U.S. PMI index contracts – What does this mean?

U.S. PMI Composite output index — which tracks activity across the services and manufacturing sectors — fell to 47.5, indicating contracting economic output. That’s also the index’s lowest level in more than two years.

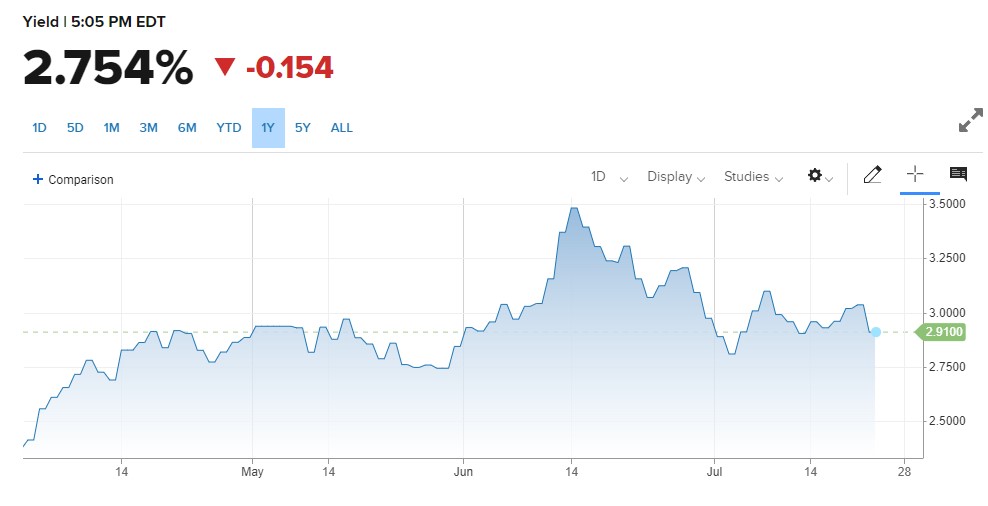

US 10-year treasury yields are moving lower after peaking at 3.5% in June.

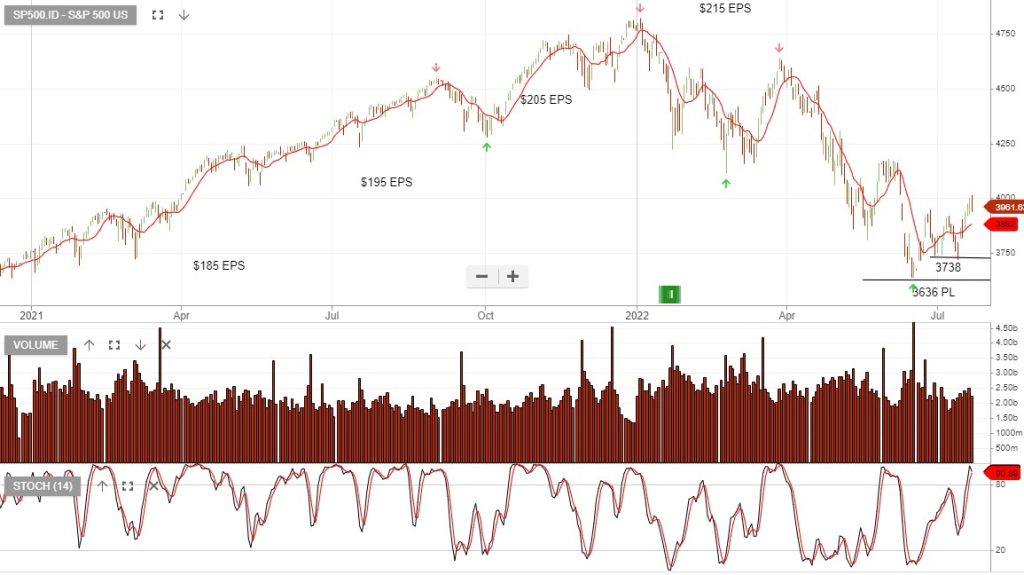

S&P500 earnings need to average $45+ for the June quarter to support the current 16x multiple and assumed 5.4% EPS growth in 2023. A break below 3738 will be negative for the S&P500 index.

Join our free Monday night webinar for more market analysis…