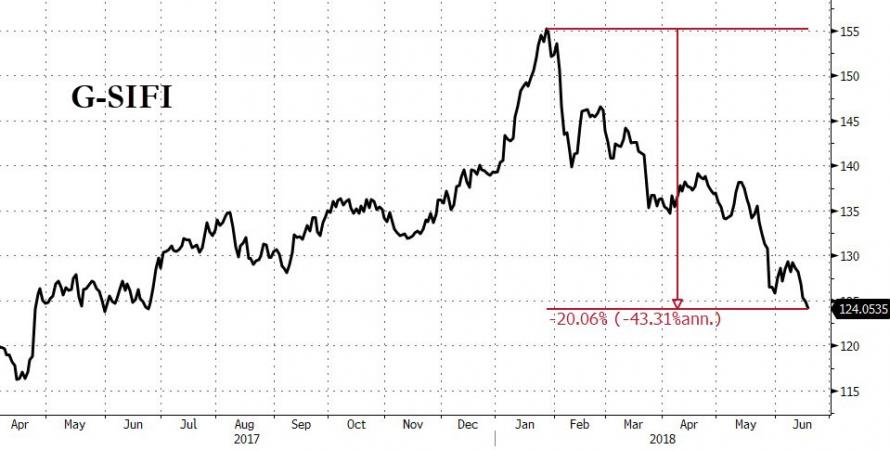

It’s a long held belief among investors that rising interest rates are good for Australian banks in terms of enhancing their earnings.

But this is not necessarily true in the current financial environment.

Banks make money on widening interest rate and credit spreads; simply, the difference between their cost of money and the return on the loans they make to their customers.

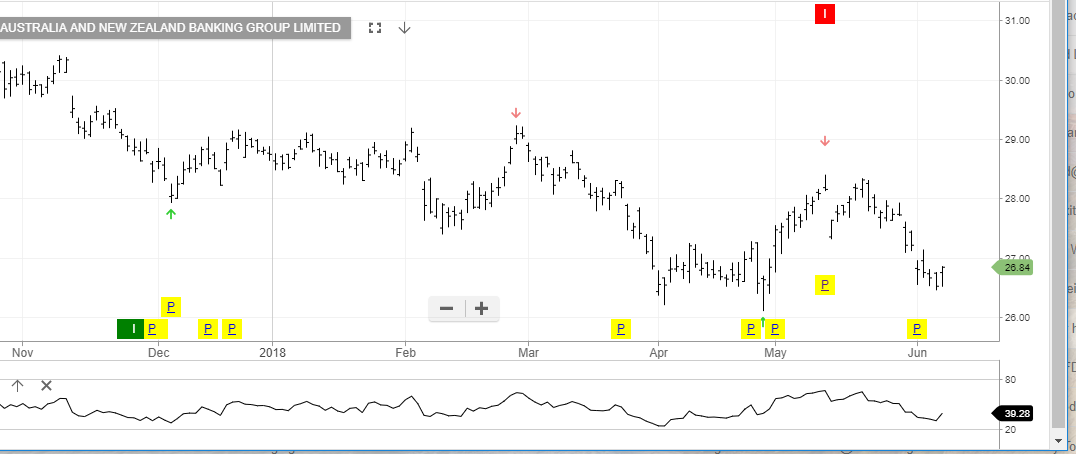

For example, last week the ANZ and CBA increased their variable rate mortgages by 16 and 15 basis points, respectfully.

The banks have cited the sustained rise in wholesale funding costs as the reason for lifting rates even though the RBA has kept official lending rates unchanged.

On a valuation basis, we’re cautious of how the repricing of variable rate mortgages will offset the headwinds of higher funding and materially add to earnings growth or an expansion of loan creation.

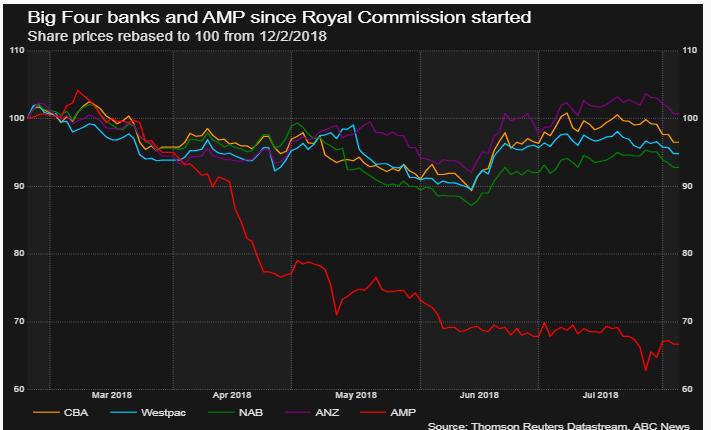

Further, it’s likely that the local banks will face increased regulatory expenses from the royal commission, including tighter underwriting standards and disclosures of fees.

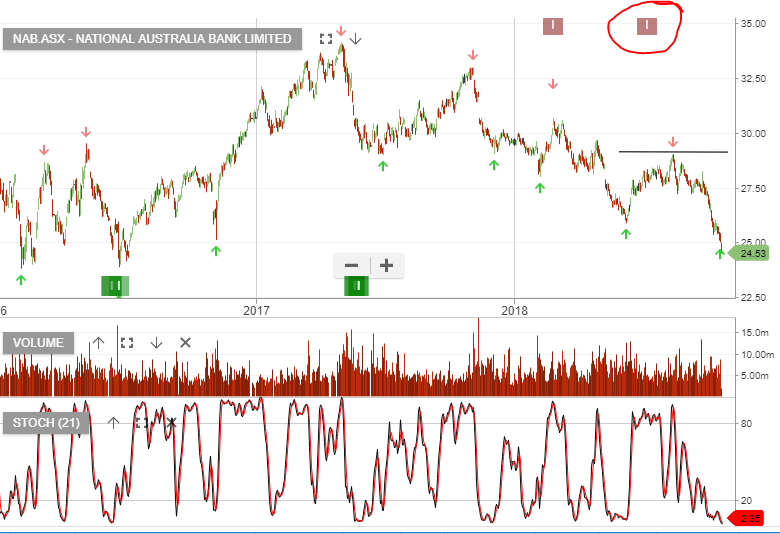

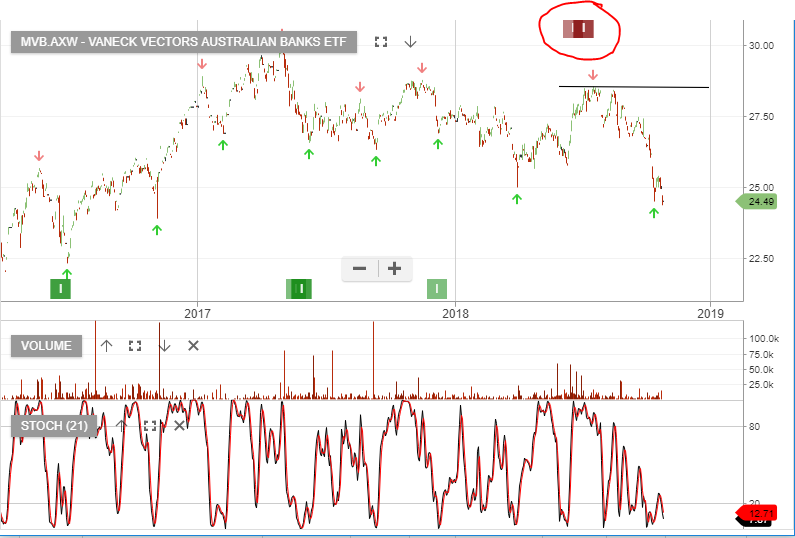

On balance, we see scope for the share prices of the domestic banks to test the lows posted in June before sustaining any protracted rally higher.

CBA

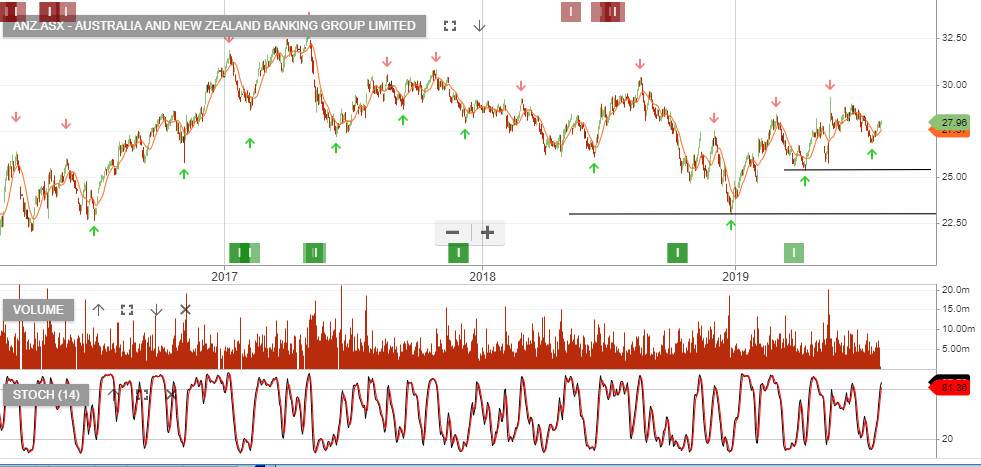

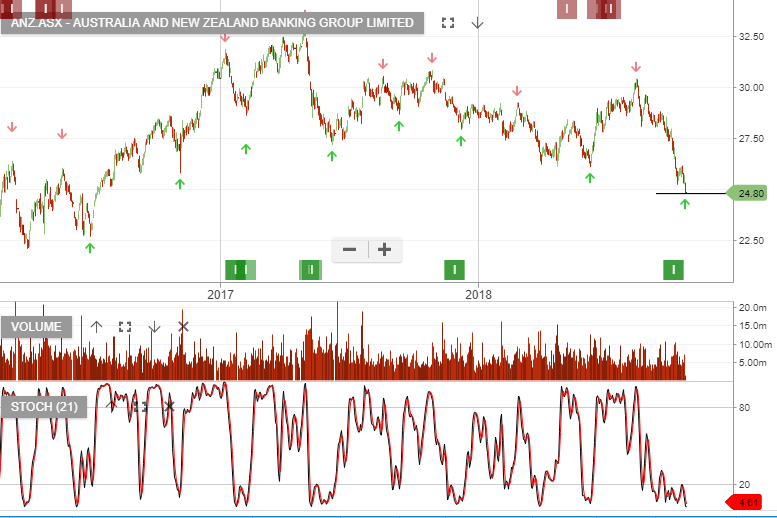

ANZ