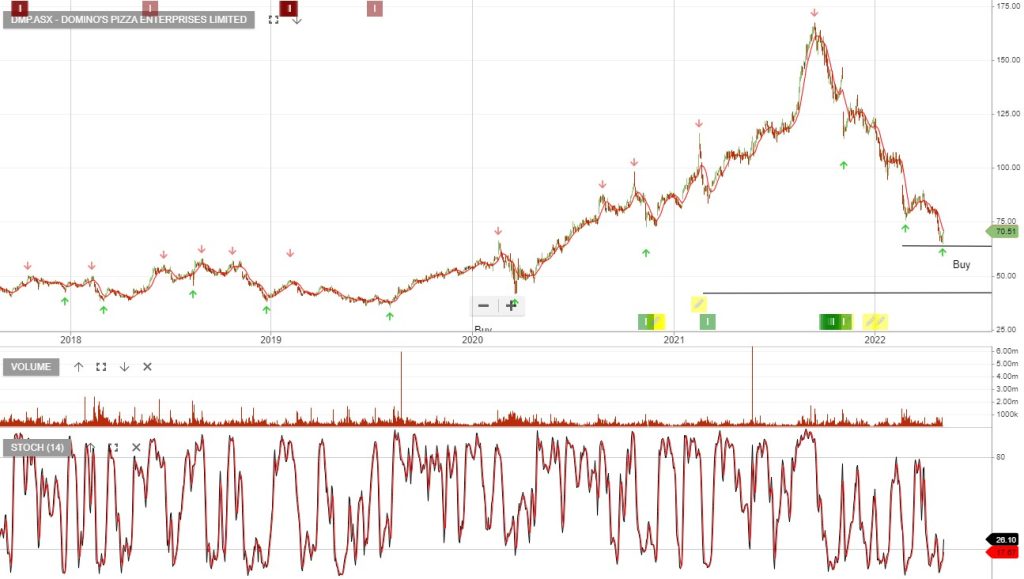

Domino’s Pizza – Algo Buy

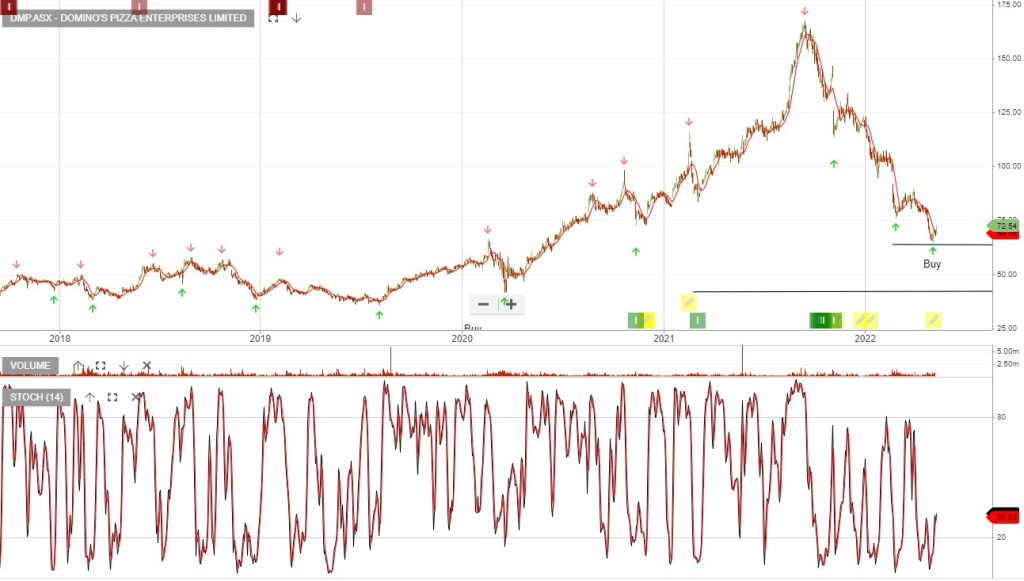

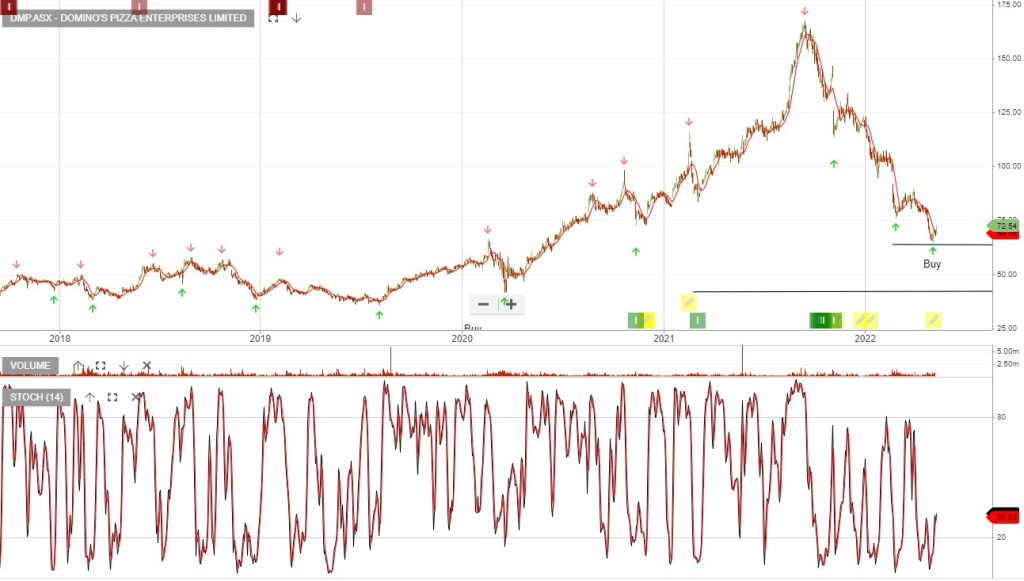

Domino’s Pizza Enterprises is under Algo Engine buy conditions.

Domino’s Pizza Enterprises is under Algo Engine buy conditions.

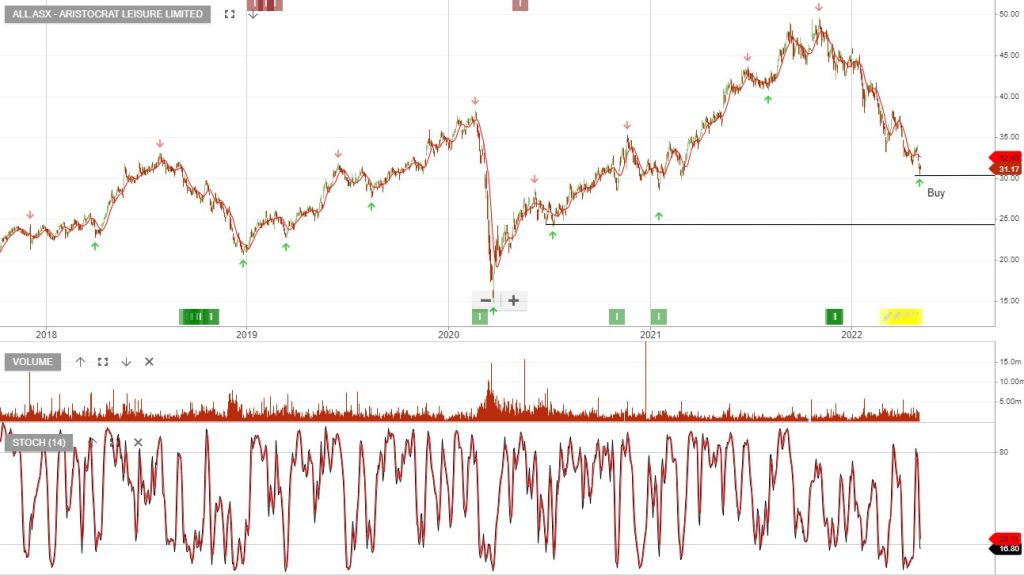

Aristocrat Leisure is under Algo Engine buy conditions.

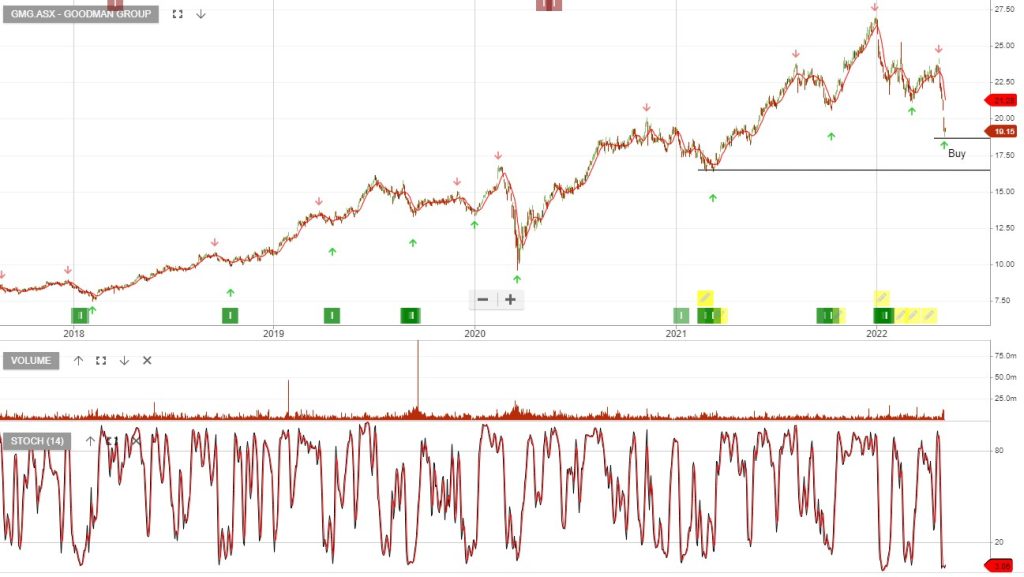

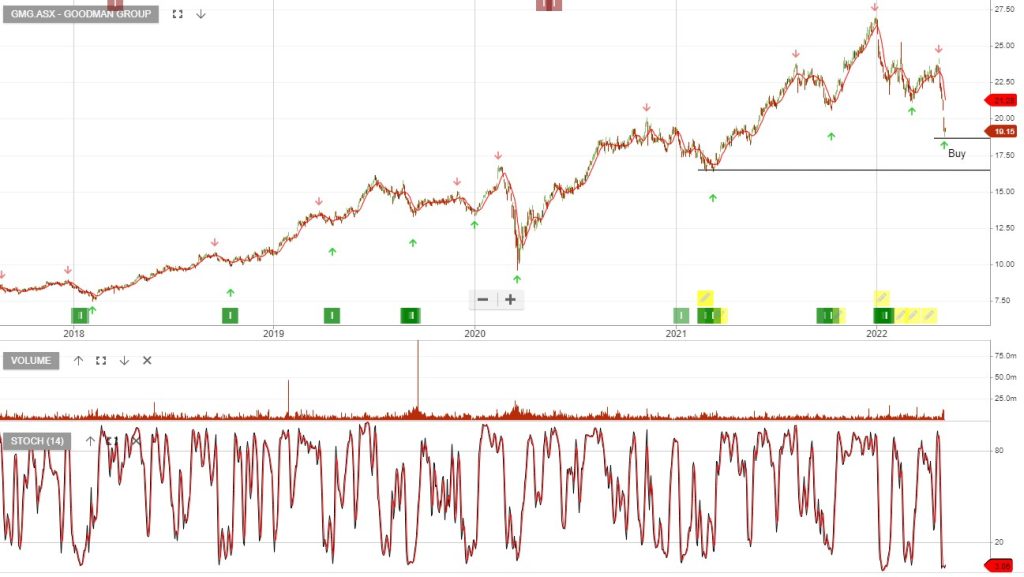

Goodman is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

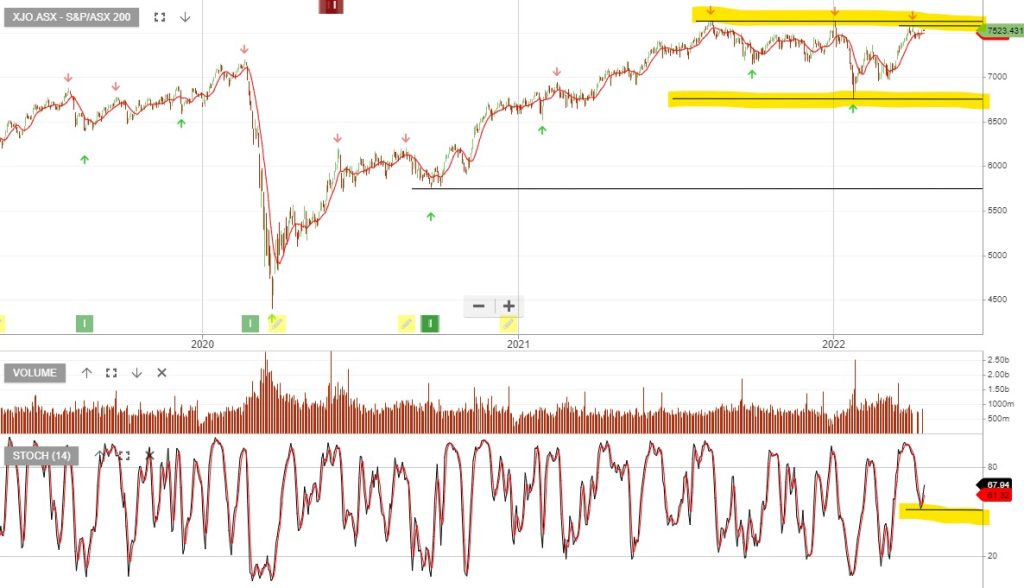

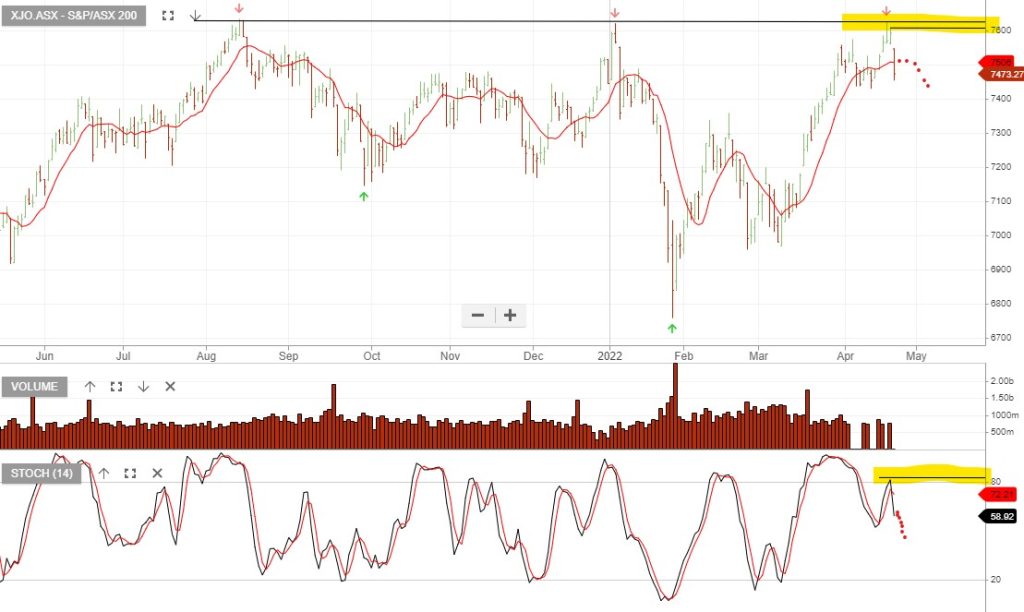

The XJO is now trading at the upper band of the consolidation channel that’s been in place since mid-last year.

23/4/2022 Update:

Update 14/5

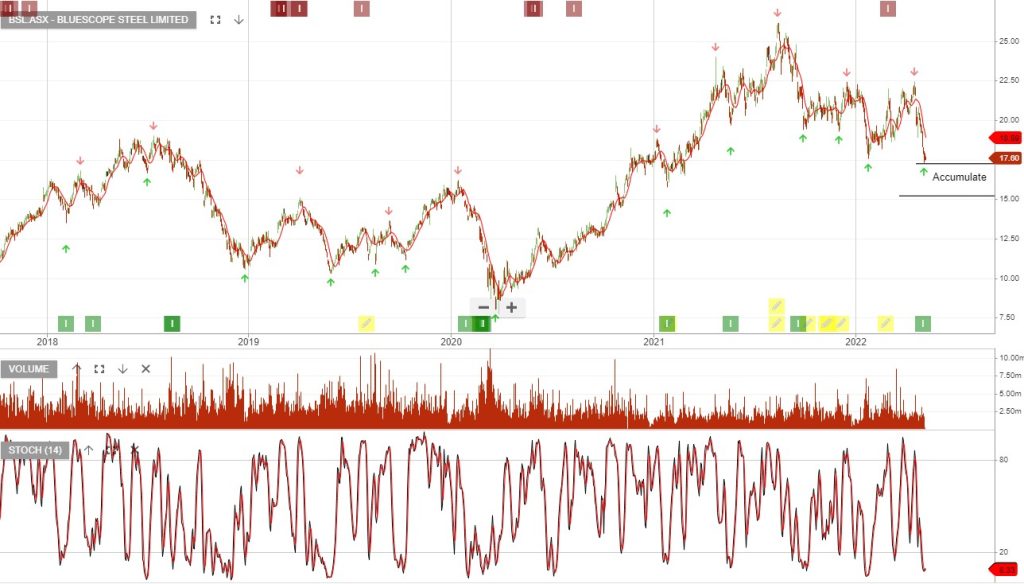

BlueScope Steel is under Algo Engine buy signals and the chart below shows the suggested accumulation range.

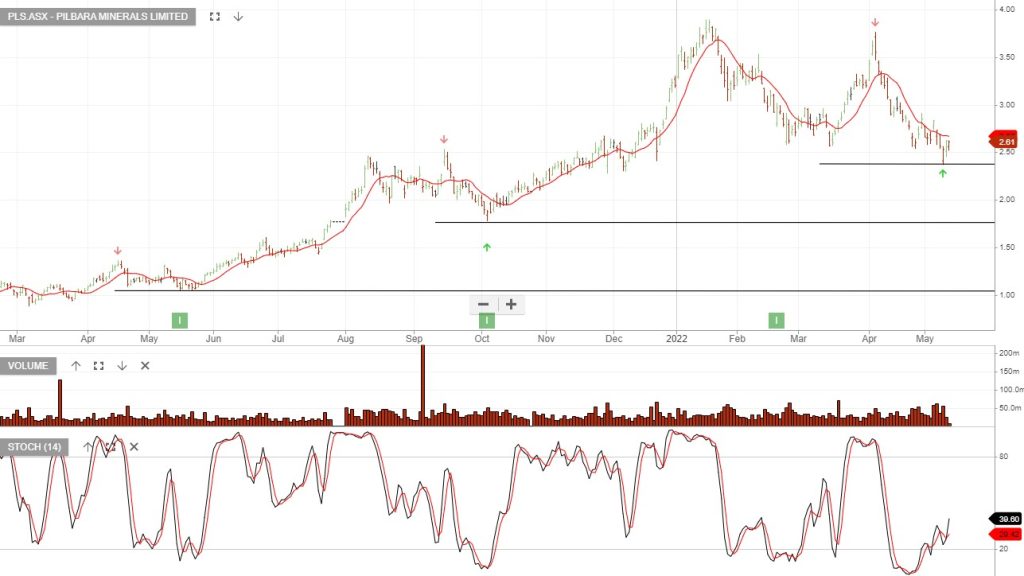

Pilbara Minerals is under Algo Engine buy conditions.

Lynas Rare Earths is under Algo Engine buy conditions.

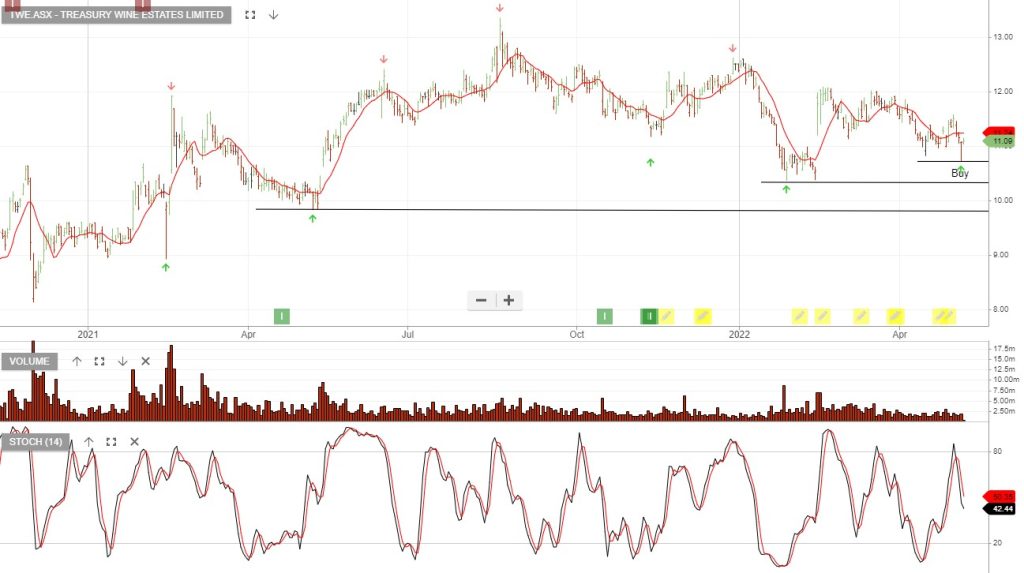

Treasury Wine Estates remains under Algo Engin buy conditions.

Treasury has significant earnings growth opportunities driven by the re-opening of higher-margin channels which were disrupted due to Covid.

Goodman is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

Domino’s Pizza Enterprises is under Algo Engine buy conditions.