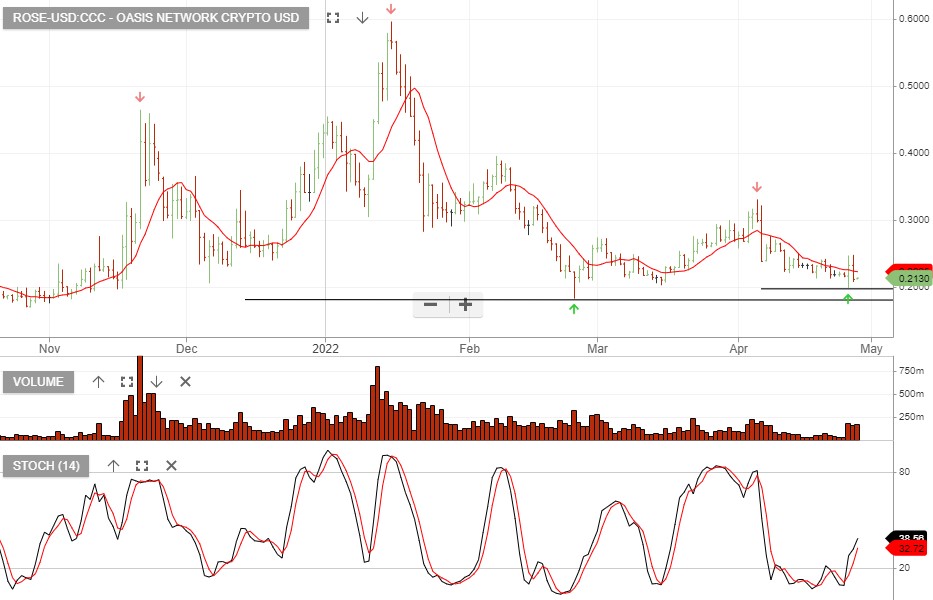

Crypto Large Cap – Signal Review

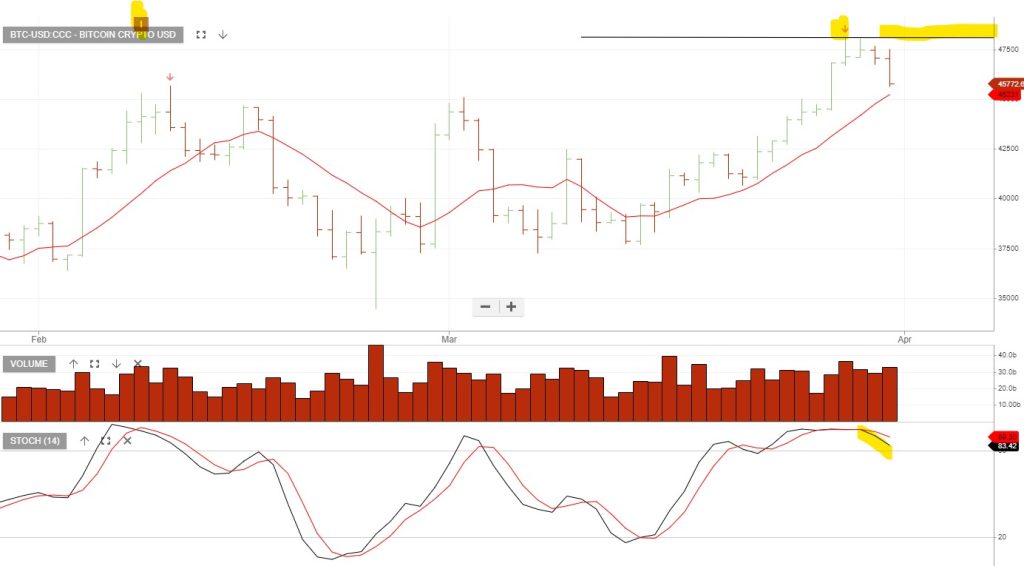

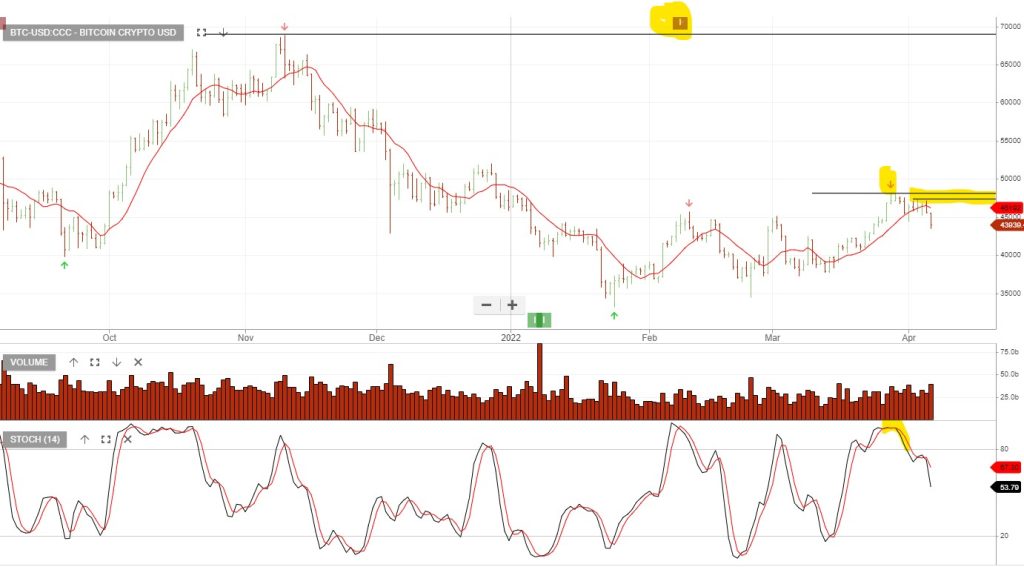

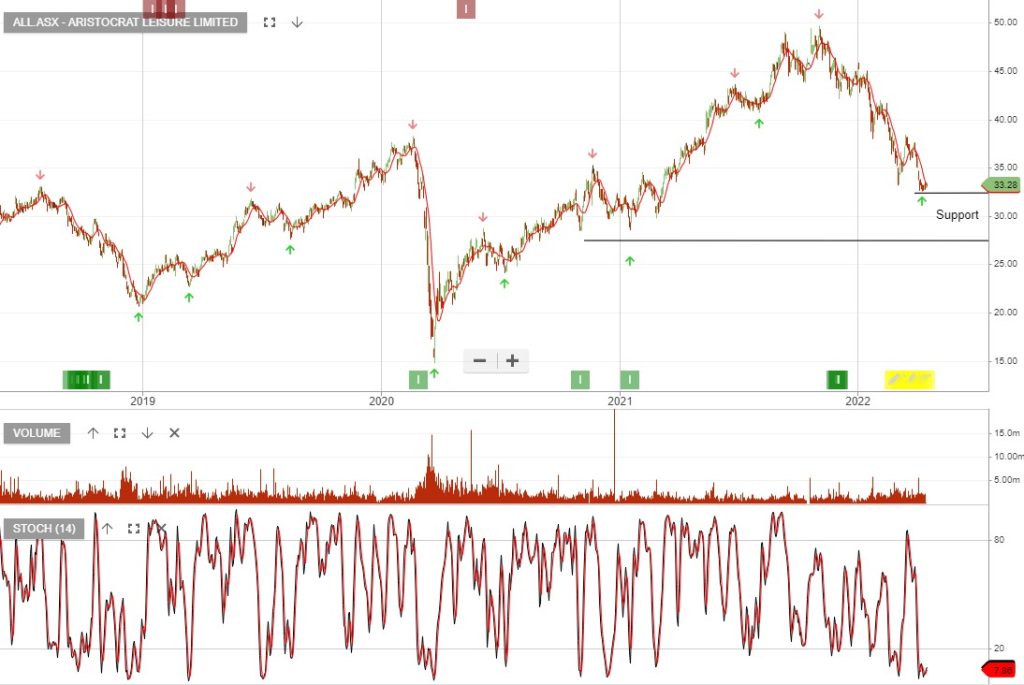

We’ve been waiting for an increase in positive pivot points to support our interest in short-term trade setups. The shift to a green arrow, (positive pivot point), combined with the primary Algo Engine buy signal is the pattern we tend to focus on when establishing short duration trades. i.e 7 to 21 days.

Referencing the initial display of the green arrow is the first indication that buying interest is beginning to rebuild. To put this into context, last week we had 2 out of 14 coins displaying the short-term setup, today we have 10 of the 14 coins.

To further filter the best trades from the 10 qualifiers, we tun to the stochastic oscillator to provide some discipline around the entry timing. Cosmos, Kadena and Oasis now meet our filtering process.