Westpac

Westpac Banking signaled a more-rapid return of ~$4bn of excess capital. 1H24 75¢ ordinary dividend, a 15¢ special dividend, and an additional $1bn added to the buyback.

WBC reported 1H24 cash earnings of $3,342m, in line with consensus.

Westpac Banking signaled a more-rapid return of ~$4bn of excess capital. 1H24 75¢ ordinary dividend, a 15¢ special dividend, and an additional $1bn added to the buyback.

WBC reported 1H24 cash earnings of $3,342m, in line with consensus.

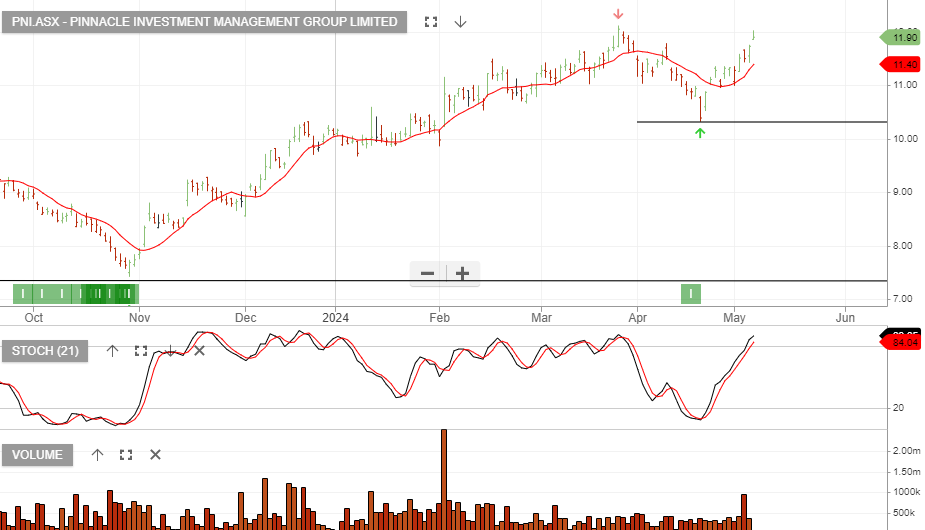

Pinnacle Investment Management Group is in the ASX 200 Trade Table, and the position is up 7.2% after a 14-day holding period.

HMC Capital is in the ASX 200 Trade Table, and the position is up 9% after an 8-day holding period.

Pexa Group is in the ASX 200 Trade Table, and the position is up 17% after a 15-day holding period.

James Hardie Industries is a new holding in the ASX200 Trade Table.

Global X S&P Biotech is trending higher after creating the $42.50 pivot low.

ASX:BOS announced the first uranium in the drum at the Honeymoon project, with production to commence from Alta Mesa in May. Strong uranium prices also support the share price.

Downer EDI is a potential momentum play with a stop loss at $4.58.

Pexa Group is under Algo Engine buy conditions. We like the growth outlook, and with private equity now looking at the business, the downside is well underpinned.