BHP

BHP Group remains an open position in the ASX200 Trade Table.

BHP Group remains an open position in the ASX200 Trade Table.

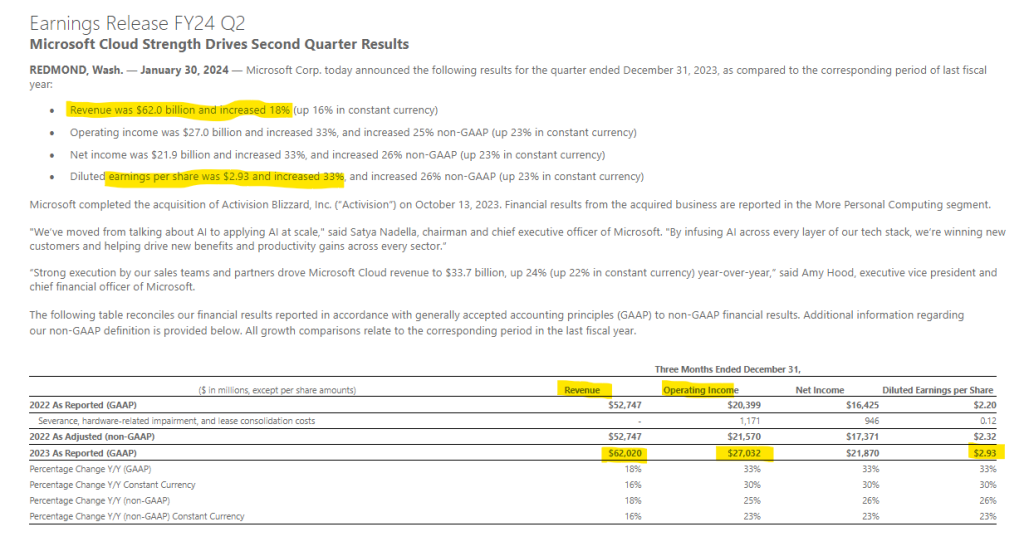

Mega-cap US tech stocks Microsoft, Alphabet, Amazon, and Meta will all report this week. Microsoft will be the most important earnings report and conference call as the launch of Copilot success and early adoption of AI is likely see earnings exceed the Street’s top-line revenue of $US61 billion and EPS of $US2.77.

Microsoft

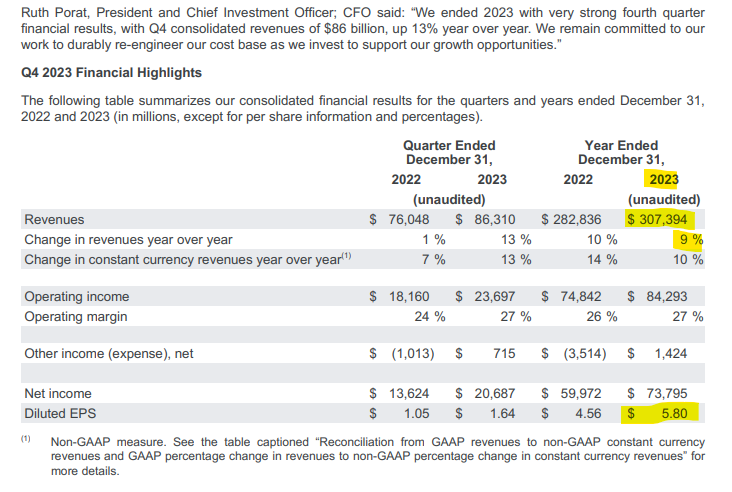

Alphabet

Meta

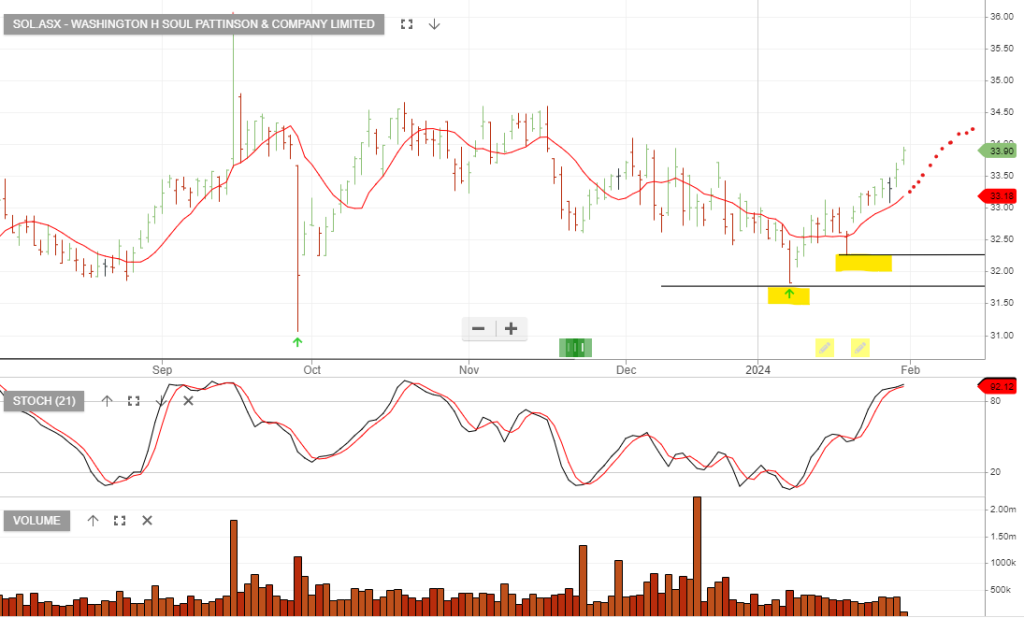

Washington H Soul Pattinson & Company continues to rally, following the bullish setup at $32.50.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

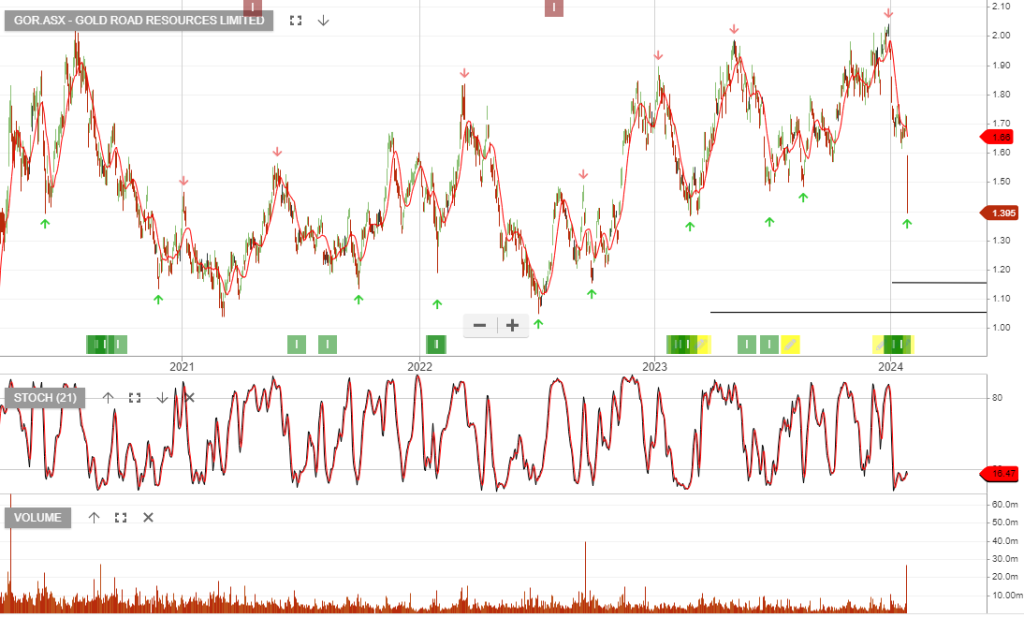

The miner reported a slip in gold production and downgraded its full-year guidance in its latest quarterly report.

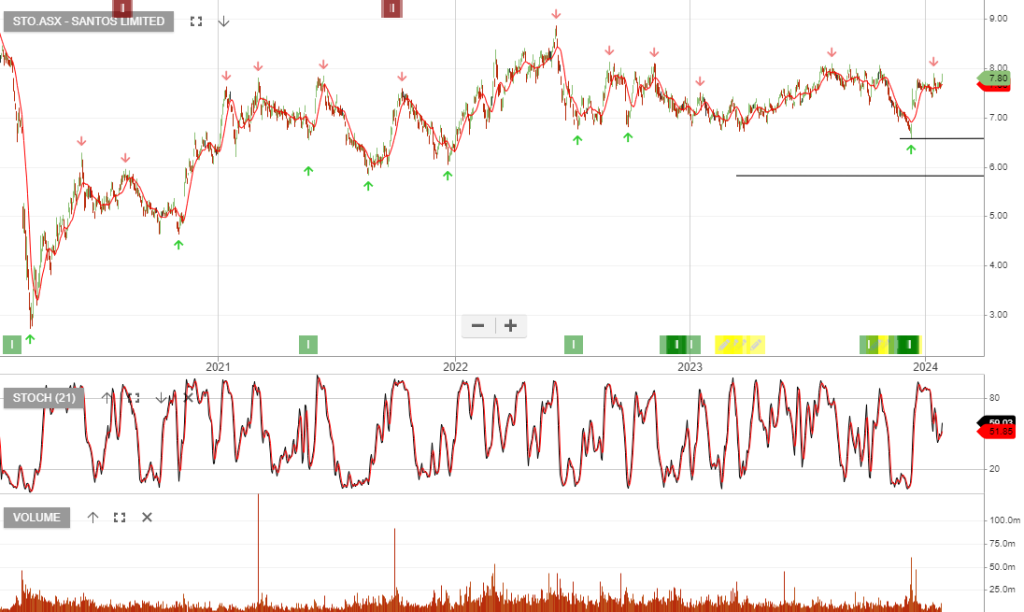

STO shares remain heavily discounted, given superior free cash flow. Barossa project progression, completion of PNG selldown, and the potential merger proposal from WDS are all positive catalysts.

We expect STO to report a solid 4Q on 25th January and we look to buy STO on the current dip in price.

BWP offers a 5%+ yield and modest capital growth.

Beach Energy is likely to benefit from the stronger oil price.

IGO has formed a higher low formation and the buying momentum has pushed the price action above the 10-day average.