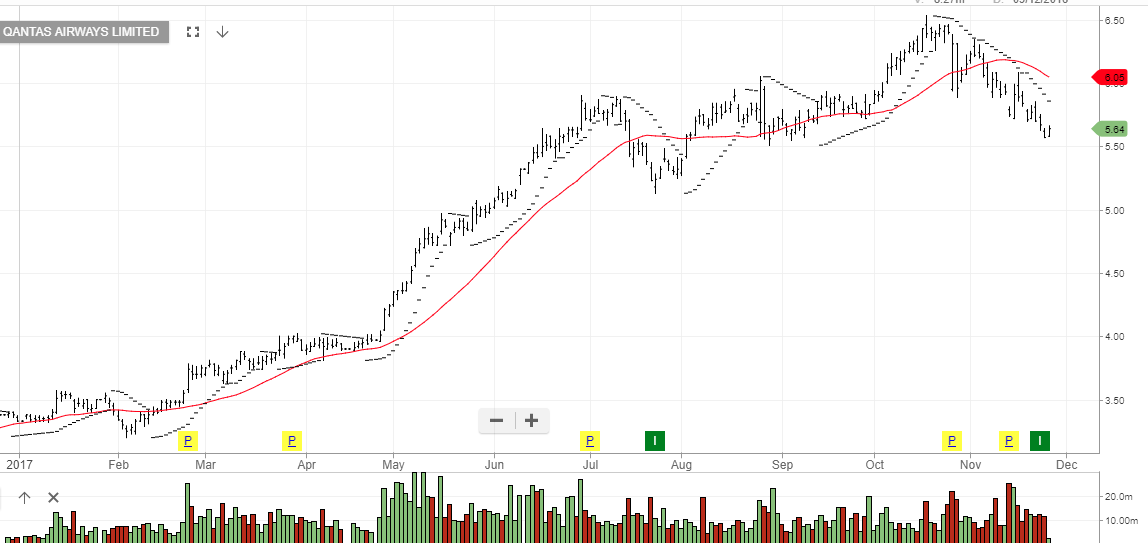

Our ALGO engine triggered a buy signal on TWE back in early July at $12.55.

Since then the share price has added close to 20% closing Friday just over $15.80.

The company, with a market cap of $11.11 billion, recently declared a final dividend of 13 cents per share, 50% franked, bringing the total dividend for FY17 to 26 cents per share, a yearly increase of 30%.

TWE has a portfolio of more than 70 brands, including Penfolds, Pepperjack and Lindeman’s, with sales operations in more than 70 countries.

French wine growers have suffered recently on the back of unfavorable weather which has resulted in vineyards in wine-growing regions such as Bordeaux and Champagne being damaged by frost.

As a result, the French Agricultural Ministry has reported wine production will fall by about 20%, leading to the lowest level of output in more than 60 years.

In addition to the strong sales growth in Asia, we consider the lower European wine production as a bullish development for TWE and expect further share appreciation into the end of the year.

Treasury Wine Estates

Treasury Wine Estates

Treasury Wine Estates

Treasury Wine Estates