Alumina – Buy Signal

AWC:ASX is now under Algo Engine buy conditions and the short-term indicators are trending higher.

AWC:ASX is now under Algo Engine buy conditions and the short-term indicators are trending higher.

ASX is under Algo Engine buy conditions and is now likely to find buying support.

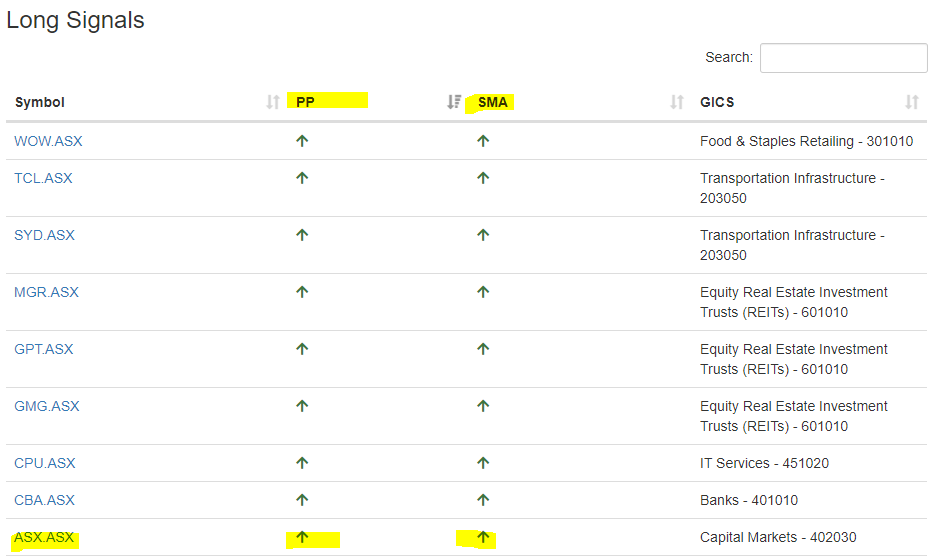

The Trade Table tab in our member area shows the stocks from within an index, (for example ASX 50), which display the three factors for our short-term trade ideas.

In the case of the ASX, it’s under Algo Engine buy or long conditions as the primary signal. Second, to this, the intermediate signal is positive, or the arrow pivot point is pointing up. The third factor is checking to see if the current price is building momentum or trading above the 10-day average.

Confirmation of the 3 factors aligning is displayed in the Trade Table screenshot below.

SHL:ASX is under Algo Engine buy conditions and is a current holding in our ASX model portfolio.

FY22 revenue is likely to be around $7.6bn on EBITDA of $1.7bn. EPS will be 30 – 40% up on FY20, which will support a forward yield of 3.5%.

Northern Star Resources is under Algo Engine buy conditions and at sub $10 the stock is now looking oversold.

{ASX:CWY) is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

We see price support building near the $2.20 level.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Goodman is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

We expect 10% EPS growth into FY22 and the 2% plus dividend yield remains well supported.

The short-term momentum indicators are now turning higher and it looks like buying support is building above the recent $16.40 low.

{ASX:CWY) is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

We see price support between $2.00 and $2.20. Watch the short-term indicators for a turn higher, within this support range.

CWY goes ex-div tomorrow $0.05 100% franked.

Fisher & Paykel Healthcare Corporation is under Algo Engine buy conditions and is now within our highlighted range.

The short-term momentum indicators are now turning higher and it looks like buying support is building above the recent $26 low.