CBA

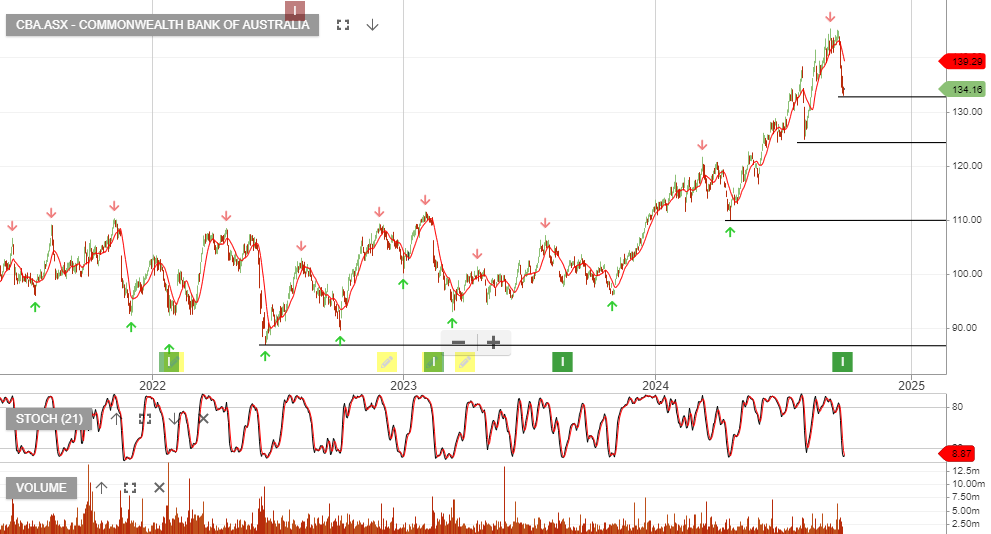

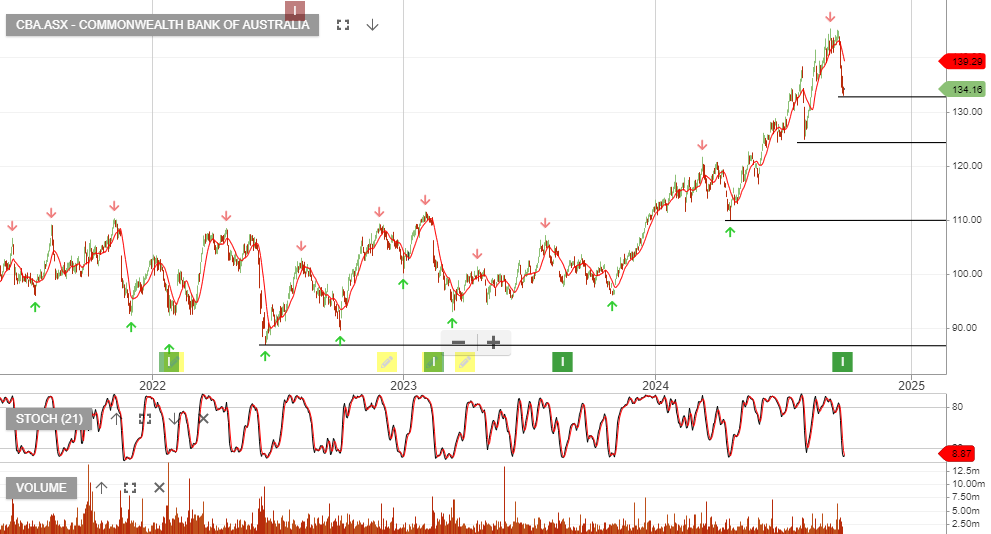

Commonwealth Bank of is under Algo Engine buy conditions from the original signal in 2023 at $100. The subsequent signal last week at $134 represents a new higher low formation, and the buying range is $120 – $134.

Commonwealth Bank of is under Algo Engine buy conditions from the original signal in 2023 at $100. The subsequent signal last week at $134 represents a new higher low formation, and the buying range is $120 – $134.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Commonwealth Bank of is scheduled to report its 1H22 result on 9 February 2022. Forecasting 1H22 cash earnings of $4.3bn with the FY22 interim dividend of $1.74 per share.

We remain underweight Australian banks.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Commonwealth Bank of posted a 21% fall in half-year net profit to $4.88bn in the six months through December from $6.16bn a year earlier. Cash earnings fell 11% to $3.89bn.

An interim dividend of A$1.50 a share, down 25% on year.

We remain cautious on the local banks following the strong run-up in share values.

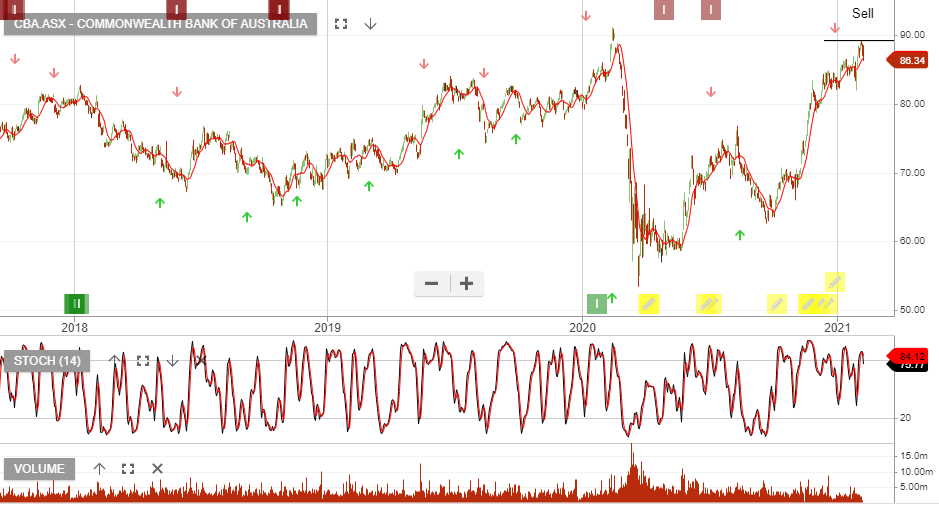

Commonwealth Bank of is under Algo Engine sell conditions and the company will report earnings on 10 Feb.

Our preference has been to be long the BetaShares Global Banks and the AXW:AXW fund.

Commonwealth Bank of is under Algo Engine sell conditions. We remain concerned about the declining profitability in retail banking.

Sell or short CBA on a break lower in the short-term momentum indicators.

Commonwealth Bank of is under Algo Engine sell conditions. We remain concerned about the declining profitability in retail banking.

Sell or short CBA on a break lower in the short-term momentum indicators.

Or start a free thirty day trial for our full service, which includes our ASX Research.