ZScaler

Zscaler, Inc. – Common Add to watchlist

Zscaler, Inc. – Common Add to watchlist

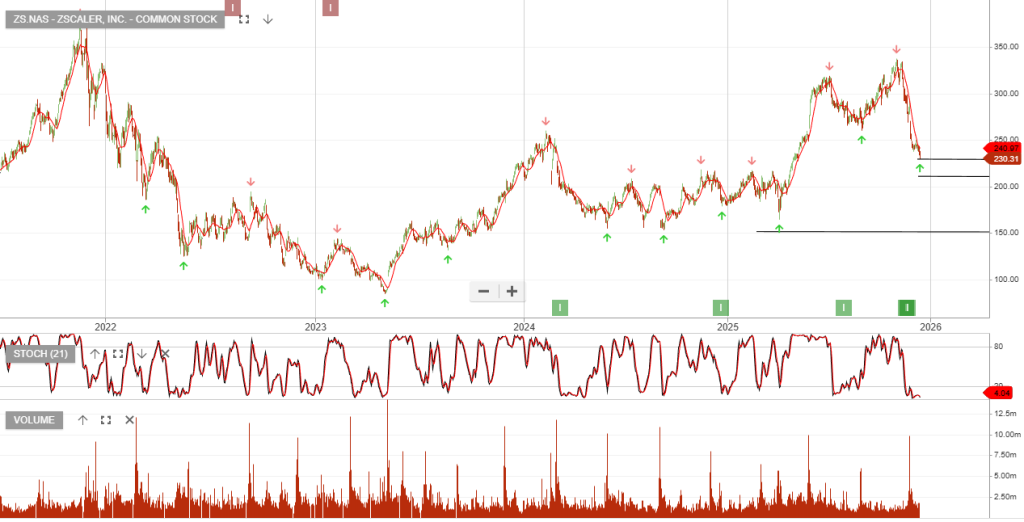

Zscaler, Inc. – Common: Buy on a price move above the 10-day average.

First quarter 2026 earnings: EPS and revenues exceed analyst expectations

First quarter 2026 results:

Revenue exceeded analyst estimates by 1.8%. Earnings per share (EPS) also surpassed analyst estimates by 37%.

Revenue is forecast to grow 16% p.a. on average during the next 3 years.

First quarter 2026 earnings: EPS and revenues exceed analyst expectations

First quarter 2026 results:

Revenue exceeded analyst estimates by 1.8%. Earnings per share (EPS) also surpassed analyst estimates by 37%.

Revenue is forecast to grow 16% p.a. on average during the next 3 years.

Zscaler, Inc. – Common is under Algo Engine buy conditions.

Zscaler, Inc. – Common is rated a buy at $185

Zscaler, Inc. – Common is rated a buy supported by revenue growth of 30% y/y to $592.9 million.

Zscaler, Inc. – Common is under Algo Engine buy conditions.

Financial Outlook

For the second quarter of fiscal 2023, we expect:

• Total revenue of $364 million to $366 million

• Total FY2023 revenue of approximately $1.525 billion to $1.530 billion