Qube

Qube Holdings

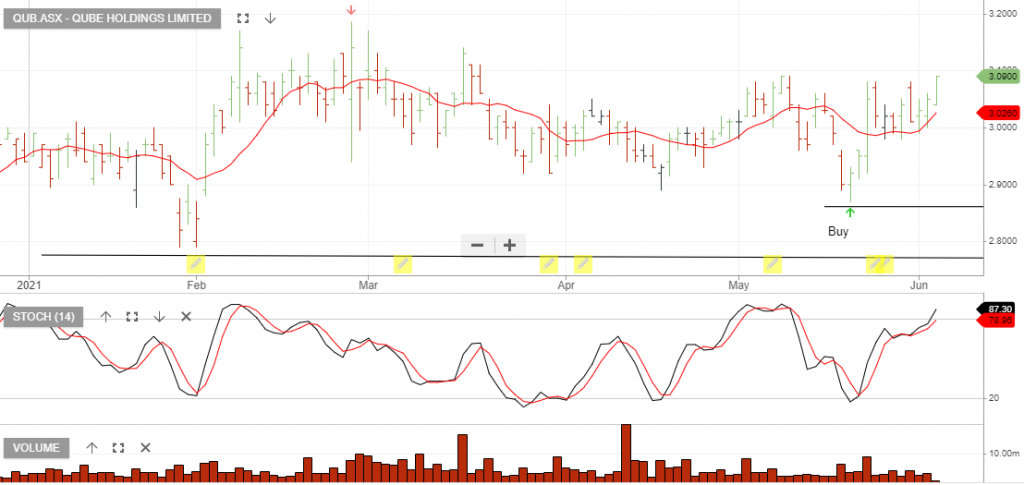

Qube Holdings is under Algo Engine buy conditions and we expect buying support to build near $2.80.

Qube Holdings

Qube Holdings is under Algo Engine buy conditions and we’re building a small initial position in the stock.

Qube Holdings

Qube 1H22 Earnings

Qube Holdings is under Algo Engine buy conditions.

1H22 NPAT of $88 million was ahead of consensus expectations.

We see moderate levels of growth, supported by container volumes and ongoing strength in commodity demand, helping to underpin 3 – 4% EPS growth into FY23 & FY24.

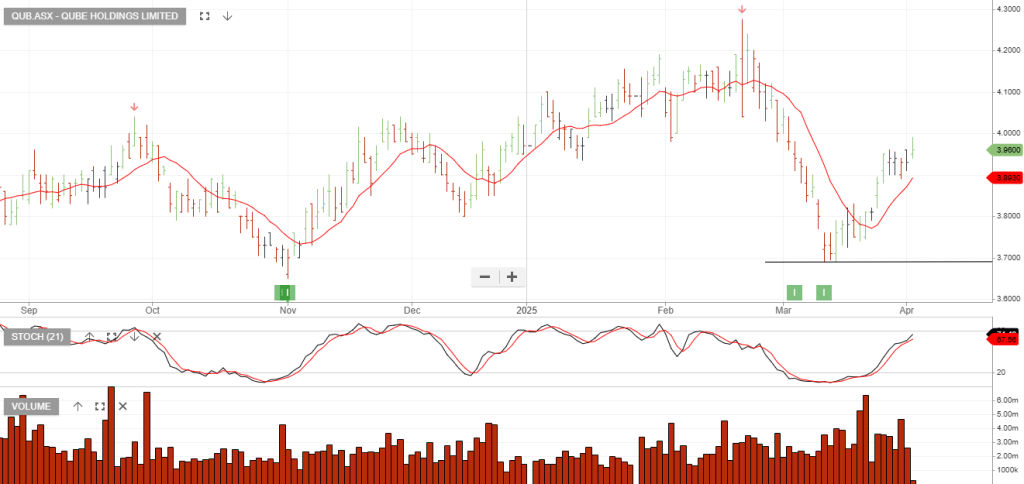

Qube Holdings – Buy

Qube Holdings is under Algo Engine buy conditions.

Qube Holdings – Buy

Qube Holdings – Buy

Qube Holdings is under Algo Engine buy conditions.

Qube Holdings – Buy

Qube Holdings is under Algo Engine buy conditions.

Port volumes for April & May were stronger than analysts expected which adds support to the $3.50 price target for Qube.

Total container movements across Australia’s major ports have increased +11% compared to the same time last year.

Send our ASX Research to your Inbox

Or start a free thirty day trial for our full service, which includes our ASX Research.