Northern Star – Buy

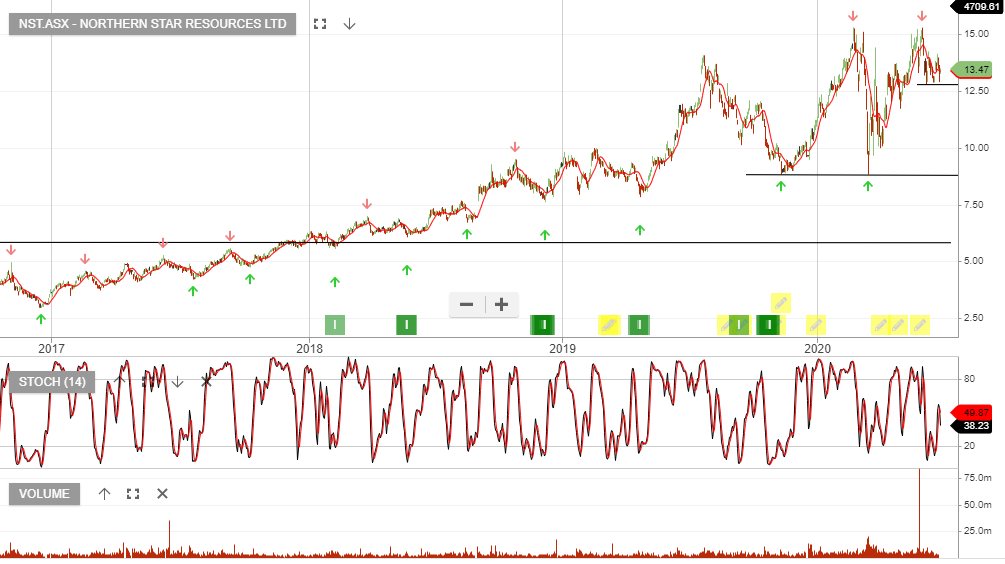

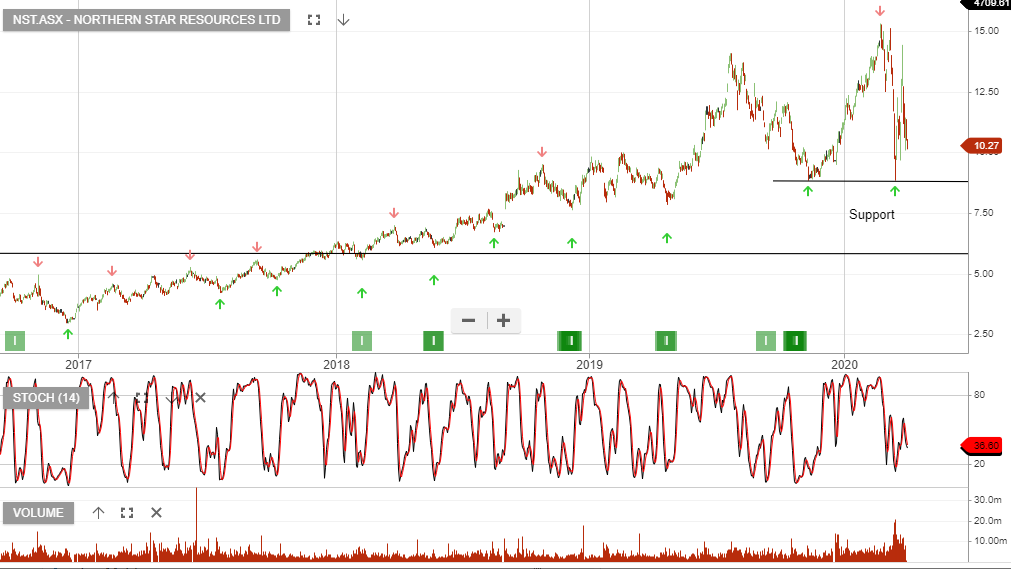

Northern Star Resources is under Algo Engine buy conditions.

Super Pit joint owners Northern Star and Saracen Mineral Holdings have now completed the merger. We see upside for the stock price from these levels and NST is now added to our “high conviction” list.