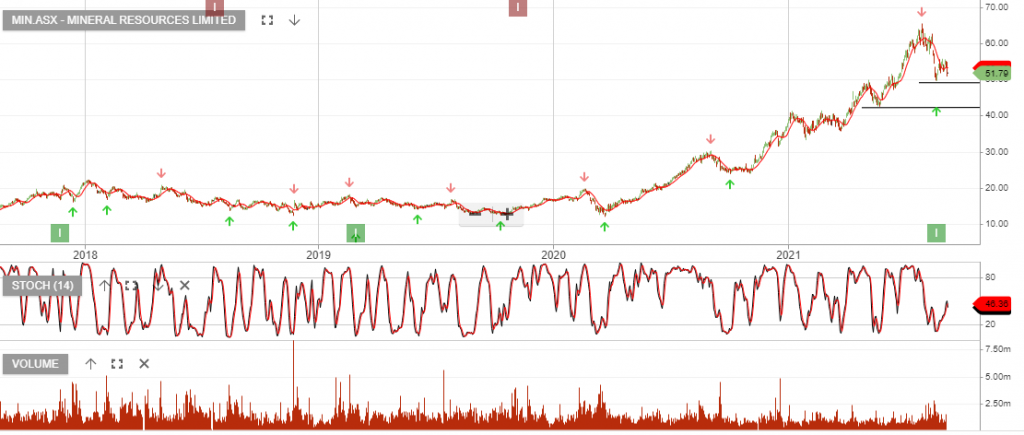

iShares S&P/ASX Dividend Opportunities ETF

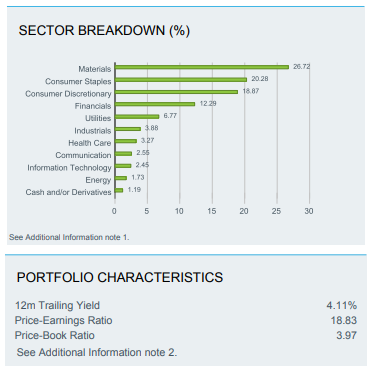

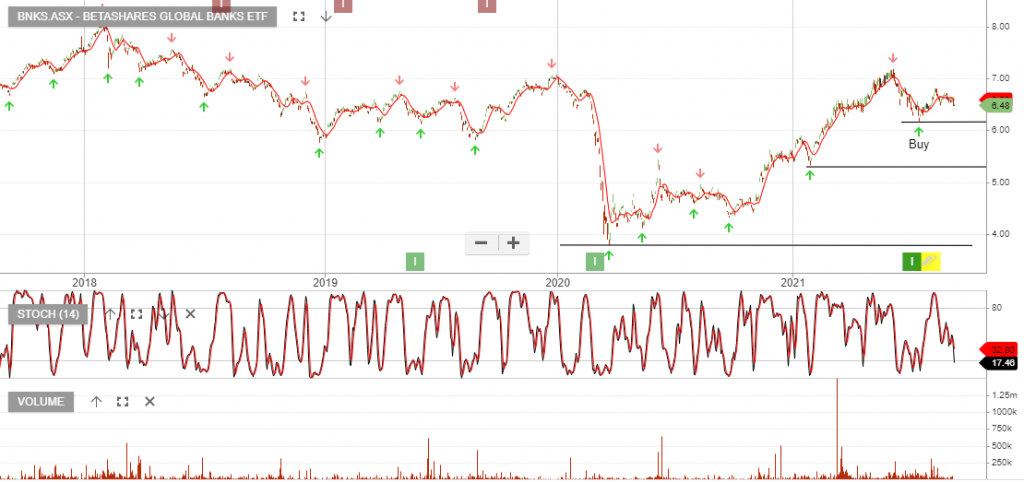

iShares S&P/ASX Dividend Opportunities is now under Algo Engine buy conditions and has been added to our ETF model portfolio.

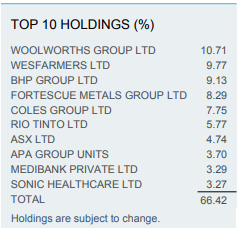

The fund aims to provide investors with the performance of the S&P/ASX Dividend Opportunities Accumulation Index, before fees and expenses. The index is designed to measure the performance of 50 ASX listed stocks that offer high dividend yields while meeting diversification, stability and tradability requirements.