Resmed – Algo Buy

ResMed is under Algo Engine buy conditions and we see buying support building.

ResMed is under Algo Engine buy conditions and we see buying support building.

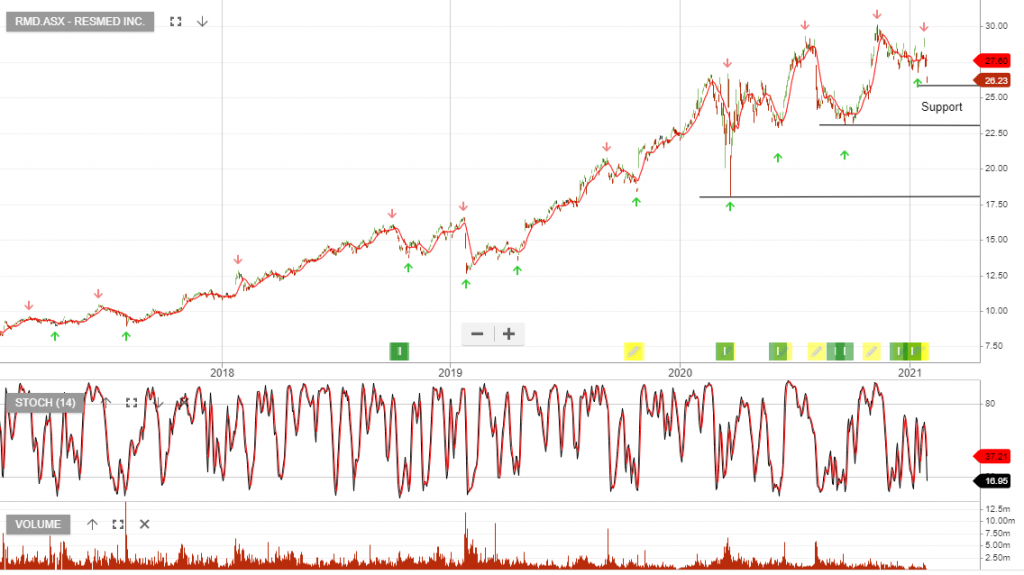

ResMed is under Algo Engine buy conditions and is now up 84% since being added to our model in October 2018.

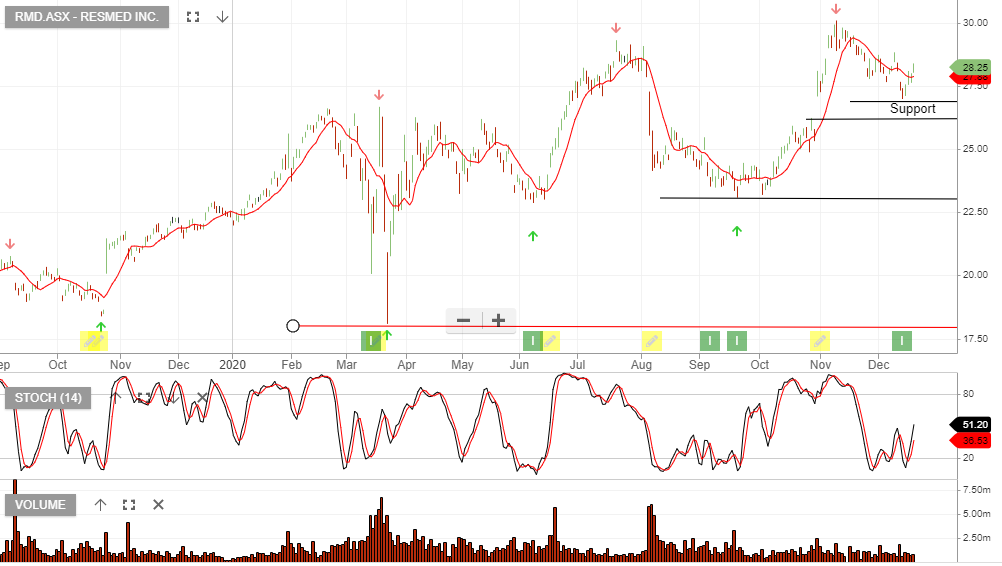

RMD delivered a solid earnings result and upgrades to earnings are partially offset by the stronger AUD.

RMD is looking to resume share buybacks in 2H21.

We see buying support at $26 and suggest investors look to accumulate the stock.

ResMed is under Algo Engine buy conditions and we see buying support building.

ResMed will release 2Q21 earnings on Friday 29 January.

ResMed is under Algo Engine buy conditions and we see buying support building.

ResMed will release 2Q21 earnings on Friday 29 January.

ResMed is under Algo Engine buy conditions and we see buying support building.

ResMed will release 2Q21 earnings on Thursday 28 January

ResMed is under Algo Engine buy conditions and we see buying support building.

ResMed is under Algo Engine buy conditions and is a current holding in our ASX model portfolio.

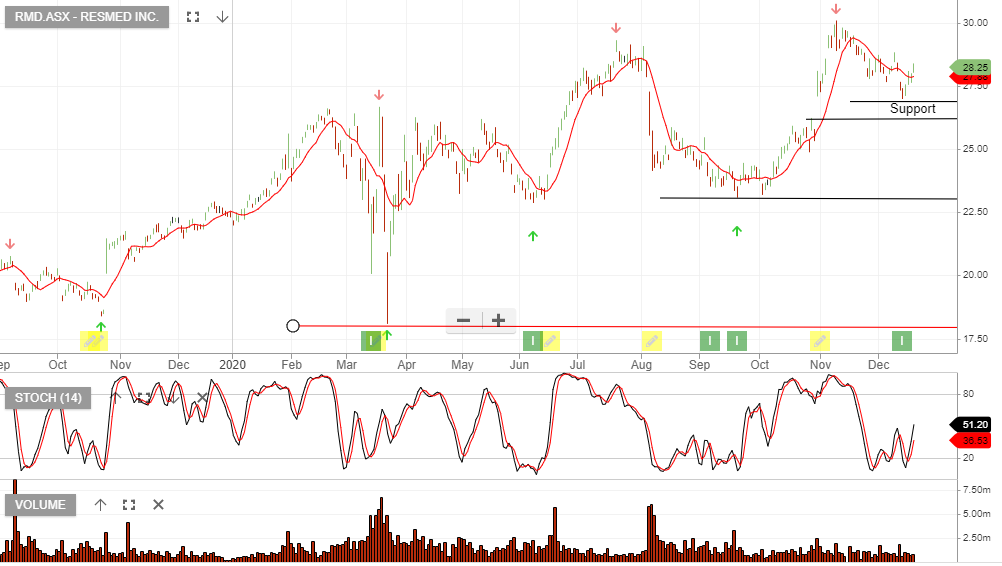

Resmed reported better than expected 1Q21 earnings with group revenue up 10% and NPAT up 37% on the same time last year.

At 35x PE Resmed remains expensive and will need to maintain double-digit earnings growth to sustain the current valuation.

Buy on future share price weakness.

ResMed is under Algo Engine buy conditions and is a current holding in our ASX top 100 model portfolio.

RMD announced 4Q20 earnings, which were better-than-expected, underpinned by robust COVID-19 ventilator demand. However, modest revenue growth is expected in the near-term, implying limited near-term growth.

The 40x PE multiple looks too rich for the current earnings outlook. The forward dividend yield is 1%.

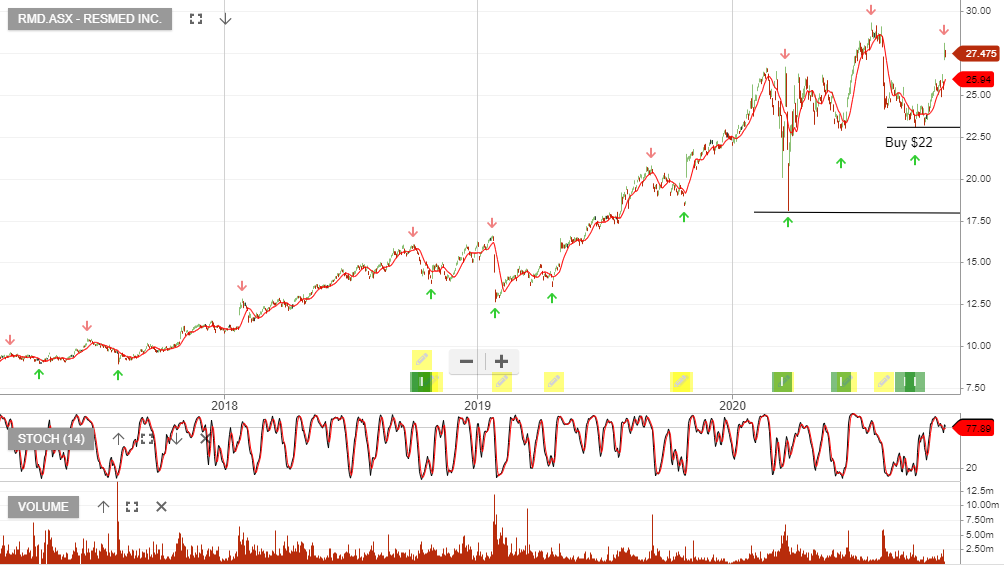

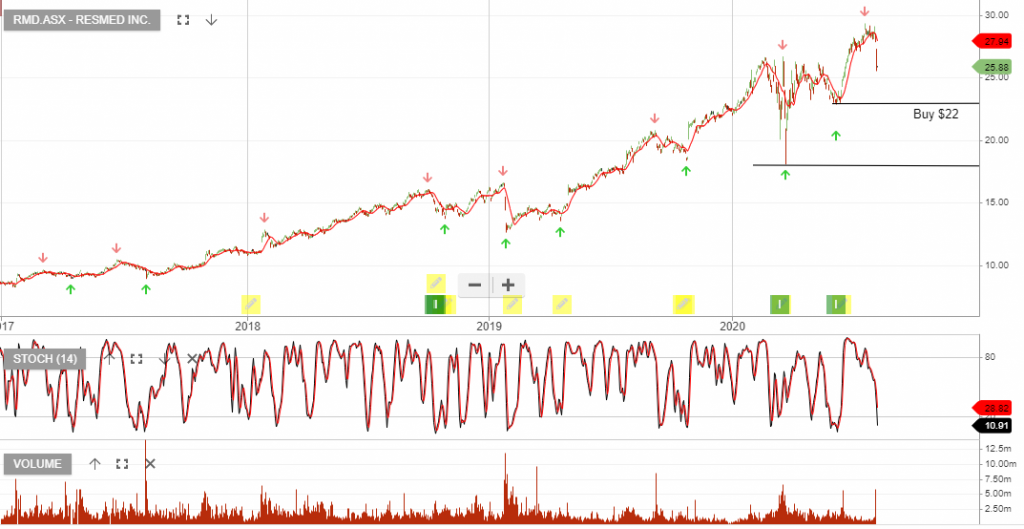

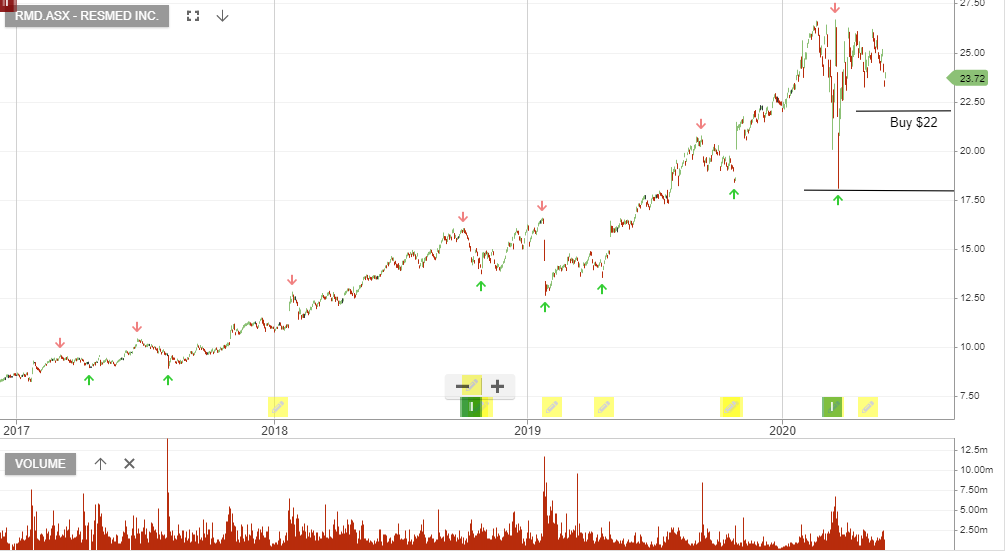

We suggest waiting for the next Algo buy signal to re-enter RMD on a pullback. Our new entry target is $22.

ResMed short term traders may wish to take profit on RMD, following the 6% rally.

ResMed is under Algo Engine buy conditions and we see buying support building.

Accumulate RMD within the $22 – $23 price range.

Or start a free thirty day trial for our full service, which includes our ASX Research.