China Large Cap

iShares China Large-Cap is under Algo Engine buy conditions.

iShares China Large-Cap is under Algo Engine buy conditions.

iShares China Large-Cap is rated a buy at $44

iShares China Large-Cap is rated a buy at $44

iShares China Large-Cap is rated a buy.

The significance of Chinese house prices to world markets cannot be overstated. For twenty years China has been powering world growth.

There are many times in the past China has been successful in re-inflating its property market and we think that on the balance of probability, they’ll achieve this again.

Relative to other global equity indices, the iShares China Large-Cap looks to offer value. The risks are high in the short term, however, an opportunity presents for the long-term investor to consider accumulating the IZZ ETF over the next 6 months.

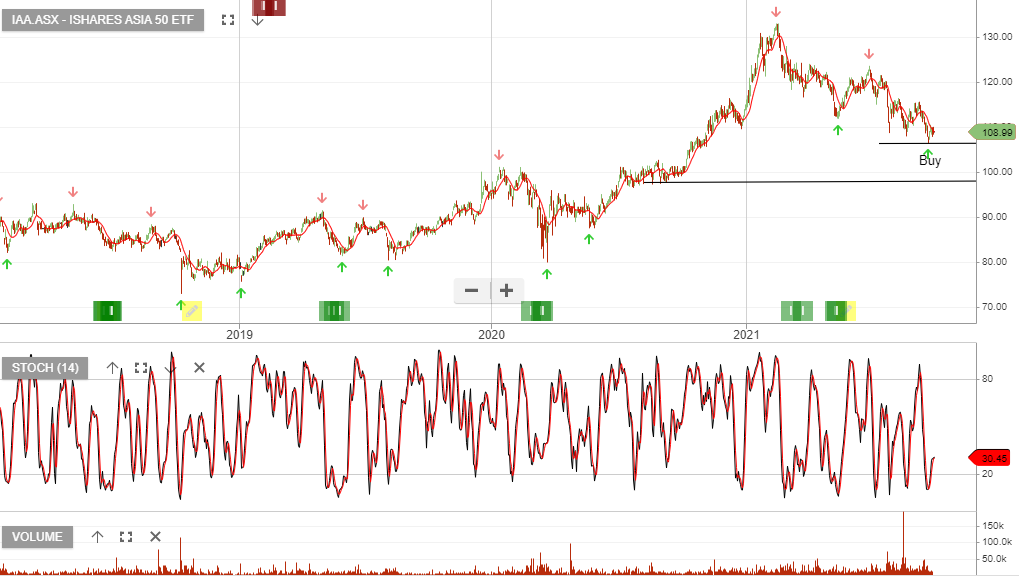

iShares Asia 50 is our preferred Asia sector ETF.

ASX:IZZ is under Algo Engine buy conditions. We expect buying interest to increase within the $55 – $60 price range.

Traders may wait for the third factor to align, an upturn in the momentum indicators. Watch for the stochastic to move higher or the price action on the main chart to cross above the 10-day average.

21/5 Buy IZZ

31/5 IZZ remains above the 10 day average.

ASX:IZZ is under Algo Engine buy conditions. We expect buying interest to increase within the $55 – $60 price range.

Traders may wait for the third factor to align, an upturn in the momentum indicators. Watch for the stochastic to move higher or the price action on the main chart to cross above the 10-day average.

21/5 Buy IZZ

ASX:IZZ is under Algo Engine buy conditions. We expect buying interest to increase within the $55 – $60 price range.

Traders may wait for the third factor to align, an upturn in the momentum indicators. Watch for the stochastic to move higher or the price action on the main chart to cross above the 10-day average.

ASX:IZZ is under Algo Engine buy conditions. We expect buying interest to increase within the $55 – $60 price range.

Traders may wait for the third factor to align, an upturn in the momentum indicators. Watch for the stochastic to move higher or the price action on the main chart to cross above the 10-day average.

Or start a free thirty day trial for our full service, which includes our ASX Research.