Cleanaway – Opportunity Approaches

The chart below shows the range where we will be watching for the short-term momentum indicators to turn higher.

The chart below shows the range where we will be watching for the short-term momentum indicators to turn higher.

Fortescue Metals Group is under Algo Engine buy conditions and is one of the top performing stocks in our ASX model portfolio.

QFY21 result was strong with shipments, realized prices and cash costs all beating analysts estimates. Strong iron-ore prices should continue to drive strong share price performance for FMG.

Newcrest Mining remains under Algo Engine buy conditions. NCM has reported an in line 1QFY21 result with group production of 503koz.

The company expects an improved production performance in 2Q.

We suggest investors accumulate NCM above the $29 support level or watch the short-term indicators for a reversal higher.

APA is under Algo Engine buy conditions and we see support building within the $10 to $10.50 price range.

Watch the short-term indicators for a turn higher.

Vaneck Vectors Gold Miners is under Algo Engine buy conditions.

GDX provides broad exposure to the leading global gold producers. After the recent sell-off from $65 down to $51.50, we expect to see buying support begin to rebuild.

Brambles is now approaching oversold levels and we suggest accumulating the stock as the short-term indicators turn higher.

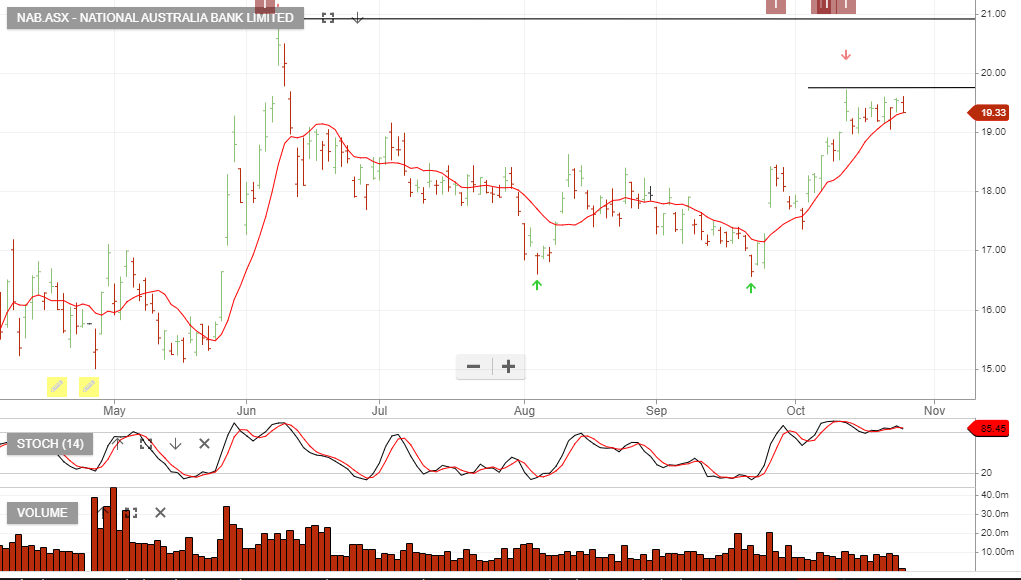

National Australia Bank is under Algo Engine sell conditions and we expect selling pressure to build at the $19.50 resistance level.

Bega Cheese has continued to see buying interest above the $5.00 support level.

Qube Holdings is under Algo Engine buy conditions and has now been added to our ASX model portfolio.

We see price support developing near the $2.50 price range. Watch the short-term momentum indicator for a turn higher.

We generally don’t buy stocks that are under Algo Engine sell conditions but occassionaly, oversold opportunities make it onto our radar.

AGL looks like it’s approaching oversold levels and investors should watch for a close above the 10-day average and a turn higher in the short-term indicators.

Or start a free thirty day trial for our full service, which includes our ASX Research.