VanEck Global Healthcare Leaders ETF

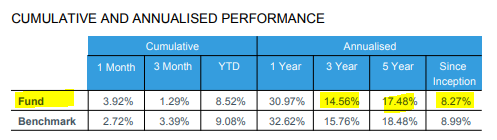

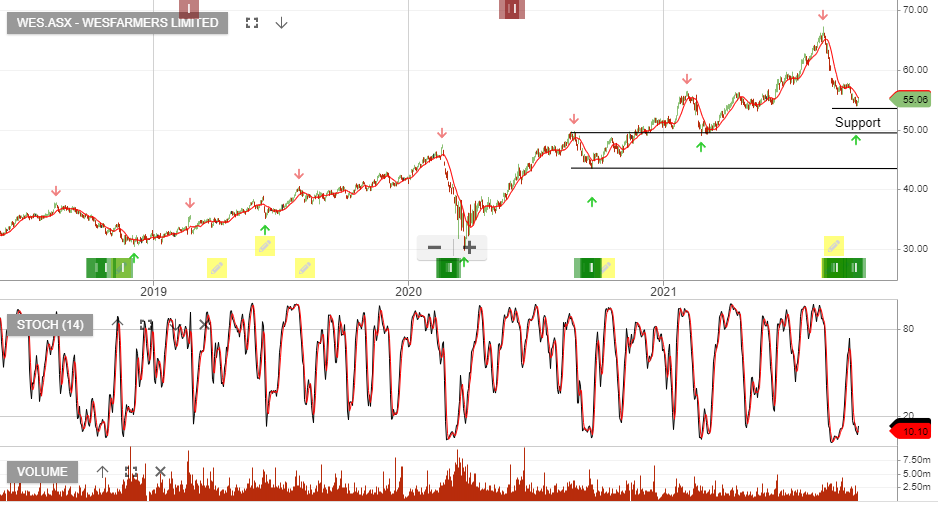

VanEck Vectors Global Health Leaders is under Algo Engine buy conditions.

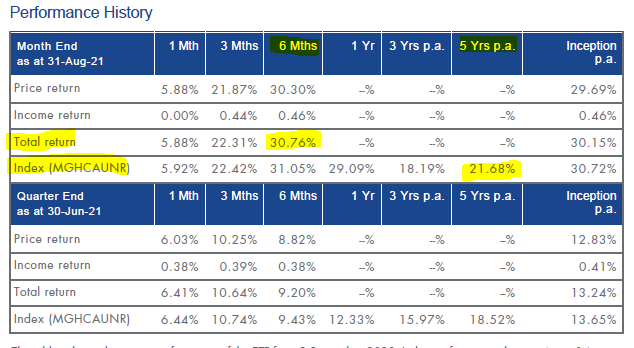

HLTH invests in a diversified portfolio of leading international developed markets (ex-Australia) companies with the best growth at a reasonable price (GARP) attributes from the global healthcare sector with the aim of providing investment returns, before fees and other costs, which track the

performance of the Index.