A New Bullish Case For Gold

Spot gold rose to its highest levels since November near $1,295 per ounce on Wednesday, good for a 13% gain so far in 2017.

In so doing, Gold broke a technical downtrend that has been in place since the September 2011 peak of $1,900 per ounce.

The support in the yellow metal may be evidence of market fear rather than reflationary exuberance. The Chinese Gold and Silver Society Exchange expects 2017 mainland gold imports to increase by 50% from the prior year, amidst increased safe haven demand.

Daily chart analysis points to the next resistance level near the September highs of $1,322.

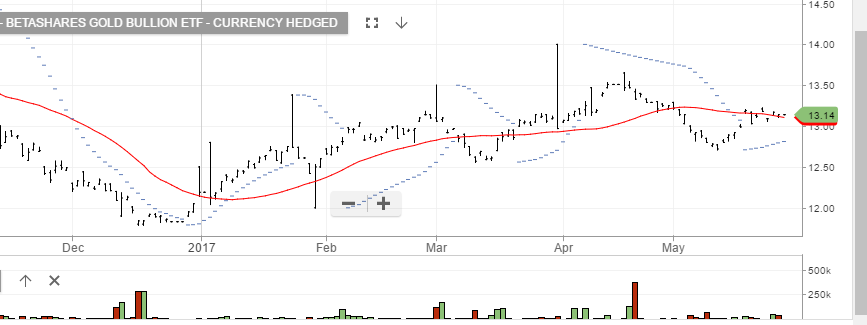

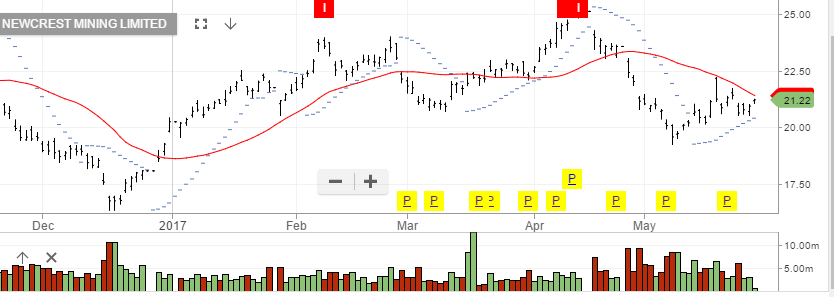

We continue to accumulate shares and call options on NCM. We also suggest shares in EVN and the BetaShare Gold ETF with the symbol QAU.

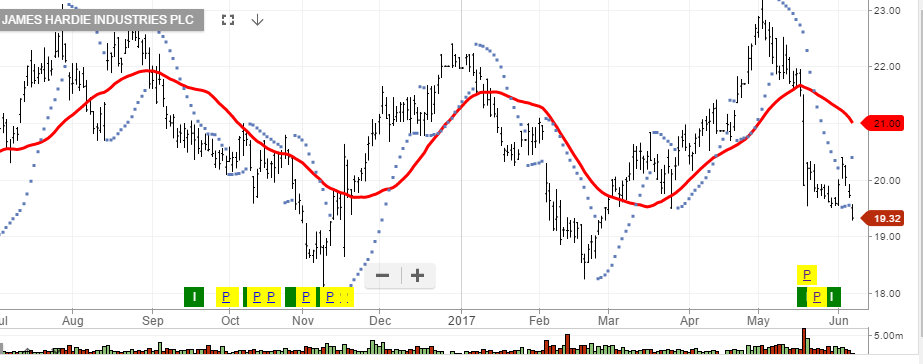

James Hardie

James Hardie Bendigo and Adelaide Bank

Bendigo and Adelaide Bank

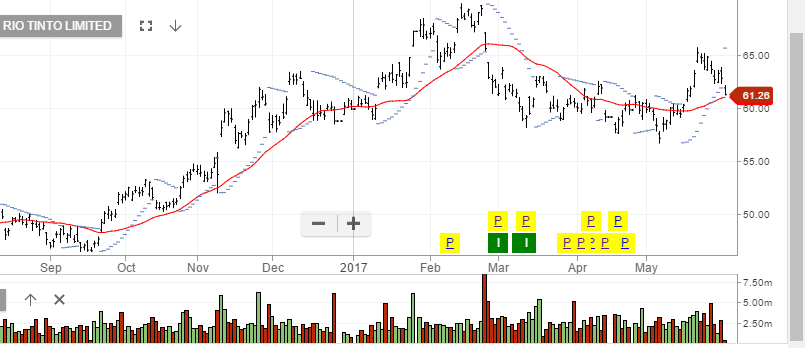

Rio Tinto

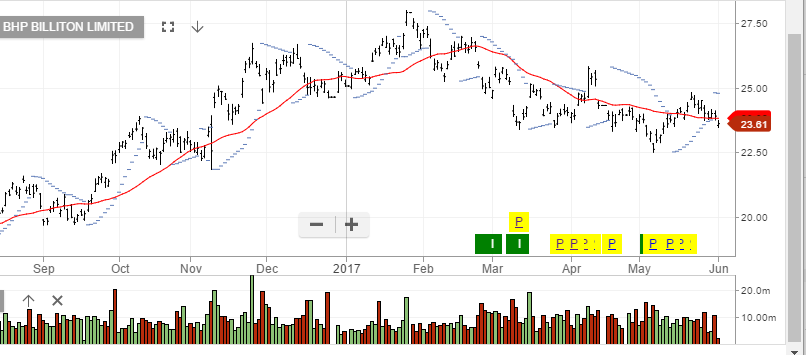

Rio Tinto BHP

BHP

Newcrest Mining

Newcrest Mining