Ramsay Healthcare – Buy

Ramsay Health Care is under Algo Engine buy conditions and is a current holding in our model portfolio.

Ramsay Health Care is under Algo Engine buy conditions and is a current holding in our model portfolio.

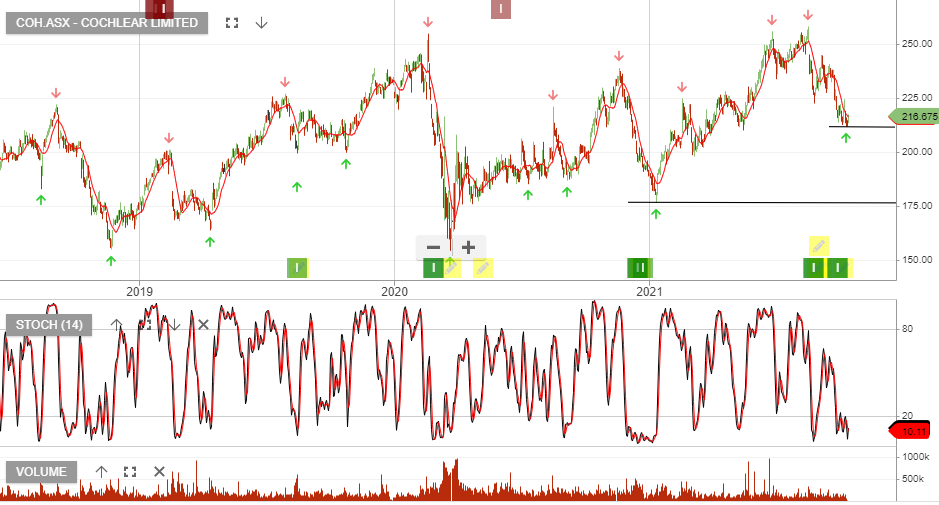

Cochlear is now under Algo Engine buy conditions and has been added to our ASX 100 model portfolio.

We expect 10% EPS growth over the next 12 months. Although, the stock remains expensive at 40x earnings and trading on a 1.8% yield.

Since writing the above post in Dec last year, COH has rallied from $175 to a high of $257. The subsequent pullback has seen buying interest rebuild at the higher low of $210.

This is the second cluster of Algo Engine buy signals and we’ve taken the opportunity to add to our original allocation.

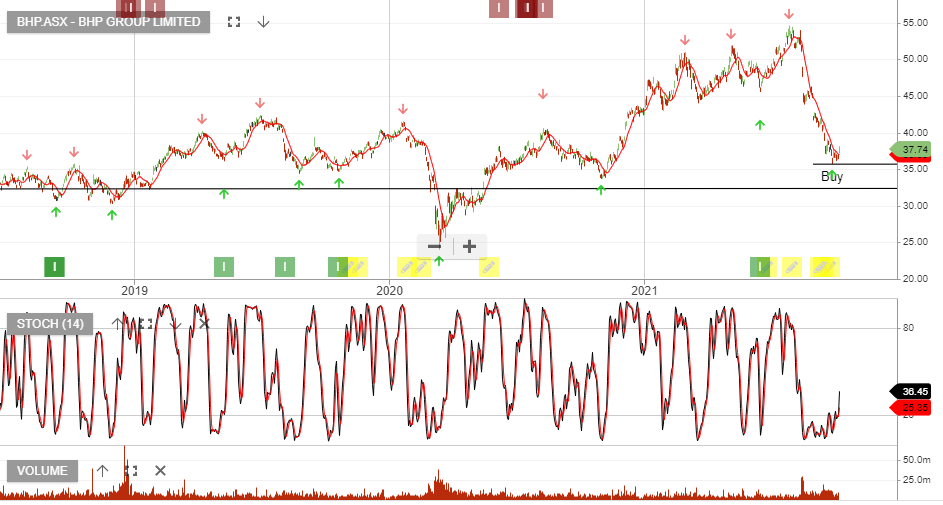

BHP Group is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

For our Members, please find below the list of our latest Model Portfolio changes.

Wesfarmers is under Algo Engine buy conditions and is a current holding in our model portfolio.

Wesfarmers now holds 19.3% of Australian Pharmaceutical Industries. The acquisition has less than two weeks left in confirmatory due diligence. The battle between Sigma and Wesfarmers for the API business and final offers will be worth watching.

Accumulate WES within the $50 – $56 price range.

.

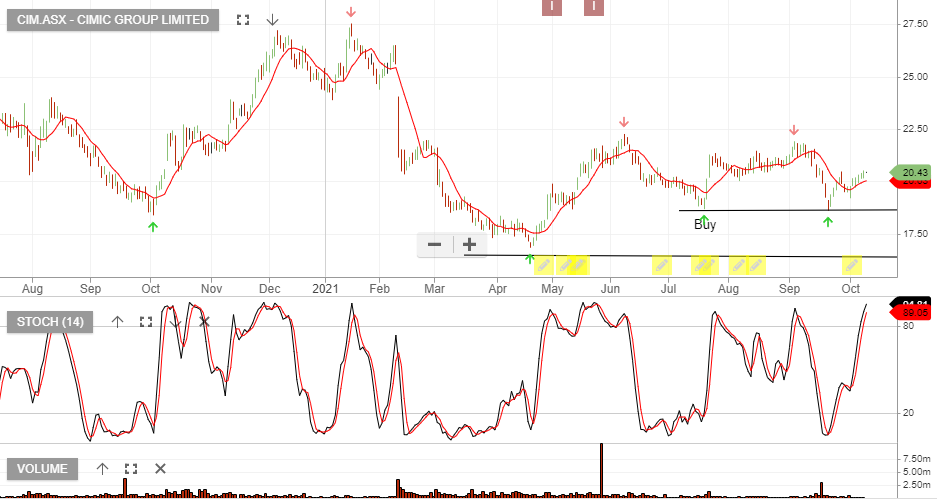

CIM:ASX is likely to see improved earnings in FY22 and we expect to soon see a recovery in the share price.

CIMIC is a high-risk counter trend investment with the prospect of a multi-year recovery, once earnings hit an inflection point.

.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

In case you missed it, you can watch last night’s webinar here.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.