Shopify

SHOP:NYS is under Algo Engine buy conditions. The growth opportunities for SHOP are appealing and we’re buyers within the $48 – $57 price range.

SHOP:NYS is under Algo Engine buy conditions. The growth opportunities for SHOP are appealing and we’re buyers within the $48 – $57 price range.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

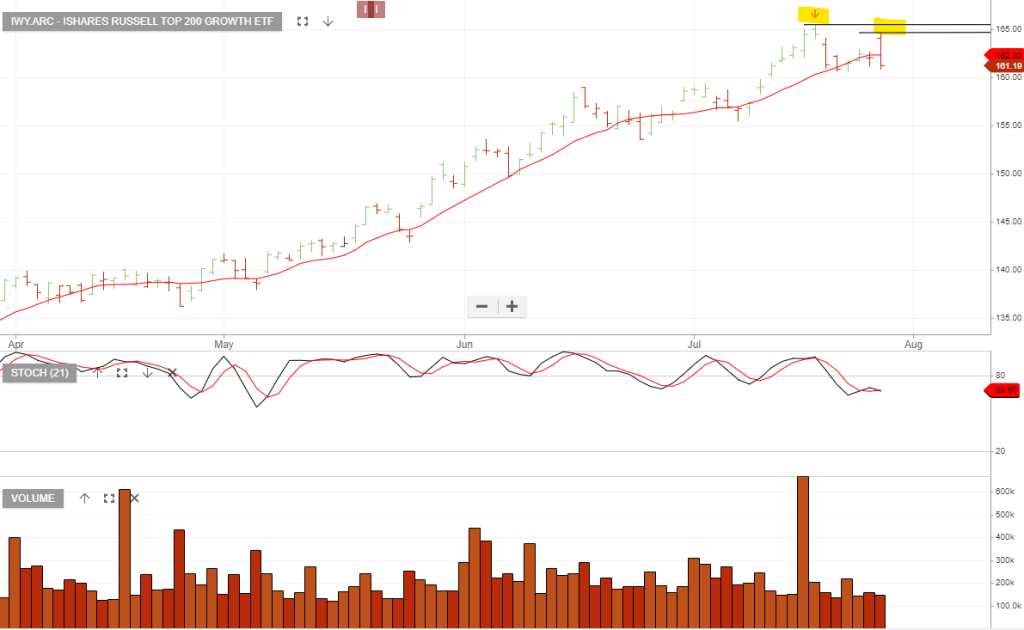

iShares Russell Top 200 Growth offers one way to capture short exposure to a correction in overpriced US growth stocks.

The iShares Russell Top 200 Growth ETF seeks to track the investment results of an index composed of large-capitalization U.S. equities that exhibit growth characteristics.

5/8 update: The price action remains below the 10-day average.

3/8/ update: The price action has rolled over and short exposure should be maintained whilst the close value is below the 10-day average.

Consider the short side with a stop loss on a break above $165.

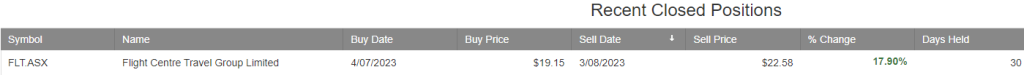

Flight Centre Travel Group was added to the ASX Trade Table at $19.15 and was closed yesterday for a 17.9% gain, after a 30-day holding period.

The ASX200 Trade Table shows a total YTD return of 31.6%. To access and review the new Trade Table technology in real-time, create a free trial now.

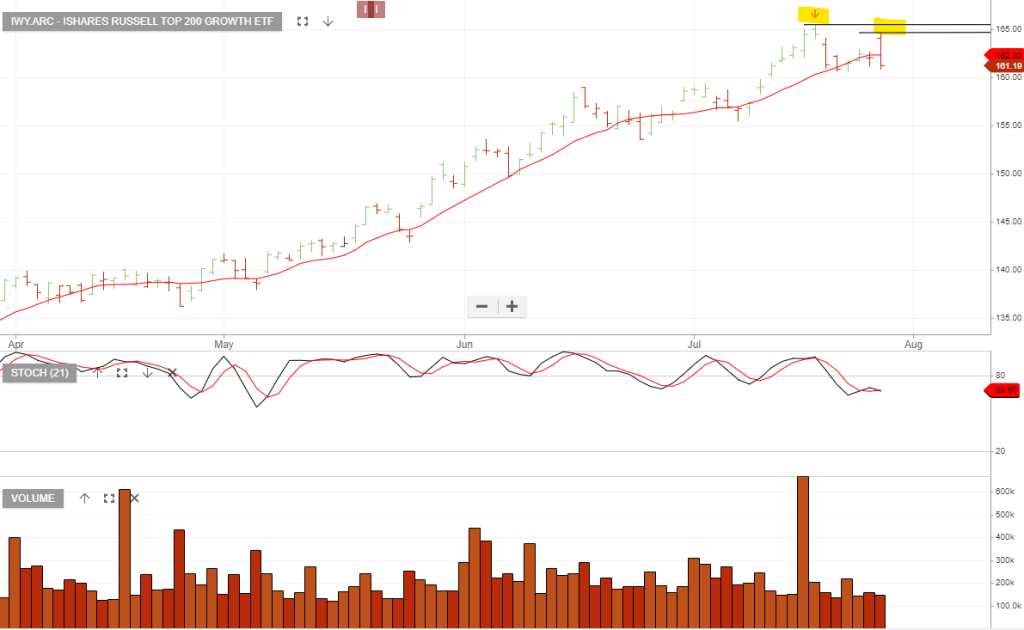

iShares Russell Top 200 Growth offers one way to capture short exposure to a correction in overpriced US growth stocks.

The iShares Russell Top 200 Growth ETF seeks to track the investment results of an index composed of large-capitalization U.S. equities that exhibit growth characteristics.

3/8/ update: The price action has rolled over and short exposure should be maintained whilst the close value is below the 10-day average.

Consider the short side with a stop loss on a break above $165.

Integral Diagnostics recently switched to Algo Engine buy conditions.