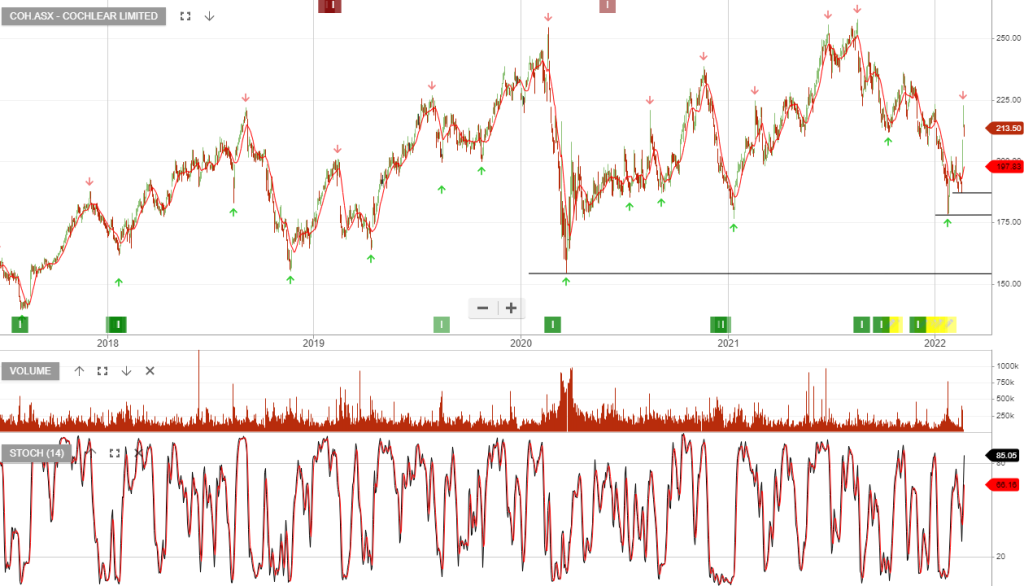

Cochlear- Algo Buy

Cochlear is under Algo Engine buy conditions.

Cochlear is under Algo Engine buy conditions.

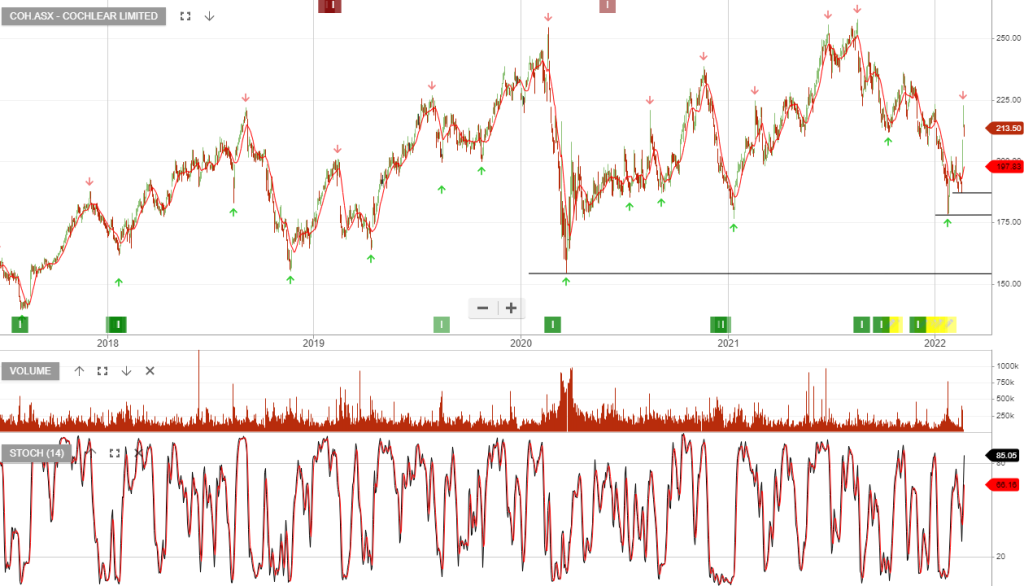

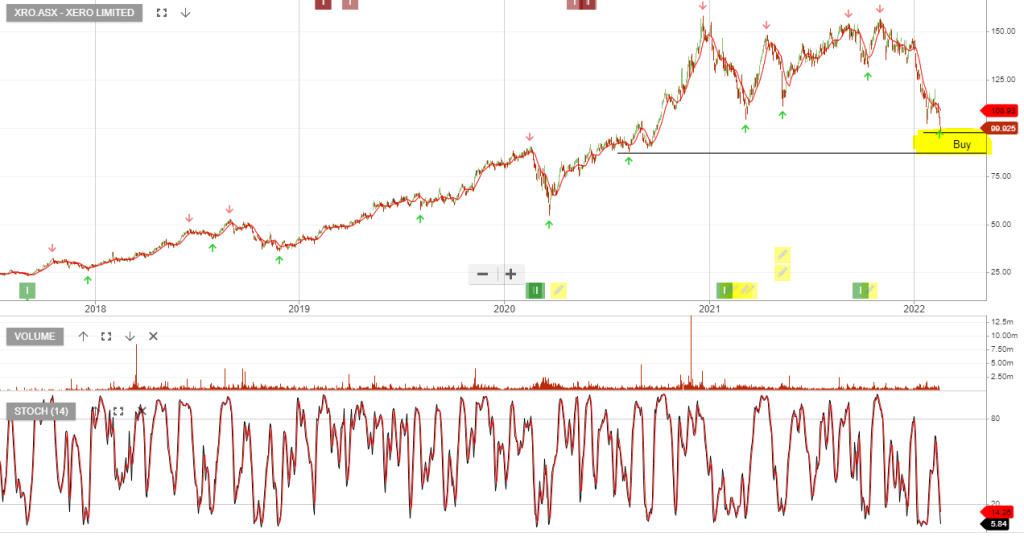

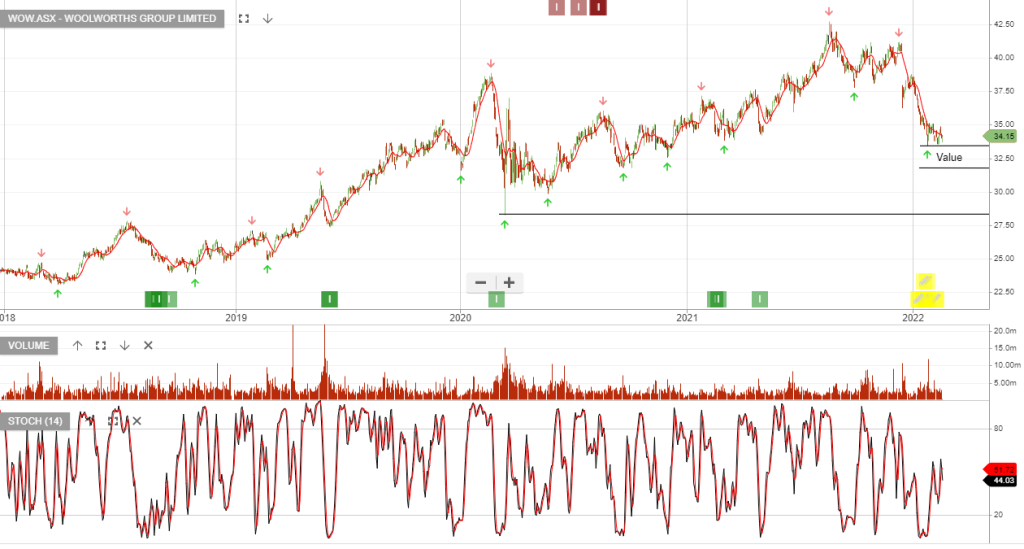

Woolworths Group is under Algo Engine buy conditions.

WOW’s 1H22 result was in line with expectations, EBIT of $1,4bn, and management expects improved financial performance in 2H22 as the environment normalises.

Bega Cheese is under Algo Engine buy conditions.

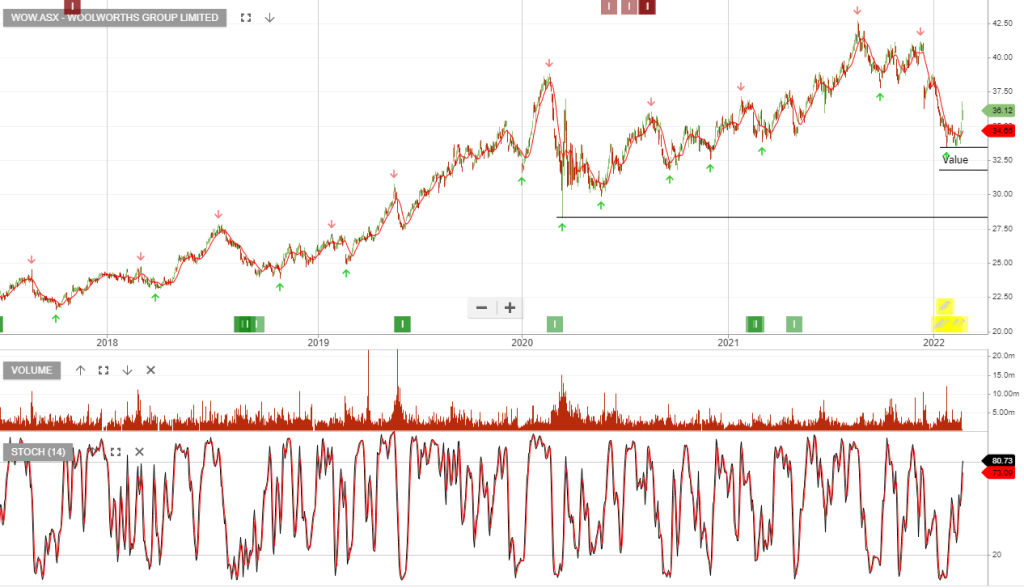

Xero is under Algo Engine buy conditions. Buying support is likely to build within the $86 to $96 price range.

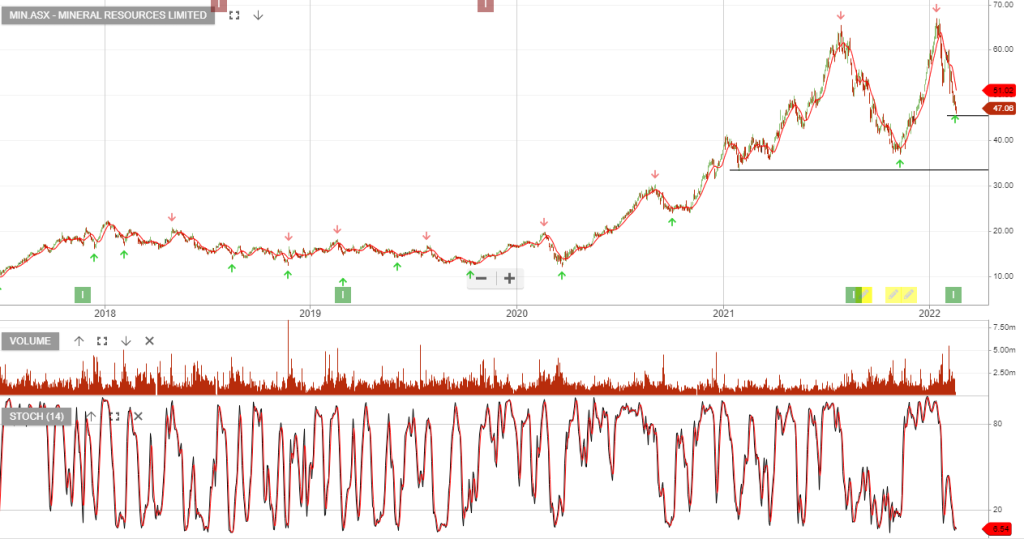

Mineral Resources is under Algo Engine buy conditions and is in our ASX 100 model portfolio. Our accumulation range for MIN is $37 – $47.

Woolworths Group is under Algo Engine buy conditions. The retailer anticipates $215mil in COVID-related expenses and before tax profit to fall from $1.3bn to $1.2bn.

We see value in the stock within the highlighted price range.

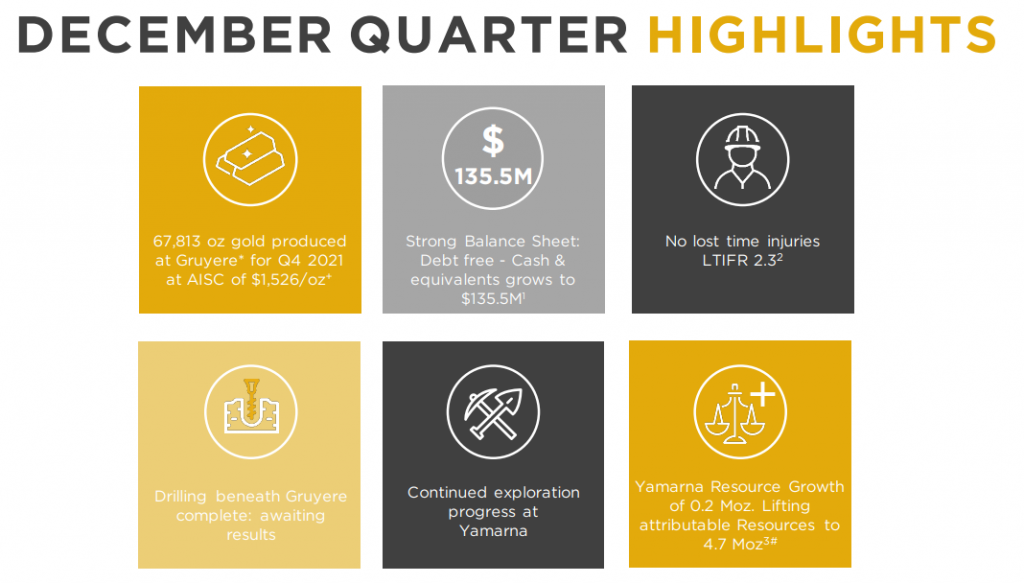

Gold Road Resources remains our preferred gold exposure.

8/2/22 Update: Algo investors are likely already set in GOR. Traders will now be recognizing the first test, first fail, (FTFF), and will be setting their entry and stop loss.

14/2 update:

18/2 update: