Westpac

Westpac Banking signaled a more-rapid return of ~$4bn of excess capital. 1H24 75¢ ordinary dividend, a 15¢ special dividend, and an additional $1bn added to the buyback.

WBC reported 1H24 cash earnings of $3,342m, in line with consensus.

Westpac Banking signaled a more-rapid return of ~$4bn of excess capital. 1H24 75¢ ordinary dividend, a 15¢ special dividend, and an additional $1bn added to the buyback.

WBC reported 1H24 cash earnings of $3,342m, in line with consensus.

Westpac Banking reported FY22 earnings of $7.195bn which is up 12% on the same time last year. Total FY23 dividends $1.42 which represents a payout ratio of 70%.

WBC announced they will commence a $1.5bn on-market share buyback.

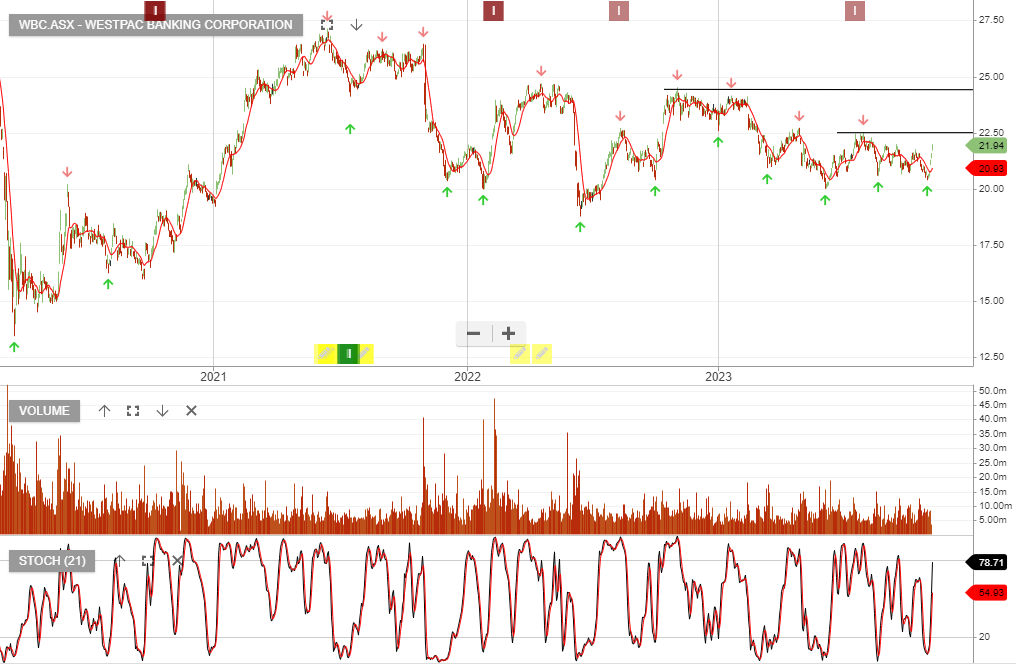

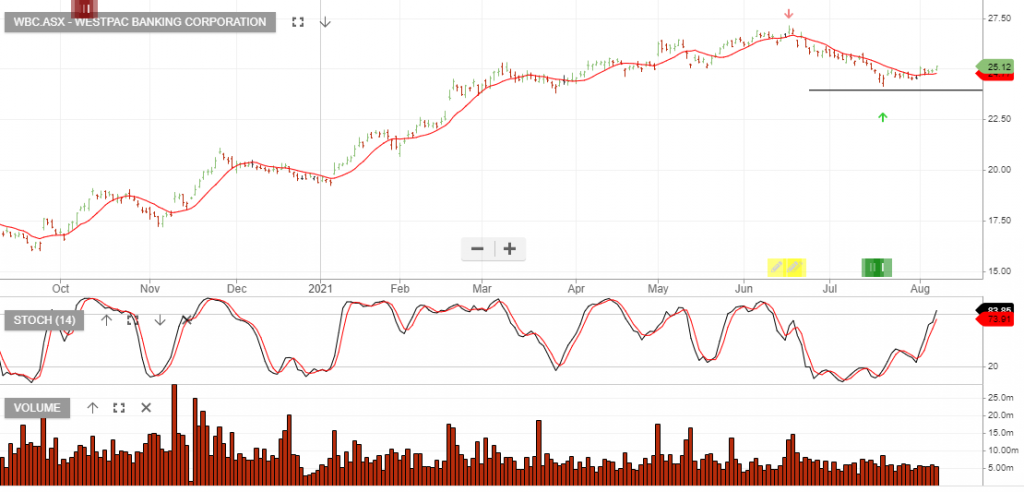

Westpac Banking is under Algo Engine sell conditions.

Westpac Banking is under Algo Engine sell conditions.

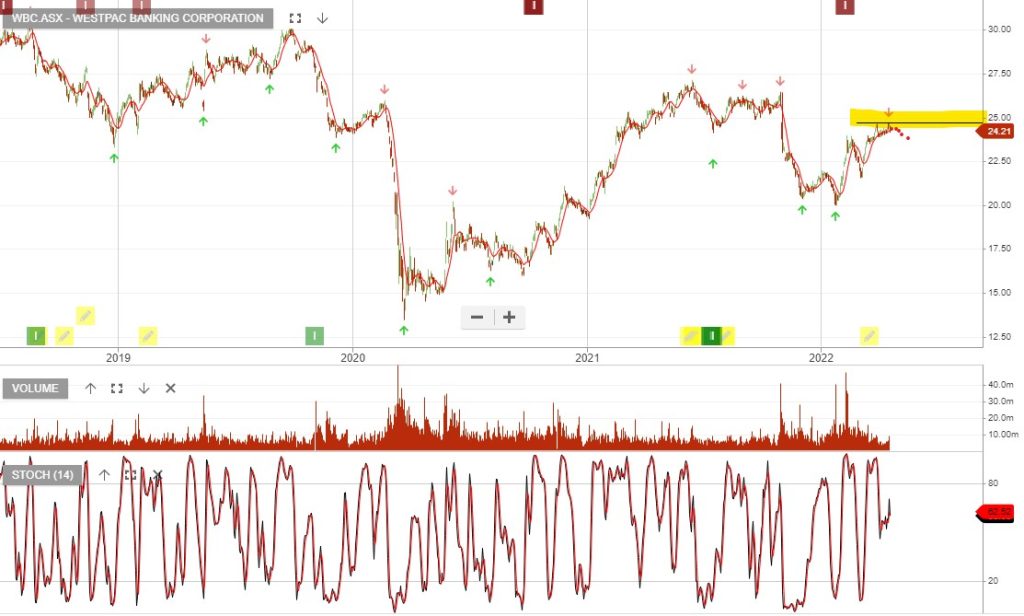

Westpac Banking is under Algo Engine buy conditions and is a current holding in our ASX model portfolio.

Westpac Banking is under Algo Engine buy conditions and is a current holding in our ASX model portfolio.

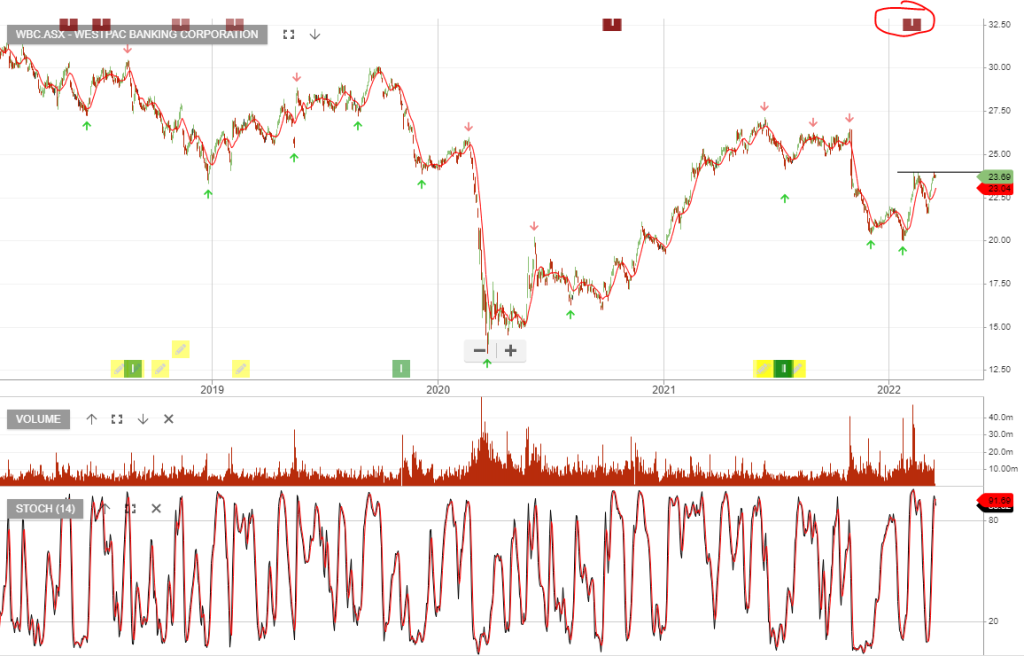

Westpac Banking is under Algo Engine sell conditions and we expect selling pressure to build with overhead resistance at $26.90

Westpac Banking is under Algo Engine sell conditions and we expect selling pressure to build with overhead resistance at $26.90

Westpac Banking is under Algo Engine sell conditions and we expect selling pressure to build with overhead resistance at $26.90

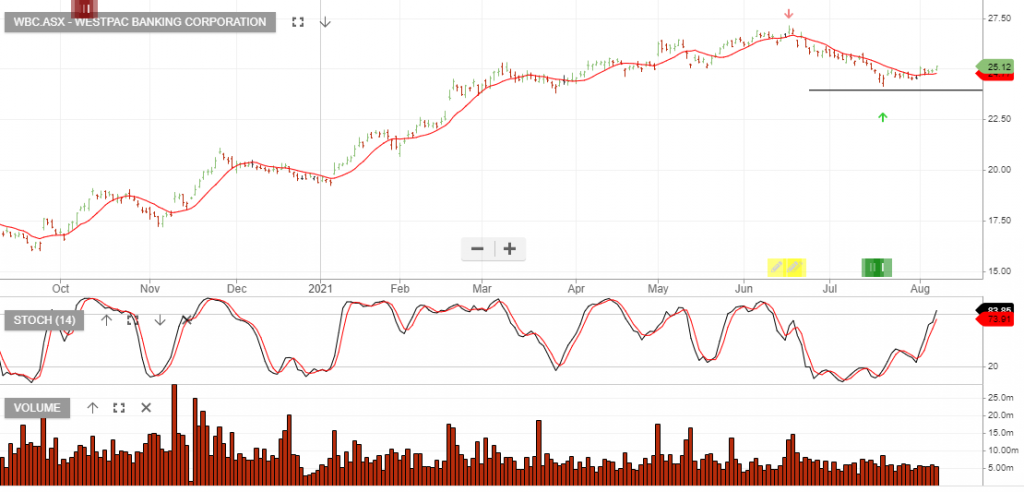

Westpac WBC reported 1Q19 earnings on Monday and despite the benefit of mortgage re-pricing pushing net interest margins higher, earnings exhibited no growth compared to the same time last year.

1Q19 cash profit came in at $2bn.

All banks, (excluding ANZ & MQG), are under Algo Engine sell conditions and we see little reason in the short term for these negative trends to reverse.

Or start a free thirty day trial for our full service, which includes our ASX Research.