: Investor Day

Altium is under Algo Engine buy conditions.

ALU’s investor day on 16 November will provide an update on revenue guidance and further details on its

fast-growing 365 cloud product.

Update 8/11:

Altium: Investor Day

Altium is under Algo Engine buy conditions.

ALU’s investor day on 16 November will provide an update on revenue guidance and further details on its

fast-growing 365 cloud product.

Altium

Altium closed at 41.95

Altium

Altium

Altium EPS is expected to grow by 17% in FY23 and the stock has recently been added to the ASX 100 model portfolio.

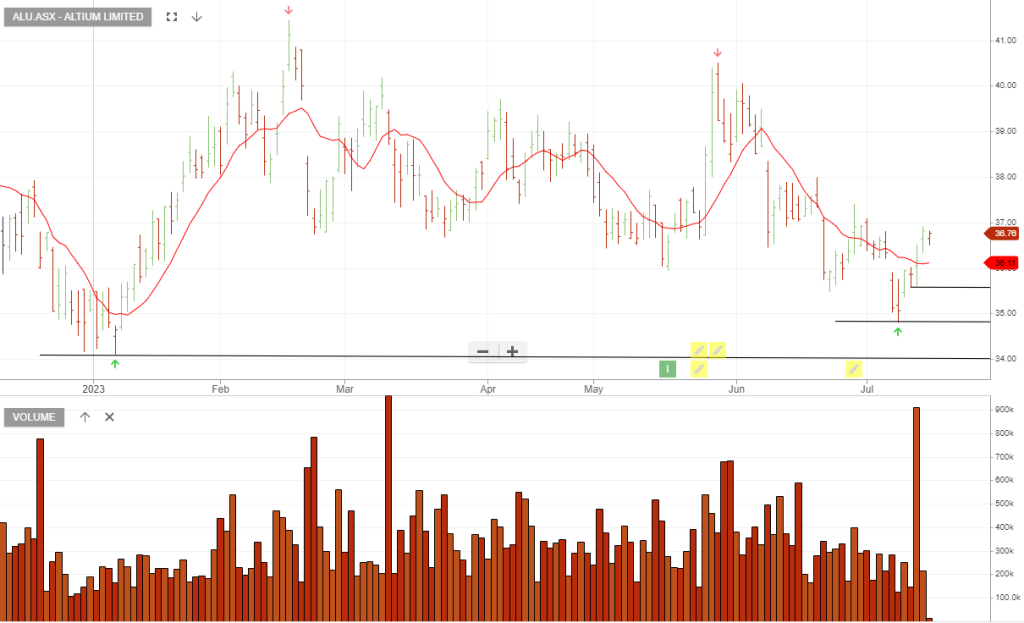

Shorter-term traders should consider opening a trade above the $35.60, (FTFF level), and placing a stop loss at the pivot low of $34.81

Altium Limited announced they will report fiscal year 2023 results After-Market on Aug 21, 2023. Altium Limited develops and sells computer software for the design of electronic products in the United States and internationally. It operates through two segments: Board and Systems; and Nexar.

Altium

Send our ASX Research to your Inbox

Or start a free thirty day trial for our full service, which includes our ASX Research.