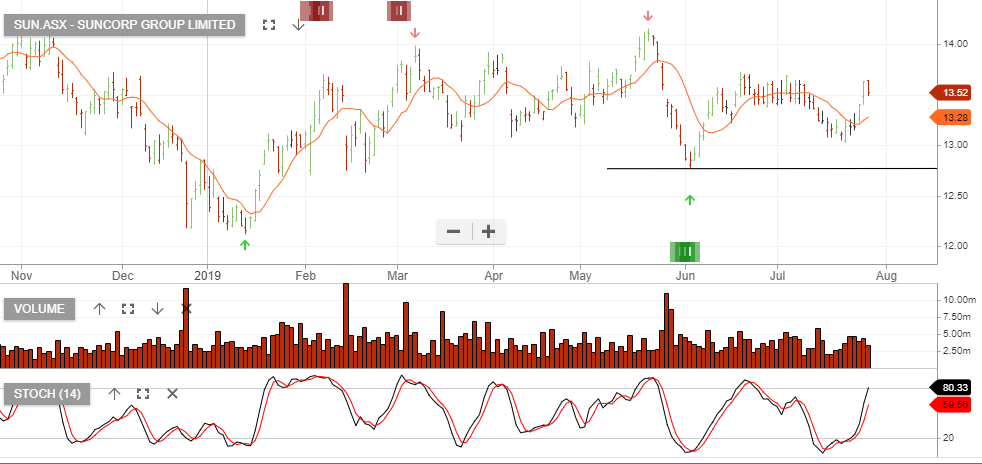

Suncorp – Buy

Suncorp Group is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

We see buying support building at $13.25 and our upside target for the stock is $14.00+.

SUN goes ex-div $0.40 on the 15th August and adding a covered call option into November will help boost the cash flow return.