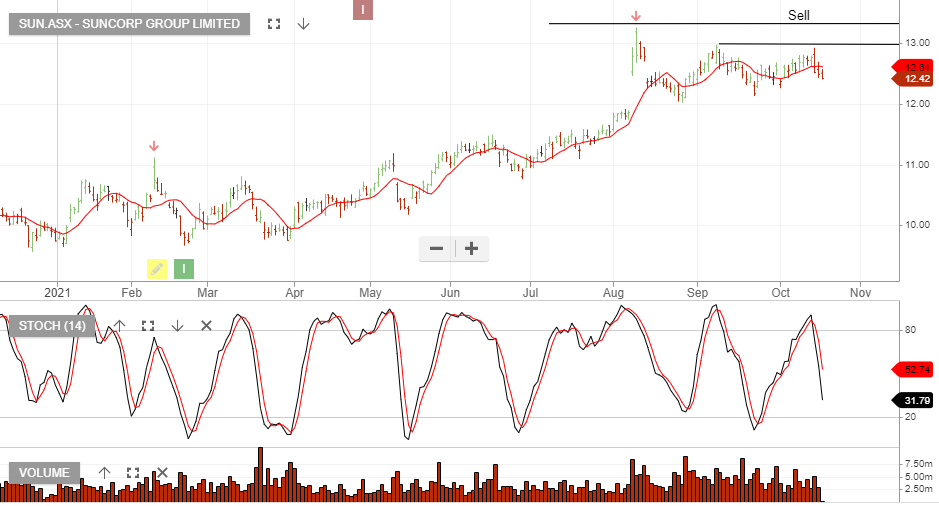

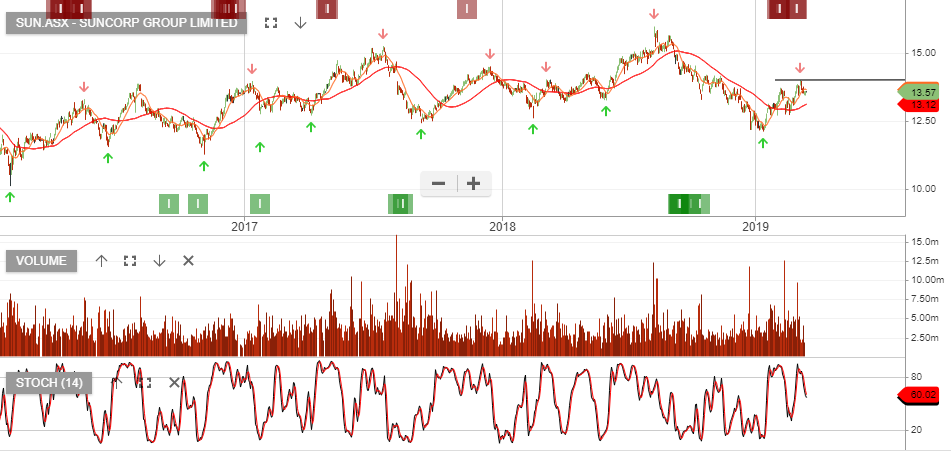

Suncorp – Sell

Suncorp Group is under Algo Engine sell conditions and we expect selling pressure to build below the $13.00 resistance level.

Short SUN with stops above $13.00

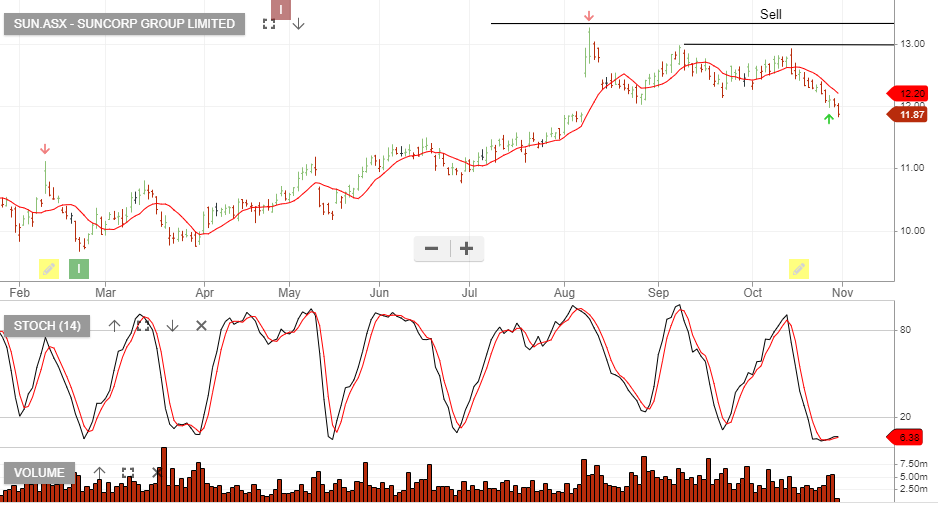

29/10 update:

Suncorp – Sell

Suncorp Group is under Algo Engine sell conditions and we expect selling pressure to build below the $13.00 resistance level.

Short SUN with stops above $13.00

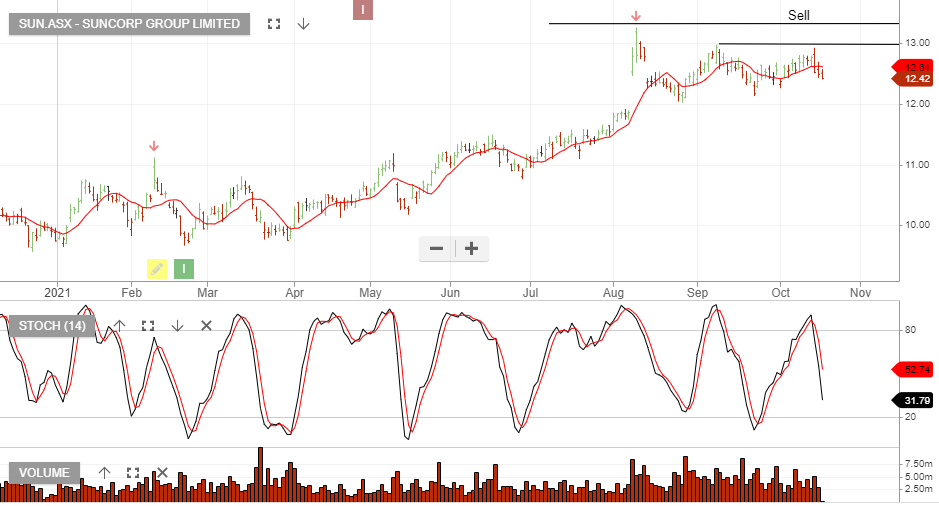

Suncorp – Algo Sell

Suncorp Group is under Algo Engine sell conditions.

1H21 earnings of $509m is well ahead of market consensus. We remain concerned with the risks of rising bad debts and a re-emergence in working claims headwinds.

Suncorp – Short Trade

Suncorp has selling resistance at $9.61 and we expect continued downside pressure on the share price.

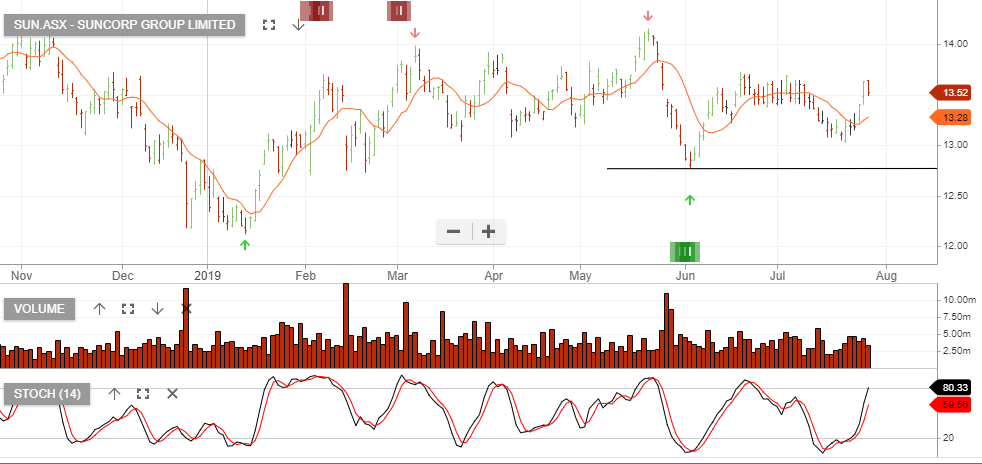

Suncorp – Special Dividend

Suncorp Group FY19 cash earnings of A$1.15bn are mostly inline with estimates.

The insurance margins are ahead of forecasts and the positive surprise that has lifted the share price is the announcement of the $0.44 final dividend plus $0.39 capital return.

The capital return of $500m is expected on the 24th of October subject to approval at the AGM.

Suncorp – Buy

Suncorp Group is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

We see buying support building at $13.25 and our upside target for the stock is $14.00+.

SUN goes ex-div $0.40 on the 15th August and adding a covered call option into November will help boost the cash flow return.

Suncorp – Weak Earnings Outlook

Suncorp Group is under Algo Engine sell conditions following a lower high formation at $13.50.

We see reduced scope for Suncorp to reprice mortgages, given the

current political and regulatory climate, and we expect to see ongoing margin

pressure.

Stay on the short side and watch for the share price to trend lower with the 10 day average crossing below the 50 day average as a reference point.

Exit Short CFD Positions in Suncorp

Our ALGO engine has triggered another buy signal for SUN into yesterday’s ASX close at $13.68.

SUN has been a popular short CFD position on our SAXO Go trading platform since trading at $15.50 two months ago.

We now suggest that investors holding short SUN positions buy them back to close the trade.

After our first ALGO signal on October 2nd, we suggested that SUN would be a reasonable buy/write strategy near the $13.60 support line.

Ongoing deleveraging in the domestic market may challenge the $13.60 price point and we will update SUN in a future posting.

Suncorp

ALGO Buy Signal For Suncorp

Our ALGO engine triggered a buy signal for Suncorp into yesterday’s ASX close at $14.20.

This “higher low” pattern is referenced to the intra-day low posted on June 14th at $13.70.

Shares of SUN have dropped over 10% during the last month as the potential for fines and increased regulations from the Royal Commission have weighed on both banking and insurance stocks.

However, the technical picture is beginning to look oversold. As such, we consider SUN a buy/write opportunity near the key support level of $13.60.

Suncorp