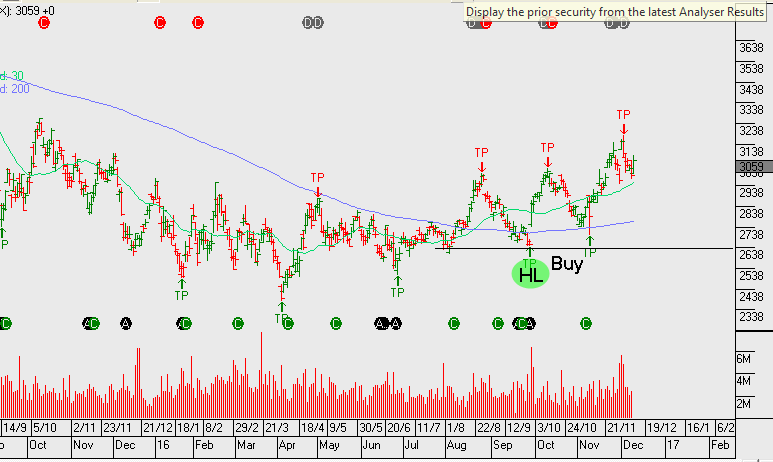

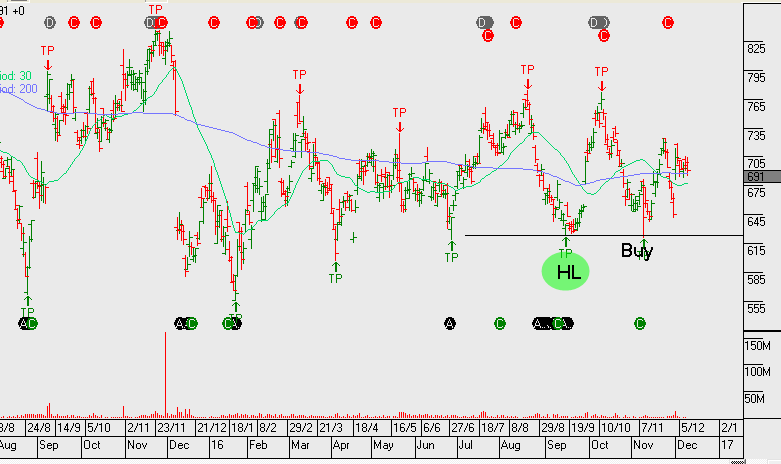

We suggested going long oil names ahead of the OPEC meting, our preferred buy ideas were WPL, ORG, OSH and BHP. We see further upside ahead!

On November 30th, leaders of the Organization of Petroleum Exporting Nations (OPEC) agreed to their first production cut in eight years by collectively deciding to curtail crude oil production by 1.2 million barrels per day. Since then, West Texas Intermediate (WTI) Oil futures have gained over 6% from $45.20 to $51.50 at Friday’s NYMEX close.

The OPEC agreement got a shot in the arm on Saturday as 11 Non-OPEC oil producing countries agreed to cut their output by 558,000 barrels per day. This is the first time in over 15 years that a global agreement to cut production has been struck and adds fundamental support to the current rally in Crude Oil.

Technical indicators suggest the January WTI contract can move higher this week. The recent high in the $52.70 area is the next logical target, but there’s scope for a move back above $54.00 after this weekend’s Non-OPEC agreement. Near-term support is seen in the $49.60 area.

Although investors may be rightfully sceptical about the longevity of the OPEC and Non-OPEC productions cuts, our reading of the charts suggests being patient in trying to pick a near-term top in crude oil prices.