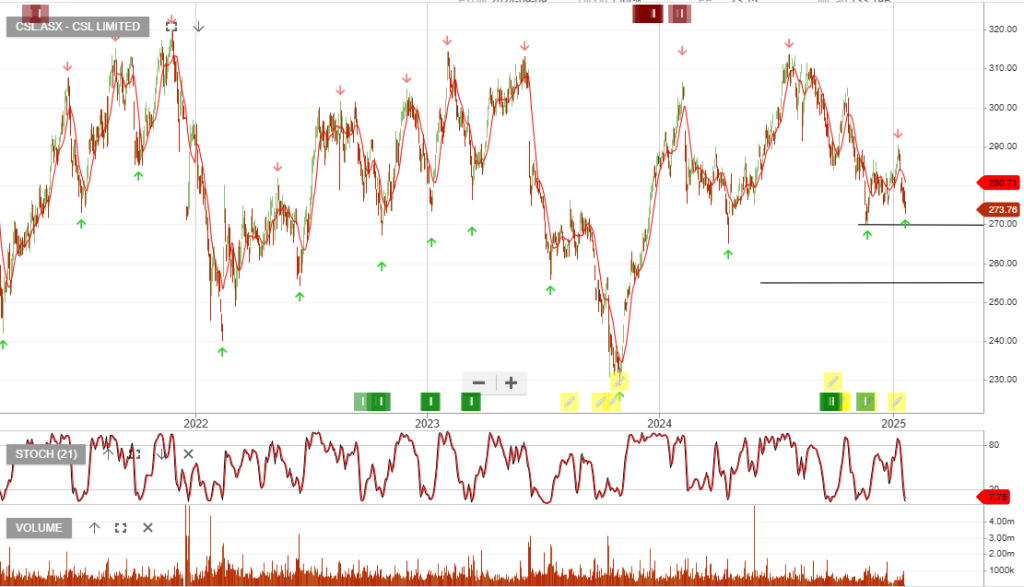

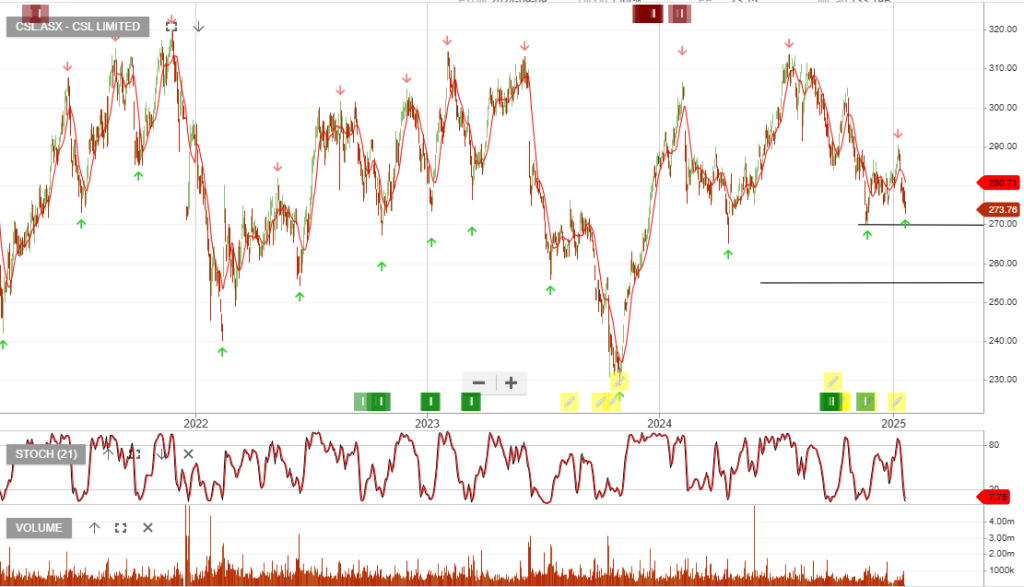

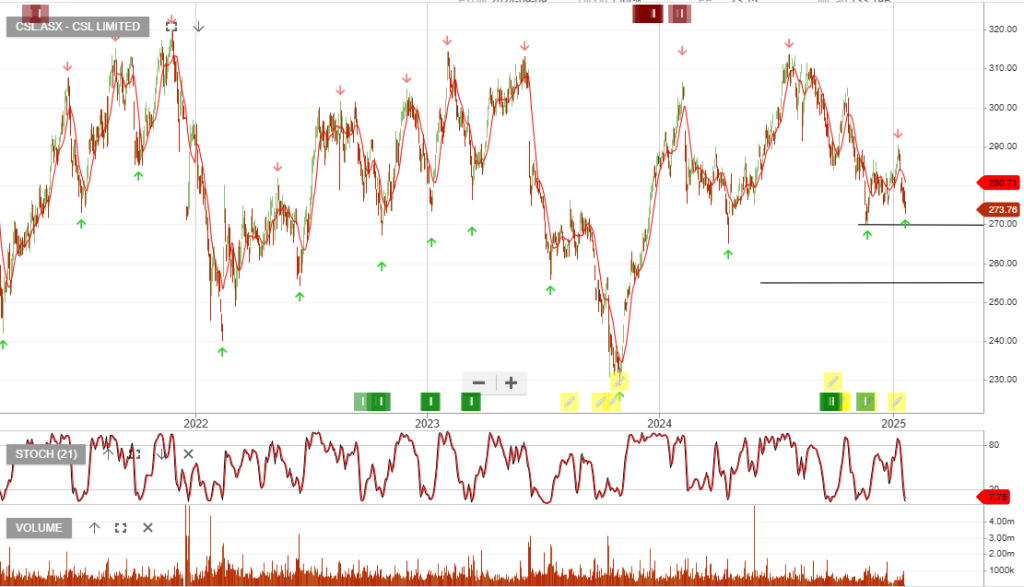

CSL

CSL is under Algo Engine buy conditions.

CSL is under Algo Engine buy conditions.

Zoom Video Communications, Inc. – Class A Common is under Algo Engine buy conditions. We recommend accumulating the stock within the current price range.

Zoom is estimated to report earnings on 24/02

Intel Corporation – Common is scheduled to report Q4 earnings on 30 Jan. Consensus estimates suggest $13.83 billion and $0.12 per share earnings.

Oracle Corporation Common is rated a buy with the stop loss at $152.42

3M Company Common is under Algo Engine buy conditions.

3M reported fourth-quarter earnings that beat expectations, adjusted profit of $1.68 per share, versus a consensus of $1.66 per share. Adjusted revenue of $5.81 billion came in above estimates of $5.78 billion. The results were boosted by higher sales of industrial adhesives, tapes, and electronics.

Collins Foods is a high-risk, short-term trade. Stop loss @ $7.12

Downer EDI is rated a buy with the stop loss at $5.17

NEXTDC is rated a buy with the stop loss at $14.94

CSL is under Algo Engine buy conditions.

BlueScope Steel is an open trade with a stop loss at $18.85