Lendlease

Lendlease

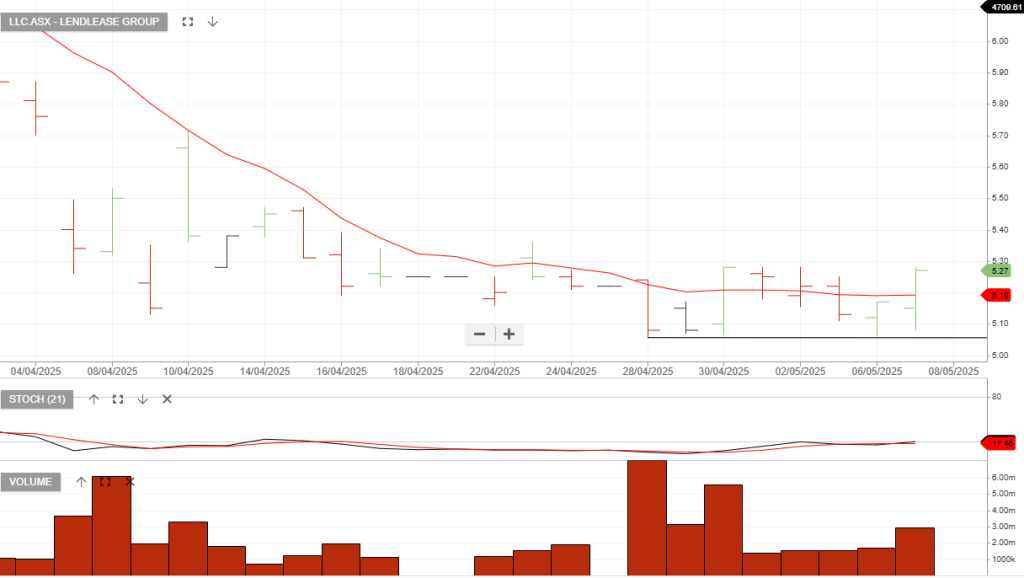

Lendlease is under Algo Engine buy conditions.

Lendlease

Lendlease is under Algo Engine buy conditions.

Lendlease

Lendlease

Lendlease is rated a buy.

Lendlease

Lendlease remains in a bullish setup pattern and the stop loss can be lifted to $6.36

Lendlease

Lendlease is rated a short-term buy with a stop loss at $6.13

Lendlease

Lendlease should be added to your watchlist. Wait for the price action to cross the 10-day average and consider adding this one to your short-term trades.

Lendlease

Lendlease is under Algo Engine buy conditions.

Send our ASX Research to your Inbox

Or start a free thirty day trial for our full service, which includes our ASX Research.