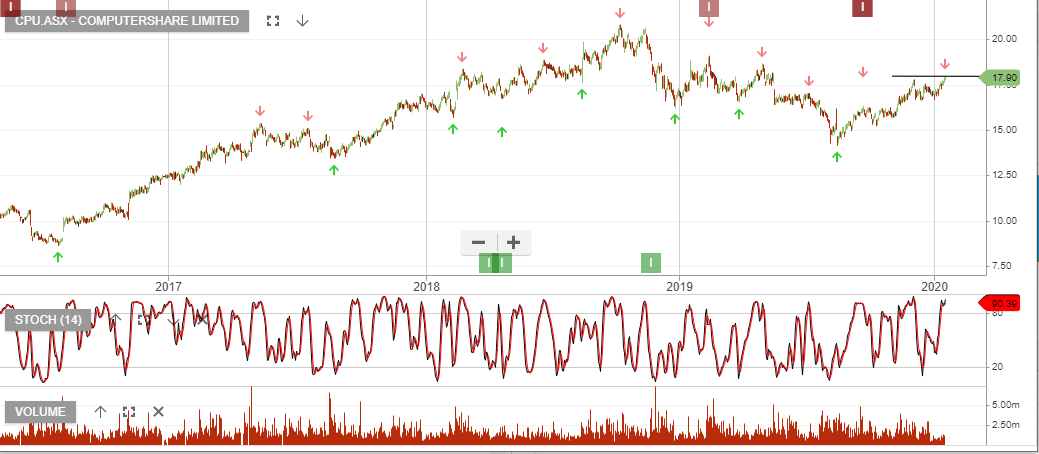

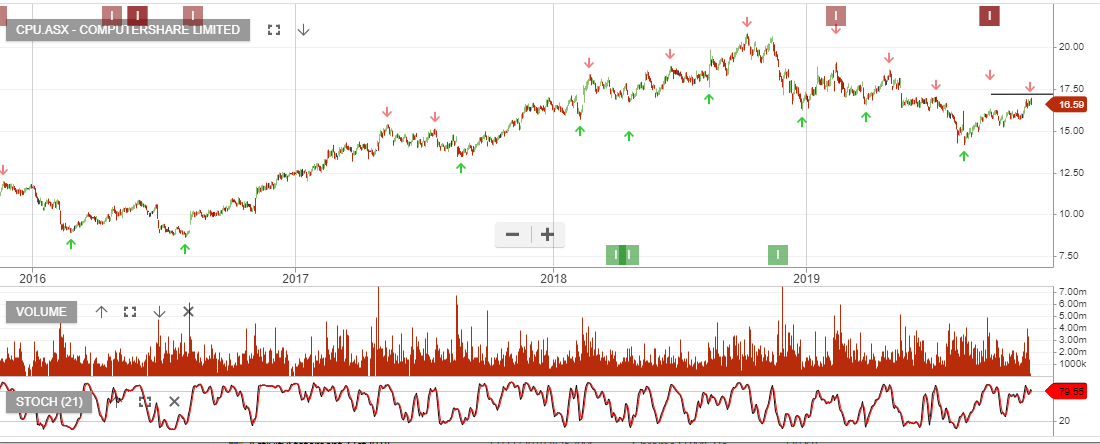

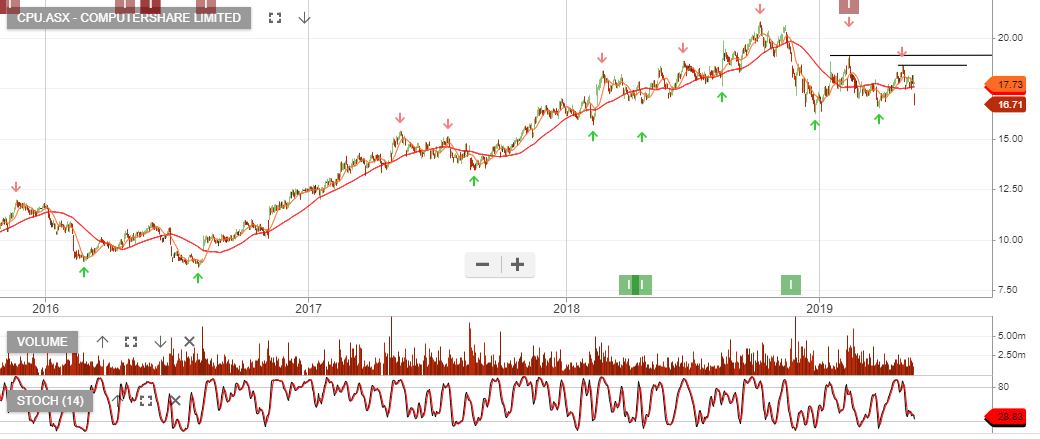

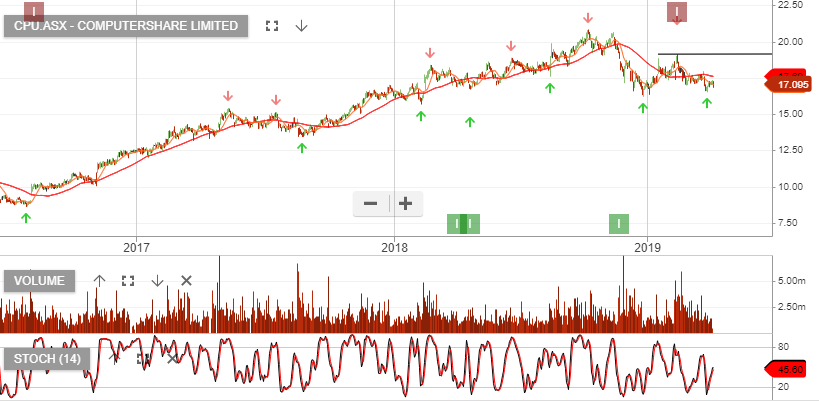

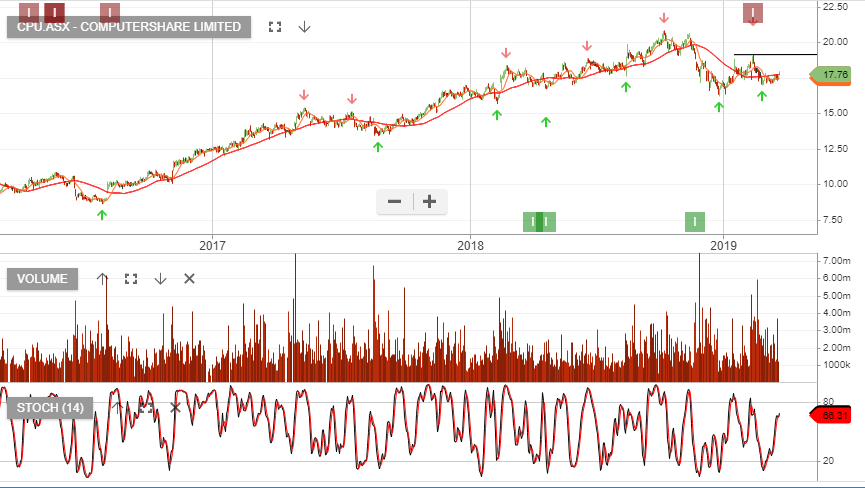

Computershare – high conviction “sell”

Computershare is under Algo Engine sell conditions.

CPU trades on 20x PE and a 2.6% dividend yield with a backdrop of falling earnings growth. We expect EPS growth to trend towards “flat” numbers at best.

Our valuation forecast is for CPU to find support at or near $14.50.