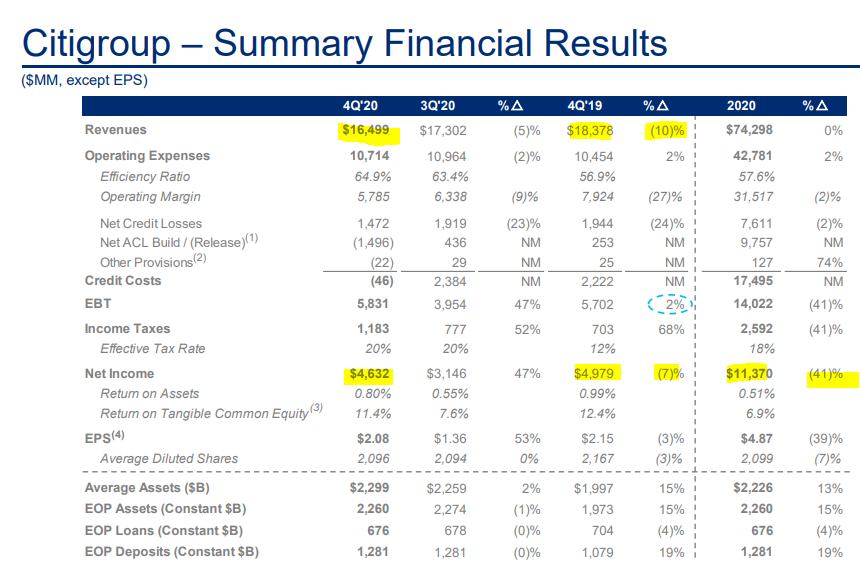

{NYS:C} reported Q4 earnings which showed a 10% fall in revenue and 7% fall in profit.

The release of $1.5bn in reserves for credit losses helps to pad the numbers, as did the potential one-off boost from growth in trading and investment-related income.

In 2021 we remain concerned about credit quality deterioration and risks to non-repeatable investment-related income growth, both likely to negatively impact returns.

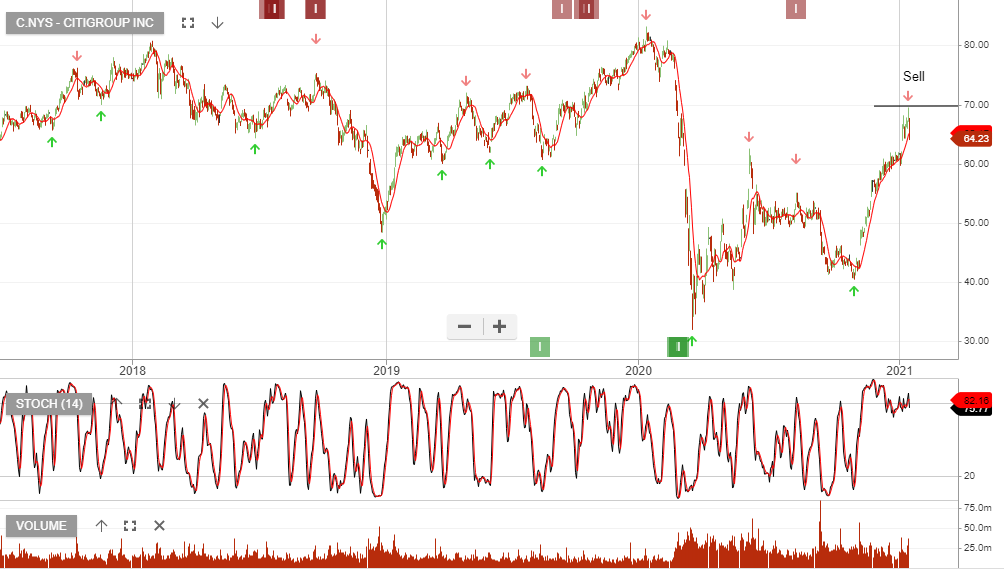

The company share buyback program will offer some downside protection and we’ll look to enter the trade from the long side, at lower price levels.

For the time being, we sit on the short side of the Citi trade.