AliBaba Group

Alibaba Group Holding Limited American Depositary Shares each representing eight Ordinary is under Algo Engine buy conditions.

Alibaba Group Holding Limited American Depositary Shares each representing eight Ordinary is under Algo Engine buy conditions.

Bitcoin needs to trade through 107,750 to re-establish the uptrend.

US May retail sales missed consensus amid a pullback in auto sales. May industrial production also unexpectedly declined as manufacturers struggled for traction against cooling demand.

NASDAQ: holding above support.

S&P500: Lower high in place and stop loss required on a reversal through 6059

Okta, Inc. – Class A Common : Add to your watchlist & wait for the price to close above the 10-day average.

Gain exclusive access inside the investing mind of Investor Signals CEO Leon Hinde. Become a wiser investor with real-time access to Leon’s Monday night webinars, and his daily portfolio advice.

Learn investment strategies from Leon Hinde and get a behind-scenes look at his investment portfolio. Get an investing advantage with benefits like industry-leading expert research and analysis, and proprietary technology built on AI algorithm models for both long-term investing and short-term trading.

Start your free trial today, click here

RTX Corporation Common is under Algo Engine buy conditions. It’s a top 5 holding in our US fund, which is now up 29%

For more information on our managed fund, click here or call 1300 614 002.

The impacts of the pandemic-era government spending and monetary policy that helped support the U.S. economy have faded, and that makes the country vulnerable to a downturn in the coming months

“I think there’s a chance real numbers will deteriorate soon,” Dimon said at a Morgan Stanley conference on Tuesday, according to a transcript from FactSet.

The Organization for Economic Co-operation and Development downgraded the US growth outlook to 1.6% in 2025 and 1.5% in 2026. The OECD previously expected a 2.2% expansion in 2025.

Nvidia reported better-than-expected earnings and revenue on Wednesday, as the company’s booming data center business recorded year-over-year growth of more than 73%.

Overall revenue grew 69% during the quarter.

EPS FY25 = $3.00: FY26 =$4.25: FY27 = $6.00: FY28 $7.30

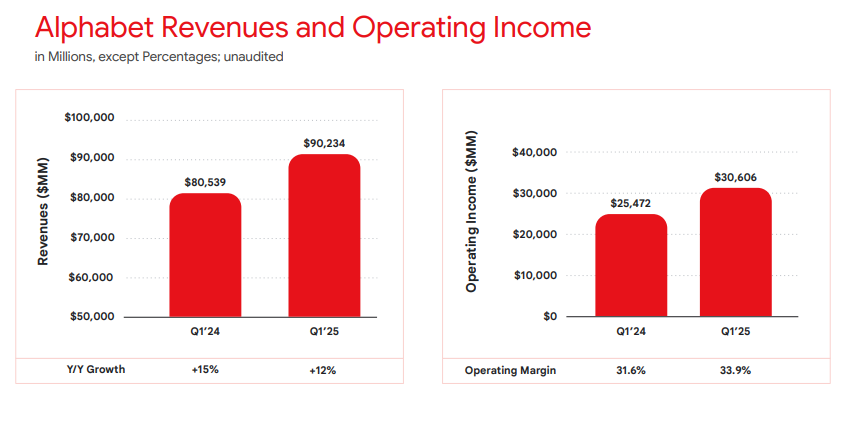

Alphabet Inc. – Class C Capital is under Algo Engine buy conditions.

A $70 billion stock buyback program was unveiled.

Revenue up 12% to $90.23B , operating income up 20% to $30.61B, with operating margin climbing to 34% from a year-ago 32%.

Google Search and other, $50.7B up 9.8%

YouTube ads, $8.93B up 10.3%

Google Network, $7.26B down 2.1%

Google subscriptions, platforms and devices, $10.38B up 18.8%

Google Cloud, $12.26B up 28.1%

Other Bets, $450M down 9.1%.

ABT:NYS is a new position opened in the US S&P 100 Trade Table.

The entry price for this position is $127.96.

Abbott Laboratories is a global healthcare company engaged in the discovery, development, manufacture, and sale of a diversified range of health care products, including cardiovascular and diabetes devices, nutritional products, diagnostic equipment, and branded generic drugs.

Or start a free thirty day trial for our full service, which includes our ASX Research.