ARB Corp – Algo Buy

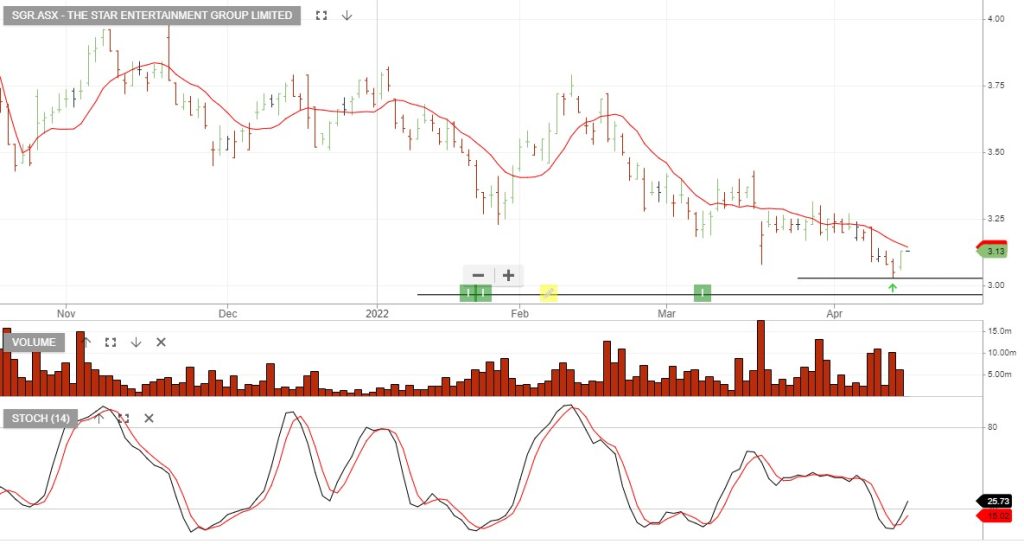

ARB Corporation is under Algo Engin buy conditions.

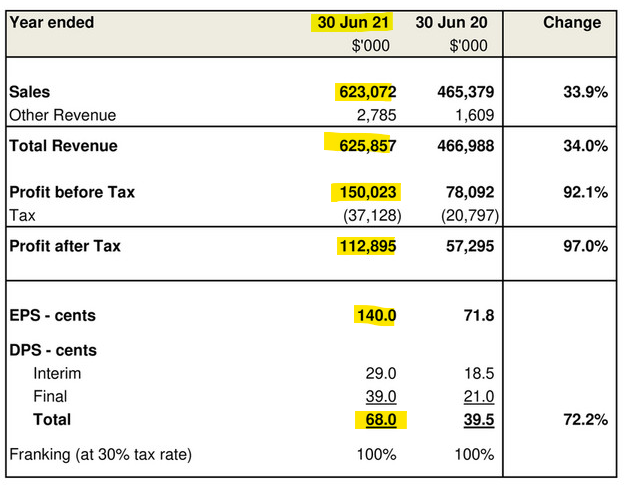

ARB is Australia’s largest manufacturer and distributor of 4×4 accessories. They have a vast international presence, with offices in the USA, Europe and the Middle East, and an export network that extends through more than 100 countries around the globe.

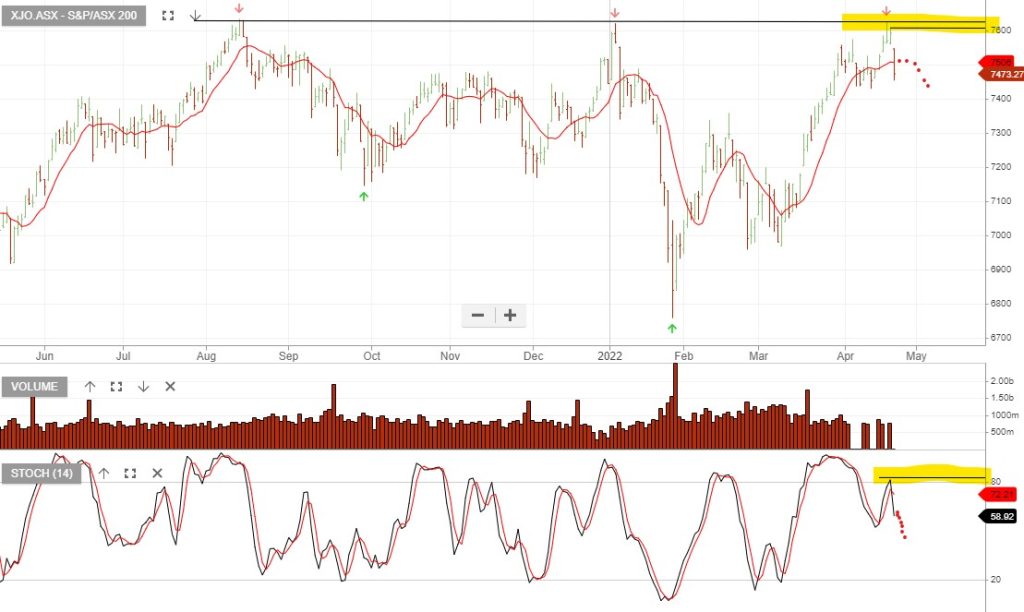

28/4 update: