Trade Table: QBE up 6.6%

QBE Insurance Group is up 6.6% after 33 days.

QBE Insurance Group is up 6.6% after 33 days.

QBE Insurance Group was added to the ASX200 Trade Table on the 19/12.

QBE Insurance Group was discussed in the “opportunities in review” webinar earlier this month. We expressed the view that $12.00 provided support and our bullish call on QBE is now playing out. The stock has rallied from $12.00 to $13.20 and we see further upside to $14.00.

The above text was last updated on the 16th of Dec and QBE has now hit our $14 price target.

QBE Insurance Group is under Algo Engine buy conditions and is a current holding in ASX 100 model portfolio.

Support at $12.00

QBE Insurance Group is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

Recent earnings update shows QBE delivering ahead of consensus. Growth should remain strong and upgrades to 2020 earnings are now likely. The balance sheet remains robust, with A$1bn buyback over three years being executed.

Higher yields in US treasuries are helping to lift investor sentiment towards QBE and financial stocks in general.

Buy QBE and look for a move into the $13.50 price range.

QBE Insurance Group is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

FY18 earnings were announced today and QBE delivered ahead of consensus. Growth was strong and upgrades to 2019 earnings are now likely.

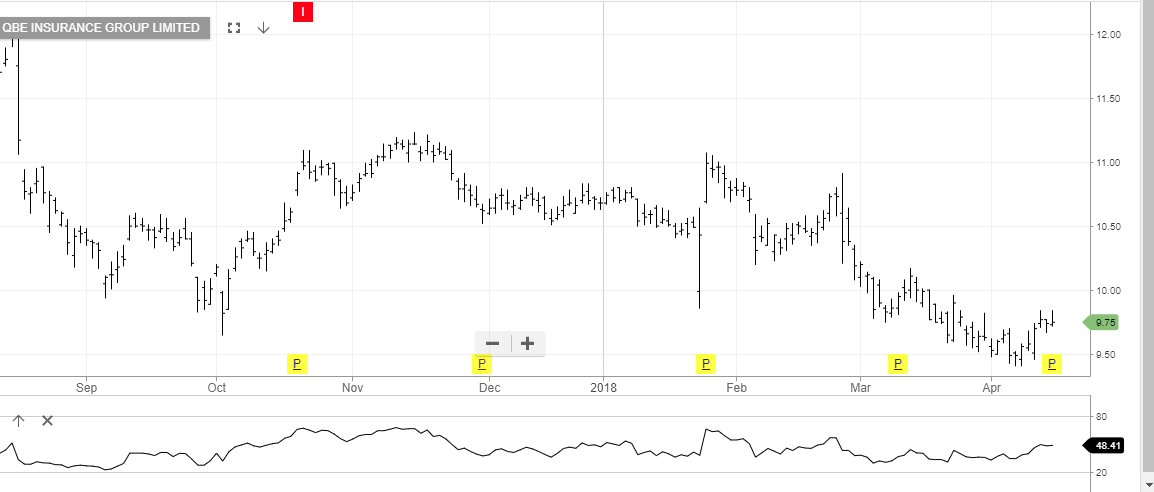

After trading as high as $10.50 on May 18th, shares of QBE have dropped over 10% and reached $9.25 last week.

However, the share price got a lift on Thursday after UK Ratings agency, A.M. Best affirmed its Financial Strength Rating to A, and its Long-Term rating to a+.

At Friday’s closing price of $9.41, QBE is trading at a P/E of 13 and the 22 cent dividend on August 24th places it on a yield of 5.10%.

Our ALGO engine triggered a sell signal on QBE at $10.30 on May 3rd. We expect that signal to reverse soon and will advise on entry levels in a future posting.

QBE

Bank of America reported a 34% rise in first-quarter profit last night, topping Wall Street estimates, as the bank benefited from higher interest rates and growth in loans and deposits.

However, BAC under-performed in fixed income, currency and commodities (FICC) trading because of a decline in bond issuance from corporations.

Trading revenue was up only 1%. Equities trading revenue, excluding items, rose 38%, while revenue from trading fixed income fell 13%.

BAC’s trading results mirrored those of rivals JP Morgan and Citigroup; revenue from stock trading rose at both the banks, but weakness in bond trading crimped total trading revenue growth, which is why their share prices remain soft.

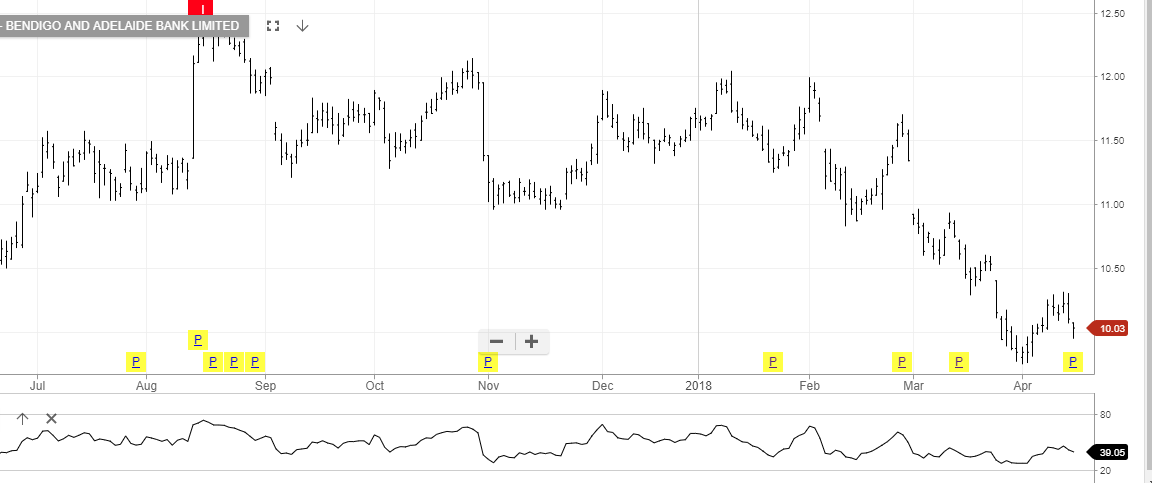

To a large degree, the local banks face the same headwinds but with the added risk of the Royal Bank commission.

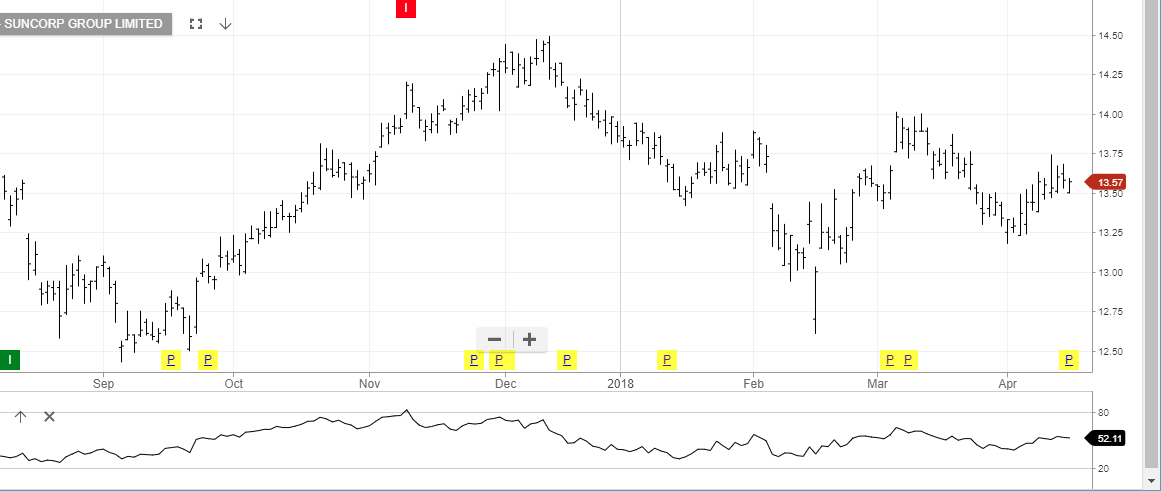

Hearings from the commission are back on this week with QBE and SUN included in the questioning over insurance related business practices.

Our ALGO engine triggered a sell signal late last year in both QBE and SUN at $10.40 and $14.05, respectfully.

We remain cautious of the local banking names and see the risk continue to be skewed to the downside, especially in the regional names like BOQ and BEN.

QBE

SUNCORP

BoQ

Bendigo Bank

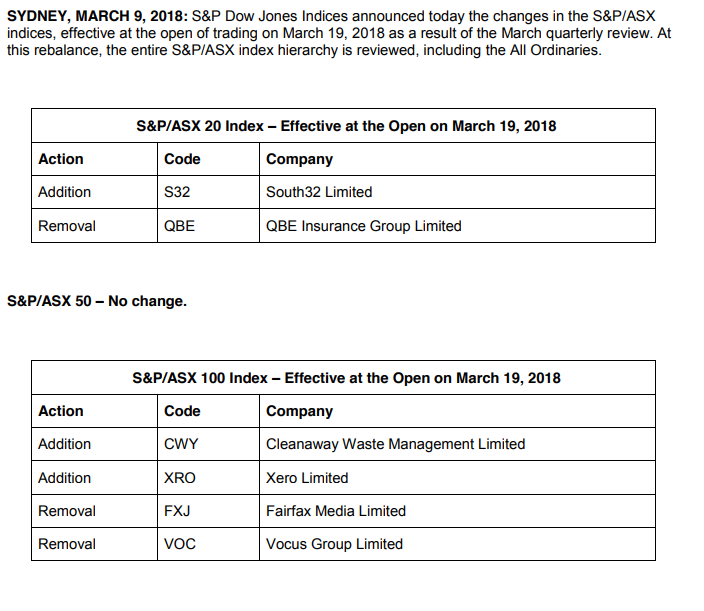

It’s always interesting to look at the index re-balancing and think about the names that have been removed or added in the index rankings.

QBE has a negative price structure and an Algo Engine sell signal.

S32 has an Algo Engine buy signal and is a core holding in our ASX Top 50 model Portfolio. As of March 19th, S32 will now move into the ASX Top 20 model.

We suggest readers look at the charts of the two new additions to the ASX100 index, CWY and XRO.

Despite warning investors about a potential US 1.2 billion full year after tax loss, shares of QBE are over 4% higher at $10.90.

After dropping over 6% to $9.85 yesterday, it seems investors looked past the headlines and saw value in the company going forward.

Much of this optimism was based on the one-off charge of US 230 million on the value of deferred tax credits in the USA and a US 700 million impairment charge.

Our ALGO engine triggered a sell signal in QBE at $11.00 on October 24th.

With the daily chart still dominated by the “lower high” pattern from mid-August, we consider QBE a reasonable stock for a BUY/WRITE strategy.

QBE Insurance

Or start a free thirty day trial for our full service, which includes our ASX Research.